FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

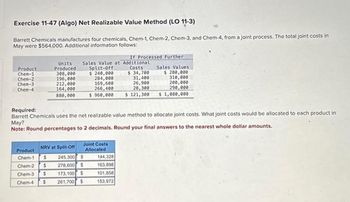

Transcribed Image Text:Exercise 11-47 (Algo) Net Realizable Value Method (LO 11-3)

Barrett Chemicals manufactures four chemicals, Chem-1, Chem-2, Chem-3, and Chem-4, from a joint process. The total joint costs in

May were $564,000. Additional information follows:

Product

Chem-1

Chem-2

Chen-3

Chen-4

Units

Produced

308,000

196,000

212,000

164,000

880,000

Sales Value at Additional

Costs

$ 34,700

Split-Off

$ 240,000

284,000

169,600

266,400

NRV at Split-Off

Product

Chem-1 $ 245,300 $

Chem-2 $

278,600 $

Chem-3 $

173,100 $

Chem-4 $ 261,700 $

If Processed Further

Joint Costs

Allocated

31,400

26,900

28,300

$ 950,000 $ 121,300 $ 1,080,000

Required:

Barrett Chemicals uses the net realizable value method to allocate joint costs. What joint costs would be allocated to each product in

May?

Note: Round percentages to 2 decimals. Round your final answers to the nearest whole dollar amounts.

Sales Values

$ 280,000

310,000

200,000

290,000

144,328

163,898

101,858

153,972

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: accountingarrow_forward20 The Mallak Company produced three joint products at a joint cost of $102,000. Two of these products were processed further. Production and sales were: Product P Q R Weight Sales 301,000 pounds $ 246,750 31,000 177,250 101,000 pounds 101,000 pounds Additional Processing Costs $ 201,000 0 101,000 Assume Q is a by-product and Mallak uses the cost reduction method of accounting for by-product cost. If estimated net realizable value is used, how much of the joint costs would be allocated to product R? Note: Do not round intermediate calculations.arrow_forwardq1arrow_forward

- Nonearrow_forwardExercise 11-47 (Algo) Net Realizable Value Method (LO 11-3) Barrett Chemicals manufactures four chemicals, Chem-1, Chem-2, Chem-3, and Chem-4, from a joint process. The total joint costs in May were $564,000. Additional information follows: If Processed Further Sales Value at Additional Product Chem-1 Chem-2 Units Produced 291,000 Split-Off Costs Sales Values $ 223,000 $ 33,000 $ 263,000 179,000 Chem-3 195,000 Chem-4 147,000 812,000 267,000 152,600 249,400 29,700 293,000 25,200 183,000 26,600 273,000 $ 892,000 $ 114,500 $ 1,012,000 Required: Barrett Chemicals uses the net realizable value method to allocate joint costs. What joint costs would be allocated to each product in May? Note: Round percentages to 2 decimals. Round your final answers to the nearest whole dollar amounts. Product NRV at Split- Off Joint Costs Allocated Chem-1 Chem-2 Chem-3 Chem-4arrow_forwardProblem 11-75 (Algo) Joint Cost Allocation and Product Profitability (LO 11-7, 8, 9) Prescott Lumber processes logs into grade A and grade B lumber. Logs cost $17,200 per load. The milling process produces 5,000 units of grade A with a market value of $100,800, and 20,000 units of grade B with a market value of 514,400. The cost of the milling process is $22,000 per load. Required: a. If the costs of the logs and the milling process are allocated on the basis of units of output what cost will be assigned to each product? b. If the costs of the logs and the milling process are allocated on the basis of the net realizable value, what cost will be assigned to each product? c-1. How much profit or loss does the grade B lumber provide using the data in this problem and your analysis in requirement (a)? c-2. Is it really possible to determine which product is more profitable? Complete this question by entering your answers in the tabs below. ReqA If the costs of the logs and the milling…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education