FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please do not give solution in image format ? And Fast Answering Please ? And please explain proper steps by Step ?

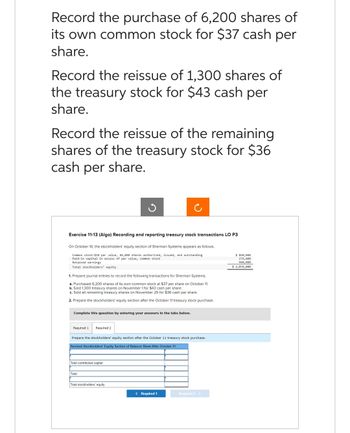

Transcribed Image Text:Record the purchase of 6,200 shares of

its own common stock for $37 cash per

share.

Record the reissue of 1,300 shares of

the treasury stock for $43 cash per

share.

Record the reissue of the remaining

shares of the treasury stock for $36

cash per share.

Exercise 11-13 (Algo) Recording and reporting treasury stock transactions LO P3

On October 10, the stockholders' equity section of Sherman Systems appears as follows.

Common stock-$10 par value, 84,000 shares authorized, issued, and outstanding

Paid-in capital in excess of par value, common stock

Retained earnings

Total stockholders' equity

1. Prepare journal entries to record the following transactions for Sherman Systems.

a. Purchased 6,200 shares of its own common stock at $37 per share on October 11.

b. Sold 1,300 treasury shares on November 1 for $43 cash per share.

c. Sold all remaining treasury shares on November 25 for $36 cash per share.

2. Prepare the stockholders' equity section after the October 11 treasury stock purchase.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare the stockholders' equity section after the October 11 treasury stock purchase.

Revised Stockholders' Equity Section of Balance Sheet After October 11

Total contributed capital

Total

Total stockholders' equity

< Required 1

Required 2 >

$ 840,000

276,000

960,000

$ 2,076,000

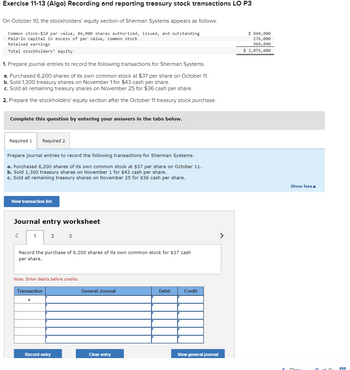

Transcribed Image Text:Exercise 11-13 (Algo) Recording and reporting treasury stock transactions LO P3

On October 10, the stockholders' equity section of Sherman Systems appears as follows.

Common stock-$10 par value, 84,000 shares authorized, issued, and outstanding

Paid-in capital in excess of par value, common stock

Retained earnings

Total stockholders' equity

1. Prepare journal entries to record the following transactions for Sherman Systems.

a. Purchased 6,200 shares of its own common stock at $37 per share on October 11.

b. Sold 1,300 treasury shares on November 1 for $43 cash per share.

c. Sold all remaining treasury shares on November 25 for $36 cash per share.

2. Prepare the stockholders' equity section after the October 11 treasury stock purchase.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare journal entries to record the following transactions for Sherman Systems.

a. Purchased 6,200 shares of its own common stock at $37 per share on October 11.

b. Sold 1,300 treasury shares on November 1 for $43 cash per share.

c. Sold all remaining treasury shares on November 25 for $36 cash per share.

View transaction list

Journal entry worksheet

1

2

Record the purchase of 6,200 shares of its own common stock for $37 cash

per share.

Transaction

a.

Note: Enter debits before credits.

3

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

>

$ 840,000

276,000

960,000

$ 2,076,000

Show less

00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education