FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:LO 3

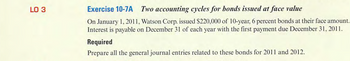

Exercise 10-7A Two accounting cycles for bonds issued at face value

On January 1, 2011, Watson Corp. issued $220,000 of 10-year, 6 percent bonds at their face amount.

Interest is payable on December 31 of each year with the first payment due December 31, 2011.

Required

Prepare all the general journal entries related to these bonds for 2011 and 2012.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cornerstone Exercise 9-46 (Appendix 9A) Bond Issue Price On December 31, 2014, Callahan Auto issued $900,000 of 9%, 10-year bonds. Interest is payable semiannually on June 30 and December 31. Required: What is the issue price if the bonds are sold to yield 8%? Follow the format shown in Present Value tables as you complete the requirement. If required, round your calculations and final answer to the nearest whole dollar.$arrow_forwardEXERCISE 21-3 On January 1, Murphy, Inc., issues 7 percent, 20-year bonds with a face value of $650,000 at 96. Interest is payable on June 30 and December 31. Journalize the following entries: a. Issuance of the bonds b. Payment of semiannual interest on June 30 and December 31 C. Adjusting entry to amortize the discount on December 31, the company's year endarrow_forwardQuestion 2. Recording and Reporting Bonds Robinson Inc., as a public company, issues $3 million of 10%, 10-year, corporate bonds on January 1, 2010. The bonds pay interest on every January 1 after the issuance. The company uses the effective-interest amortization method. Required: If market rate on issue date is 10%, prepare journal entries for the issuance and journal entries at the end of December 2010, 2011, and 2019. If market rate on issue date is 12%, prepare journal entries for the issuance and journal entries at the end of December 2010 and 2011. If market rate on issue date is 8%, prepare journal entries for the issuance and journal entries at the end of December 2010, 2011, and 2019.arrow_forward

- 7arrow_forwardSubject: accountingarrow_forwardQuestion 6 (i) On 1 April, year 1, Happy Corporation issues $50 million of 10%, 30-year bonds payable at par. Interest on the bonds is payable semiannually each 1 April and 1 October. The journal entry to record the first cash payment to bondholders on 1 October, year 1, will include: A: A credit to Cash of $5,000,000. B: A credit to Interest Payable of $2,500,000. C: A debit to Bonds Payable of $5,000,000. D: A debit to Interest Expense of $2,500,000. (ii) ABC Manufacturing Company sold a vehicle for cash of $70,000 with a loss of $10,000 recognized. The accumulated depreciation amounted to $140,000. The original cost of the asset must have been: A: $130,000. B: $150,000. C: $200,000. D: $220,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education