Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

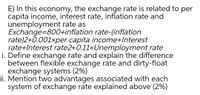

Transcribed Image Text:E) In this economy, the exchange rate is related to per

capita income, interest rate, inflation rate and

unemployment rate as

Exchange=800+inflation rate-(inflation

rate)2+0.001×per capita income+Interest

rate+Interest rate2+0.11xUnemployment rate

i. Define exchange rate and explain the difference

between flexible exchange rate and dirty-float

exchange systems (2%)

ii. Mention two advantages associated with each

system of exchange rate explained above (2%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Choose the correct answer and give short explaination. 3. Advantages of a fixed exchange rates includeA. Reduction in exchange rate risk for businessesB. Reduction in transactions costsC. Reduction in trading frictionsD. All of the abovearrow_forwardIf the U.S.DOLLAR is determined to be the functional currency, which of the following is usually used to restate to US$ monetary assets and liabilities to the reporting currency? I. The average exchange rate II. The historical exchange rate III. The current exchange rate A) III only. B) Either Il or III, depending on the nature of the item. C) I only. D) II only.arrow_forwardIf $1.68 equals to a pound and $1.39 equal to an Euro, what is cross rate between pound and euro (Pound/Euro rate)?arrow_forward

- Required: h) Determine for each, whether the interest parity condition holds or not, if ES = 1.10 $/€ (American terms) Please select the YES or NO in the last column of following table for your answers. Note: E denotes exchange rate. Interest rate for Dollar (R$) (%) 4 7 ·∞∞ 8 8 Interest rate for Euro (R€) (%) 2 2 6 4 Exchange rate of depreciation 2 5 0 3 (Uncovered) interest parity condition holds? YES/NO YES/NO YES/NO YES/NOarrow_forwardWhich of the following eliminates settlement risk? Trans-European Automated Real-Time Gross Settlement Express Transfer System (TARGET) TARGET2 payment system Continuous Linked Settlement (CLS) Intercompany net settlement systems Real-Time Gross Settlement (RTGS) systemsarrow_forwardF2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education