Concept explainers

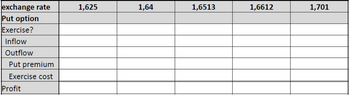

BioCytex SA, a French biotech company expects to receive royalty payments totaling GBP 1.25 million next month and wants to receive USD. It is interested in protecting these payments against a drop in the value of GBP

It can sell 30 day GBP futures at a price of USD 1.6513 /GBP or it can buy pound put options with a strike price of USD 1.6612 /GBP at a premium of 2 cents per GBP.

The spot price of the GBP is currently USD 1.6560 /GBP and the GBP is expected to trade in the rage of USD 1.6250 /GBP to USD 1.7010 /GBP

BioCytex treasurer believes that the most likely price for the GBP in 30 days will be USD 1.6400 /GBP

Calculate BioCytex’s

Step by stepSolved in 2 steps

- Suppose that your company is planning to sell 1.25 million litres of fuel in two years. Thecurrent price of fuel is £1.60 per litre. a) Suppose there is a two-year heating oil futures contract available. The futuresprice is £1.63 per litre. How many contracts would you need to fully eliminate yourrisk exposure over the next two years? How many contracts would you need ifyour optimal hedging ratio was 0.75? What position in these contracts would youtake today? Explain. b) Evaluate the outcomes of your hedging strategy if the price of fuel in two years is(1) £1.72 per litre, and (2) £1.58 per litre. In each case assume the heating oilfutures price to be equal to that of the fuel. Comment on your results.arrow_forwardThe spot price of oil is $40 per barrel and the cost of storing a barrel of oil for one year is $3.3, payable at the end of the year. The risk-free interest rate is 2.6% per annum, continuously compounded. What is an upper bound for the one-year futures price of oil? Your answer should be correct to one decimal place. Assume there are no transaction costs involved in arbitraging over-priced futures contracts.arrow_forwardAn investment manager based in Germany hedges a portfolio of UK gilts with a 3-month forward contract. The current spot rate is GBP0.833/EUR and the 90-day forward rate is GBP0.856/EUR. At the end of 3 months, the gilts have risen in value by -2.50% (in GBP terms), and the spot rate is now GBP0.82/EUR. What was the true cost of the forward contract? a. 11.044% annualised. b. 17287% annualised. c. 7287% annualised. d. 14.787% annualised.arrow_forward

- A UK oil trader, Teresa, is considering purchasing oil on the spot market for speculative purposes. The current spot price is $18 a barrel. However, she expects the price to decline to $16 a barrel in one month's time. If she bought on the spot market today, she would hold the oil for one month at a cost of £0.002 a barrel for the month, after which she could sell the oil on the spot market. The current US dollar exchange rate is $1.50/£. If she expects the exchange rate to be $1.30/£1 in one month's time, what is her expected gain/loss on the oil deal? A. £0.306 gain per barrel B. £0.027 gain per barrel C. £1.540 loss per barrel D. £6.202 loss per barrelarrow_forwardTo find the quoted price of a 180-day T - bill with a 5% yield and the contract price for a $ 1,000,000 90 - day notional Eurodollar contract, we need to do a couple of calculations.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education