FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

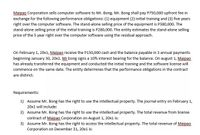

Transcribed Image Text:Maipao Corporation sells computer software to Mr. Bong. Mr. Bong shall pay P750,000 upfront fee in

exchange for the following performance obligations: (1) equipment (2) initial training and (3) five years

right over the computer software. The stand-alone selling price of the equipment is P380,000. The

stand-alone selling price of the initial training is P280,000. The entity estimates the stand-alone selling

price of the 5 year right over the computer software using the residual approach.

On February 1, 20x1, Maipao receive the P150,000 cash and the balance payable in 3 annual payments

beginning January 30, 20x2. Mr bong signs a 10% interest bearing for the balance. On august 1, Maipao

has already transferred the equipment and conducted the initial training and the software license will

commence on the same date. The entity determines that the performance obligations in the contract

are distinct.

Requirements:

1) Assume Mr. Bong has the right to use the intellectual property. The journal entry on February 1,

20x1 will include:

2) Assume Mr. Bong has the right to use the intellectual property. The total revenue from license

contract of Maipao Corporation on August 1, 20x1 is:

3) Assume Mr. Bong has the right to access the intellectual property. The total revenue of Maipao

Corporation on December 31, 20x1 is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer only question B, because I sent already A in a separate question. Thank you! a) The following payments are agreed for the purchase of a property at the nominal annual interest rate of 0.8%:- 100,000 euros on 01.01.2022- 50,000 Euro on 01.07.2022- 200,000 euros on 01.03.2023 What is the value of these payments on the valuation date 01.01.2022 with1. linear interest calculation?2. monthly interest at the relative interest rate?3. relative mixed interest?4. continuous interest calculation? b) On 01.01.2022, EUR 347,942.42 is paid into an account at 0.8% annual interest. At On which date (day.month.year) in 2022, the year 2022 has 365 days, will the value of the interest rate, does the value of the deposit exceed 350,000 euros for the first time?arrow_forwardAn investor is considering purchasing a sale-leaseback with the following 10-year cash flows: ΕΟΥΙ Cash Flows + 0 1 $350,000 2 $357,000 3 $364,140 4 $371,423 5 $378,851 6 $386,428 7 $394,157 8 $402,040 9 $410,081 10 $418,282 + Sale Proceeds $5,333,000 If the seller/lessee in the previous question insists on a purchase price of $5,000,000 today, what would the investor's yield be? 9.56 percent 7.66 percent 8.22 percent 8.03 percentarrow_forwardFind the present value PV of the given future value. (Round your answer to the nearest cent.) future valye $5,250 at 4.875 simple interest for 670 days PV = $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education