Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

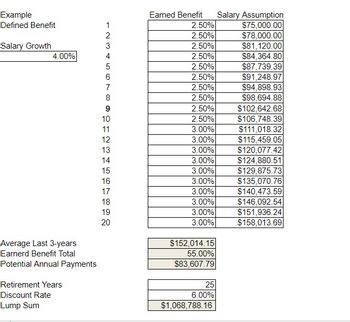

explain me with the steps, computations and the manual formulas !! how to get the results in the green boxes. ! i want to understand the logicof this insurance defined benefit exercise.

Transcribed Image Text:Example

Defined Benefit

Salary Growth

4.00%

Earned Benefit

Salary Assumption

1234567∞

2.50%

$75,000.00

2.50%

$78,000.00

2.50%

$81,120.00

2.50%

$84,364.80

2.50%

$87,739.39

2.50%

$91,248.97

2.50%

$94,898.93

8

2.50%

$98,694.88

9

2.50%

$102,642.68

10

2.50%

$106,748.39

11

3.00%

$111,018.32

12

3.00%

$115,459.05

13

3.00%

$120,077.42

14

3.00%

$124,880.51

15

3.00%

$129,875.73

16

3.00%

$135,070.76

17

3.00%

$140,473.59

18

3.00%

$146,092.54

19

3.00%

$151,936.24

20

3.00%

$158,013.69

Average Last 3-years

$152,014.15

Earnerd Benefit Total

55.00%

Potential Annual Payments

$83,607.79

Retirement Years

Discount Rate

25

6.00%

Lump Sum

$1,068,788.16

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Describe the major elements of the affordable care act. What problem is the legislation trying to address? How much is it expected to cost? How will the extra spending be financed? What are the major objections to the legislation?arrow_forwardWhat were your feelings about your need for life insurance before you read this chapter? What are they now? What is the difference between Term and whole life insurance? Which one do you prefer? and why?arrow_forwardExamples of benefits include all of the following, EXCEPT: a) retirement benefits. b) paid vacation. c) health insurance. d) profit sharing.arrow_forward

- Why do we need FDIC insurance?arrow_forwardCompare and contrast the early historical accounting for postretirement health care and life insurance benefits with the guidance or rules in place today.arrow_forwardSelf-insurance is connected to workers compensation. State what is self -insurance and outline three advantages of it.arrow_forward

- The main selling point(s) of managed care is (are) what? ☐ 1) Reduce the cost of care. 2) Raise or maintain the quality of care 3) Help employer select healthier employees in the insurance pool. ○ 4) A & B ☐ 5) B & C ○ 6) A & Carrow_forwardAn able account is a type of 529 plan intended to benefit?arrow_forwardExamples of health insurance offsets include all of the following, EXCEPT: a) Co-pays b) Deductibles c) Co-insurance d) Preventive programsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education