Concept explainers

Assets: Assets are the resources of an organization used for the purpose of business operations. They include both current and non-current assets. The assets which are used or are converted into cash within a year or less are called current assets and assets which are used for long term i.e. more than a year are called non-current or long term assets.

Depreciation: It is the value of the asset diminished for its use in the business operations. Thus, a portion of the value used in a year is treated as expense and is charged against the revenues.

Useful life: It is the period during which the asset is expected to work or is used for the purpose of business operations.

Salvage value: It is the expected value that can be fetched for an asset at the end of its useful like.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

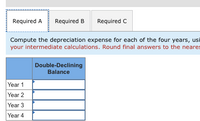

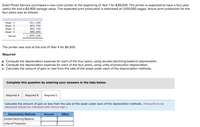

- A machine costing $211,400 with a four-year life and an estimated $19,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 481,000 units of product during its life. It actually produces the following units: 123,200 in Year 1, 123,600 in Year 2, 121,400 in Year 3, 122,800 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate—this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. Straight Line Units of Production Year Year 1 Year 2 Year 3 Year 4 Total Compute depreciation for each year (and total depreciation…arrow_forwardA machine costing $217,200 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce 493,000 units of product during its life. It actually produces the following units: 122,200 in Year 1, 124,100 in Year 2, 121,500 in Year 3, 135,200 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate—this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) A machine costing $217,200 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce…arrow_forwardi need the answer quicklyarrow_forward

- A machine costing $217,600 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 494,000 units of product during its life. It actually produces the following units: 122,200 in Year 1, 124,300 in Year 2, 120,000 in Year 3, 137,500 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. Straight Line Units of Production Double declining balance Compute depreciation for each year (and total depreciation of all years…arrow_forwardRequired information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value. During its second year, the machine produces 34,500 units of product. Exercise 8-6 Double-declining-balance depreciation LO P1 Determine the machine's second-year depreciation using the double-declining-balance method. Double-declining-balance Depreciation es Annual Depreciation Expense Depreciation expense Choose Factors: Choose Factor(%) !! First year's depreciation Second year's depreciation %3Darrow_forwardNeed help correctingarrow_forward

- A machine’s first cost is $60,000 with salvage values over the next 5 years of are $50K, $40K, $32K, $25K, and $12K. The annual operating and maintenance costs are the same every year. Determine the machine total cost.arrow_forward! Required information [The following information applies to the questions displayed below.] Exact Photo Service purchased a new color printer at the beginning of Year 1 for $36,110. The printer is expected to have a four-year useful life and a $3,800 salvage value. The expected print production is estimated at $1,781,500 pages. Actual print production for the four years was as follows: Year 1 Year 2 Year 3 Year 4 Total 550,700 481,800 376,300 394,700 1,803,500 The printer was sold at the end of Year 4 for $4,100. Required: a. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Year 1 Year 2 Year 3 Year 4 Total accumulated depreciation Depreciation Expensearrow_forwardRequired information [The following information applies to the questions displayed below.] Exact Photo Service purchased a new color printer at the beginning of Year 1 for $38,000. The printer is expected to have a four-year useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows. Year 1 Year 2 Year 3 Year 4 390,000 410,000 420,000 300,000 Total 1,520,000 The printer was sold at the end of Year 4 for $1,650. c. Calculate the amount of gain or loss from the sale of the asset under each of the depreciation methods. Double Declining Balance Units of Productionarrow_forward

- A machine costing $210,200 with a four-year life and an estimated $19,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce 478,000 units of product during its life. It actually produces the following units: 121,800 in Year 1, 122,400 in Year 2, 119,600 in Year 3, 124,200 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate—this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) ompute depreciation for each year (and total depreciation of all years combined) for the machine under the Double-declining-balance. DDB Depreciation for the…arrow_forwardYour business buys a copy machine for $8,000 on January 1. You estimate that the copy machine will produce 350,000 copies during its useful life; its salvage value after producing the 350,000 copies is projected to be $1,000. The copy machine produced 75,200 copies in year 1 and 68,300 copies in year 2. Calculate depreciation for each of the first two years using the units-of-production method.arrow_forwardEquipment purchased 2 years ago by Newport Corporation to make pneumatic vibration isolators cost $110,500. It has a market value that can be described by the relation $110,500 – $8,600k, where k is the years from time of purchase. The operating cost for the first 5 years is $63,000 per year, after which it increases by $6,800 per year. The asset's salvage value was originally estimated to be $7000 after a predicted 10-year useful life. Determine the values of P, S, and AOC if (a) a replacement study is done now and it is assumed that the equipment will be kept a maximum of one more year, and (b) a replacement study is done 5 years from now and it is assumed that the equipment will be kept a maximum of only one more year after that. a) The value of Pis $ The value of S is $ The value of AOC is $ b) The value of Pis $ The value of S is $ The value of AOC is $arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education