Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

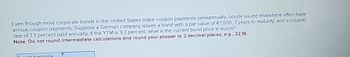

Transcribed Image Text:Even though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have

annual coupon payments. Suppose a German company issues a bond with a par value of €1,000, 7 years to maturity, and a coupon

rate of 7.3 percent paid annually. If the YTM is 9.3 percent, what is the current bond price in euros?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

hond price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forward5farrow_forwardJennifer Davis is planning to buy 10-year zero-coupon bonds issued by the u.s. treasury. if these bonds have a face value of $1000 and are currently selling at $410.63, what is the effective annual yield? assume that interest compounds semiannually on similar coupon-paying bonds. round answer to 5 decimal places.arrow_forward

- (Related to Checkpoint 9.2) (Yield to maturity) The market price is $800 for a 10-year bond ($1,000 par value) that pays 11 percent annual interest, but makes interest payments on a semiannual basis (5.5 percent semiannually). What is the bond's yield to maturity? The bond's yield to maturity is nothing%. (Round to two decimal places.)arrow_forward1-7arrow_forwarda) At 21 February 2018, the US Government could borrow at an annual 10-year yield of 2.89%. At that yield, how much were financial markets paying for the right to receive $100 from the US Government 10 years later? (b) Suppose a 5-year zero-coupon bond (??? = $100) issued by the US government is currently trading at $90. What is the annual yield an investor would receive for buying such a bond and holding it to maturity? (c) Suppose the US Federal Reserve (the US Central Bank) wants to lower longer-maturity yields. Briefly explain the process (known as Quantitative Easing) it could use to achieve this.arrow_forward

- After setting aside the required reserves, the bank decides to invest the remaining amount of cash. The bank invests £15 million in a coupon bond issues by UK Treasury. What remains is loaned out. The coupon bond of point (e) pays a coupon of 4% per year, paid semi-annually. It has 2 years to maturity. If the current Yield-to-Maturity is 3.5% semi-annually, what is the price of the bond?arrow_forwardNikularrow_forwardWhat is the Macaulay duration of a 7 percent semiannual coupon bond with two years to maturity and a current price of $1,055.30? (Note: You are required to solve the problem by calculating "Years \times PV / Bond Price" for each cash flow and summing the results. YTM and PV must be calculated using a financial calculator. Round your answer to four decimal places.)arrow_forward

- Ef 350.arrow_forwardSuppose the U.S. Treasury offers to sell you a bond for $697.25. No payments will be made until the bond matures 4 years from now, at which time it will be redeemed for $1,000. What interest rate would you earn if you bought this bond at the offer price? a. 5.51% b. 35.86% c. 7.48% d. 9.43% e. 12.77%arrow_forwardThe U.S. Treasury has issued 10-year zero coupon bonds with a face value of $1,000. Assume that the bond compounds interest semiannually. What will be the current market price of these bonds if the yield to maturity for similar investments in the market is 6.75 percent? $860 O $520 O $604 O $515arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education