FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

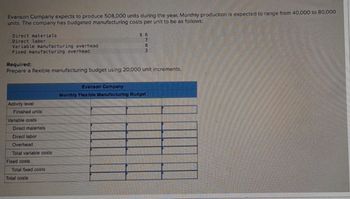

Transcribed Image Text:Evanson Company expects to produce 508,000 units during the year. Monthly production is expected to range from 40,000 to 80,000

units. The company has budgeted manufacturing costs per unit to be as follows:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Required:

$ 6

7

8

3

Prepare a flexible manufacturing budget using 20,000 unit increments.

Evanson Company

Monthly Flexible Manufacturing Budget

Activity level

Finished units

Variable costs

Direct materials

Direct labor

Overhead

Total variable costs

Fixed costs

Total fixed costs

Total costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The production manager of Rordan Corporation has submitted the following quarterly production forecast for the upcoming fiscal year: Units to be produced 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 9,000 7,000 7,500 8,400 Each unit requires 0.45 direct labor-hours, and direct laborers are paid $10.00 per hour. Required: 1. Prepare the company's direct labor budget for the upcoming fiscal year. (Round "Direct labor time per unit (hours)" answers to 2 decimal places.) Direct labor time per unit (hours) Total direct labor-hours needed Direct labor cost per hour Total direct labor cost 1st Quarter Rordan Corporation Direct Labor Budget 2nd Quarter 3rd Quarter 4th Quarter Yeararrow_forwardThe Chicago power plant that services all manufacturing departments of MidWestEngineering has a budget for the coming year. This budget has been expressed in thefollowing monthly terms:Manufacturing Needed at Practical Capacity Average Expected MonthlyDepartment Production Level (Kilowatt- Usage (Kilowatt-Hours)Rockford 10,000 8,000Peoria 20,000 9,000Hammond 12,000 7,000Kankakee 8,000 6,000Total 50,000 30,000The expected monthly costs for operating the power plant during the budget year are $15,000:$6,000 variable and $9,000 fixed.Required:1. Assume that a single cost pool is…arrow_forwardCanyon Corporation's budgeted production schedule, by quarters, for the coming year is as follows: Quarter 1= 26,500 units Quarter 2 = 23,000 units Quarter 3 = 21,000 units Quarter 4 = 28,000 units Each unit of product requires three pounds of direct material. The company's policy is to begin each quarter with 25% of that quarter's direct materials production requirements. Canyon expects to have 54,000 pounds of direct materials on hand at the beginning of Quarter 1. What would be Canyon budgeted direct materials purchases (in pounds) for the first quarter?arrow_forward

- The master budget of Vaughn Manufacturing shows that the planned activity level for next year is expected to be 50000 machine hours. At this level of activity, the following manufacturing overhead costs are expected: Indirect labor Machine supplies Indirect materials Depreciation on factory building Total manufacturing overhead $810000 O $1666000. O$1514000. O $1704000. O $1420000. 190000 230000 190000 $1420000 A flexible budget for a level of activity of 60000 machine hours would show total manufacturing overhead costs ofarrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Cost Formulas Direct labor $16.40q Indirect labor $4,000 + $1.40q Utilities $5,300 + $0.30q Supplies $1,600 + $0.10q Equipment depreciation $18,500 + $3.00q Factory rent $8,200 Property taxes $2,500 Factory administration $13,600 + $0.60q The Production Department planned to work 4,400 labor-hours in March; however, it actually worked 4,200 labor-hours during the month. Its actual costs incurred in March are listed below: Actual Cost Incurred in March Direct labor $ 70,480 Indirect labor $ 9,340 Utilities $ 7,010 Supplies $ 2,250 Equipment depreciation $ 31,100 Factory rent $ 8,600 Property taxes $ 2,500 Factory…arrow_forwardThe production department of Headstrong Company has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Units to be produced 8,100 9,100 7,100 6,100 In addition, the beginning raw materials inventory for the first quarter is budgeted to be 1,950 kilograms and the beginning accounts payable for the first quarter are budgeted to be $3,490. Each unit requires 3.1 kg of raw material that costs $2.50 per kilogram. Management desires to end each quarter with an inventory of raw materials equal to 10% of the following quarter’s production needs. The desired ending inventory for the fourth quarter is 2,325 kilograms. Management plans to pay for 80% of raw material purchases in the quarter acquired and 20% in the following quarter. Each unit requires 0.6 direct labour-hours, and direct labour-hour workers are paid $19.5 per hour. Required: 1-a. Prepare the company's direct…arrow_forward

- Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where qis the number of labor-hours worked in a month: Cost Formulas $16.60g $4, 200 + $1.60g $5,300 + $0.70g $1,700 + $0.30g $18,500 $2.90g $8, 300 $2,500 $13,100 + $0.80g Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory adeinistration The Production Department planned to work 4,100 labor-hours in March; however, it actually worked 3,900 labor-hours during the month. Its actual costs incurred in March are listed below: Direct labor Indirect labor Utilities Supplies Equipnent depreciation Factory rent Property taxes Factory administration Actual Cost Incurred in March $ 66,380 $ 9,940 $ 8,560 $ 3,140 $ 29,810 $ 8,700 $2,500 $ 15,610 Required: 1. Prepare the Production…arrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Cost Formulas Direct labor $16.20q Indirect labor $4,700 + $1.40q Utilities $5,700 + $0.50q Supplies $1,700 + $0.20q Equipment depreciation $18,600 + $2.50q Factory rent $8,400 Property taxes $2,600 Factory administration $13,100 + $0.70q The Production Department planned to work 4,100 labor-hours in March; however, it actually worked 3,900 labor-hours during the month. Its actual costs incurred in March are listed below: Actual Cost Incurred in March Direct labor $ 64,740 Indirect labor $ 9,620 Utilities $ 8,140 Supplies $ 2,730 Equipment depreciation $ 28,350 Factory rent $ 8,800 Property taxes $ 2,600 Factory…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education