SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

pare.3

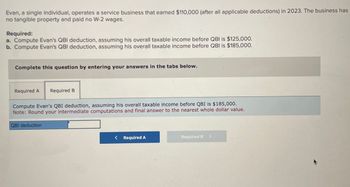

Transcribed Image Text:Evan, a single individual, operates a service business that earned $110,000 (after all applicable deductions) in 2023. The business has

no tangible property and paid no W-2 wages.

Required:

a. Compute Evan's QBI deduction, assuming his overall taxable income before QBI is $125,000.

b. Compute Evan's QBI deduction, assuming his overall taxable income before QBI is $185,000.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compute Evan's QBI deduction, assuming his overall taxable income before QBI is $185,000.

Note: Round your intermediate computations and final answer to the nearest whole dollar value.

QBI deduction

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the 2019 tax year, Brian, a single taxpayer, received $ 7,400 in Social Security benefits. His adjusted gross income for the year was $14,500 (not including the Social Security benefits) and he received $ 30,000 in tax-exempt interest income and has no for-AGI deductions, Calculate the amount of the Social Security benefits that Brian must include in his gross income for 2019. SIMPIFIED TAXABLE SOCIAL SECURITY WORKSHEET (FOR MOST PEOPLE) 1. Enter the total amount of Social Security income. 2. Enter one-half of line 1 3. Enter the total of taxable income items on Form 1040 except Social Security income. 4. Enter the amount of tax-exempt interest income. 5. Add lines 2,3, and 4 6. Enter all adjustments for AGl except for student loan interest, the domestic production activities deduction, and the tuition and fees deduction. 7. Subtract line 6 from line 5 . If zero or less, stop here, none of the Social Security benefits are taxable. 8. Enter $ 25,0001 $ 32,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 9. Subtract line 8 from line 7 . If zero or less, enter -0 - Note: If line 9 is zero or less, stop here; none of your benefits are faxable. Otherwise, go on to line 10 10. Enter $ 9,0001 $12,000 if married filing jointly; 0 if married filing separately and living with spouse at any time during the year) 11. Subtract line 10 from line 9. If zero or less, enter -0 -. 12. Enter the smaller of line 9 or line 10 . 13. Enter one-half of line 12 14. Enter the smaller of line 2 or line 13 . 15. Multiply line 11 by 85 (. 85 ). If line 11 is zero, enter -0 -. 16. Add lines 14 and 15 17. Multiply line 1 by 85(.85) 18. Taxable benefits. Enter the smaller of line 16 or line 17 . 1.____________ 2.____________ 3.____________ 4.____________ 5.____________ 6.____________ 7.____________ 8.____________ 9.____________ 10.____________ 11.____________ 12.____________ 13.____________ 14.____________ 15.____________ 16.____________ 17.____________ 18.____________arrow_forwardIn 2019, Tracy generates a $10,000 loss from an otherwise qualified business activity. Fortunately, she also works as an employee and has taxable income of $40,000. Tracy's 2019 QBI deduction is $0 $2,000 $8,000 $6,000arrow_forwardTroy, a cash basis taxpayer, is employed by Eagle Corporation, also a cash basis taxpayer. Tray is a full-time employee of the corporation and receives a salary of 60,000 per year. He also receives a bonus equal to 10% of all collections from diems he serviced during the year. Determine the tax consequences of the following events to the corporation and to Troy: a. On December 31, 2019, Troy was visiting a customer. The customer gave Troy a 10,000 check payable to the corporation for appraisal services Troy performed during 2019. Troy did not deliver the check to the corporation until January 2020. b. The facts are the same as in part (a), except that the corporation is an accrual basis taxpayer and Troy deposited the check on December 31, but the bank did not add the deposit to the corporations account until January 2020. c. The facts are the same as in part (a), except that the customer told Troy to hold the check until January 2020 when the customer could make a bank deposit that would cover the check.arrow_forward

- Rochelle is a limited partner in Megawatt Partnership. For 2021, her schedule K-1 from the partnership reported the following share of partnership items: Ordinary income Section 1231 loss Nondeductible expense Cash distribution Required: $ 25,000 (3,000) 1,000 5,000 a. Calculate the net impact of the given items on Rochelle's 2021 taxable income. Assume that Rochelle does not qualify for the QBI deduction. b. Assume that Rochelle's marginal tax rate is 35 percent. Calculate her 2021 after-tax cash flow as a result of her interest in Megawatt. Complete this question by entering your answers in the tabs below. Required A Required B Calculate the net impact of the given items on Rochelle's 2021 taxable income. Assume that Rochelle does not qualify for the QBI deduction. Net impact on taxable income Required A Required B >arrow_forwardEvan, a single individual, operates a service business that earned $110,000 (after all applicable deductions) in 2021. The business has no tangible property and paid no W-2 wages. Required: b. Compute Evan's QBI deduction, assuming his overall taxable income before QBI is $175,000. * I only need Requirement B to be solvedarrow_forwardSubject:arrow_forward

- Evan, a single individual, operates a service business that earned $110,000 (after all applicable deductions) in 2021. The business has no tangible property and paid no W-2 wages. Required: b. Compute Evan's QBI deduction, assuming his overall taxable income before QBI is $175,000. ** Only need Requirement B, The answer is NOT 17,556 or 0arrow_forwardEvan, a single individual, operates a service business that earned $110,000 (after all applicable deductions) in 2021. The business has no tangible property and paid no W-2 wages. Required: b. Compute Evan's QBI deduction, assuming his overall taxable income before BI is $175,000. *I only need Requirement B to be solved, please make QBI deduction amount clear (bold, underlined, or highlighted)arrow_forwardPlease do not give image formatarrow_forward

- In 2023, Purple Company reports $200,000 in net income before deducting any compensation or other payment to its sole owner, Kirsten. Kirsten is single and she claims the $13,850 standard deduction for 2023 (she has no other deductions). Purple Company is Kirsten's only source of income. Ignoring any employment tax considerations, compute Kirsten's after-tax income if: (LO.1) a. Purple Company is a proprietorship and Kirsten withdraws $50,000 from the business during the year; Kirsten claims a $37,230 deduction for qualified business income. b. Purple Company is a C corporation and the corporation pays out all of its after- tax income as a dividend to Kirsten. c. Purple Company is a C corporation and the corporation pays Kirsten a salary of $158,000.arrow_forwardEva received $83,000 in compensation payments from JAZZ Corporation during 2022. Eva incurred $16,000 in business expenses relating to her work for JAZZ Corporation JAZZ did not reimburse Eva for any of these expenses. Eva is single and deducts a standard deduction of $12,950. Based on these facts, answer the following questions: Use Tax Rate Schedule for reference. Assume that Eva is considered to be an employee. What amount of FICA taxes is she required to pay for the year? Assume that Eva is considered to be an employee. What is her regular income tax liability for the year? Assume that Eva is considered to be a self-employed contractor. What are her self-employment tax liability and additional Medicare tax liability for the year? Assume that Eva is considered to be a self-employed contractor. What is her regular tax liability for the year?arrow_forwardPurple Company has $200,000 in net income for 2022 before deducting any compensation or other payment to its sole owner, Kirsten. Kirsten is single and she claims the $12,950 standard deduction for 2022 (she has no other deductions). Purple Company is Kirsten's only source of income. Ignoring any employment tax considerations, compute Kirsten's after-tax income for each of the following situations. Click here to access the 2022 individual tax rate schedule to use for this problem. Assume the corporate tax rate is 21%. When required, carryout intermediate tax computations to the nearest cent and then round your final tax liability to the nearest dollar. a. Purple Company is a proprietorship and Kirsten withdraws $50,000 from the business during the year; Kirsten claims a $37,410 deduction for qualified business income. Kirsten's taxable income is s 149,640 ✔ and her after-tax income is $ 170,251 ✔ b. Purple Company is a C corporation and the corporation pays out all of its after-tax…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT