Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

(a)Evaluate the projects using each of the following criteria, stating which project(s) Insignia Corporation Limited should choose under each criteria and why:

- Payback

- Discounted Payback

Net Present Value - Profitability Index

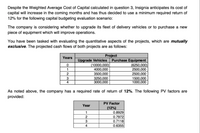

Transcribed Image Text:Despite the Weighted Average Cost of Capital calculated in question 3, Insignia anticipates its cost of

capital will increase in the coming months and has thus decided to use a minimum required return of

12% for the following capital budgeting evaluation scenario:

The company is considering whether to upgrade its fleet of delivery vehicles or to purchase a new

piece of equipment which will improve operations.

You have been tasked with evaluating the quantitative aspects of the projects, which are mutually

exclusive. The projected cash flows of both projects are as follows:

Project

Years

Upgrade Vehicles Purchase Equipment

(6250,000)

2500,000

2500,000

1500,000

1000,000

(10000,000)

4000,000

3500,000

3250,000

3000,000

1

3

4

As noted above, the company has a required rate of return of 12%. The following PV factors are

provided:

PV Factor

Year

(12%)

0.8929

1

2

0.7972

3

0.7118

4

0.6355

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Subject :- Accountingarrow_forwardWhich of the following best describes the process of capital budgeting? a Forecasting revenues and expenses hmiting funds for capital improvements without considering the profitability of proposed prot determining a companys short term goals d. determinung the amount to spend on fixed assets and which fixed assets to purchasearrow_forwardWhich of the following is a method of evaluating projects by first analyzing the project under all-equity financing and then adding in the effects of debt-financing? Multiple Choice Adjusted present value. Net present value. Pure play approach. Equity-debt approach. Modified IRR.arrow_forward

- The average accounting rate of return (AAR): Select one: A. is the best method of financially analysing mutually exclusive projects. B. is similar to the return on assets ratio. C. measures net income as a percentage of the sales generated by a project. D. considers the time value of money. E. is the primary methodology used in analyzing independent projects.arrow_forwardWhich of the following can be used to place capital investment proposals involving different amounts of investment on a comparable basis for purposes of net present value analysis? a. future value index b. price-level index c. rate of investment index d. present value indexarrow_forward10.-From the following options, choose the four that correspond to the application of financial management in the long term. A) Preparing financial reports B) Long-term investments C) Manage working capital D) Capital structure E) Support in identifying SWOT F) Budgeting G) Financial strategy (Class excercise)arrow_forward

- Compute the Profitability Index (PI) for each project? Project A Project B Profitability Index (PI) 5- In light of your answers above, suppose that these two projects might be mutually exclusive or independent. According to these two assumptions, fill in the blanks in the table below with the suitable answer: Points Investment Criteria If A and B are mutually exclusive, then I would select If A and B are independent, then I would select PBP NPV IRR PIarrow_forwardWhich term is used to represent the sales level that results in a project's net income exactly equalling zero? Group of answer choices Cash breakeven Operational breakeven Present value breakeven Financial breakeven Accounting profit breakevenarrow_forwardi. Whether profitable project or non-profit project the time value of money is important consideration among project planners and profesions develop a case of your choice demonstrating future value and present value computations to validate this statement ii. Define the following terms a) Cost benefit analysis b) Time value of money c) Capital d) Multiple rate of return e) Institutional appraisalarrow_forward

- Exercise 14-7 (Algo) Net Present Value Analysis of Two Alternatives [LO14-2] Perit Industries has $110,000 to invest. The company is trying to decide between two alternative uses of the funds. The alternatives are: Cost of equipment required Working capital investment required Annual cash inflows Salvage value of equipment in six years Life of the project Project A $ 110,000 $0 $ 20,000 $ 8,600 1. Net present value project A 2. Net present value project B 3. Which investment alternative (if either) would you recommend that the company accept? 6 years Project B $0 $ 110,000 $ 68,000 $0 6 years The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries' discount rate is 16%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project A. (Enter negative values with a minus sign. Round your final answer to the nearest…arrow_forwardWhich of the following tools is sometimes used to rank investment proposals? 01. 02. 03. 04. 05. Project assessment guide (PAG). Investment opportunity index. Annuity index. Profitability index. Capital ranking index.arrow_forwardThe average accounting rate of return (AAR): is the primary methodology used in analyzing independent projects. O O O O O is the best method of financially analyzing mutually exclusive projects. is similar to the return on assets ratio. considers the time value of money. measures net income as a percentage of the sales generated by a project.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education