Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

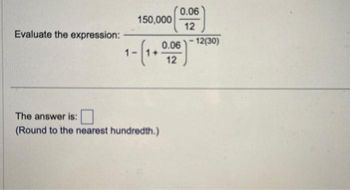

Transcribed Image Text:Evaluate the expression:

0.06

12

0.06 -12(30)

150,000

The answer is:

(Round to the nearest hundredth.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- L(RS, YUS) = 10 YUS RS +1arrow_forwardSolve it using formulas, no tables correct answers: i) i^2 0.059126 > 0.0341 iii) P(wd) £73.34 per £100 nominal iv) using i* > 6% pa --> NPV(6%)= 2.78020 and NPV(6.5%) = 1.59578 therefore i= 6.32% pa and f=2.5% --> i'= 3.72% pa A fixed interest security pays coupons of 5% per annum convertible half-yearly in arrears. The security is redeemable at 110% at the option of the borrower on any anniversary date between 15 and 25 years after the date of issue. An investor, who is liable to tax on income at a rate of 25% and on capital gains at a rate of 30%, intends to buy the product exactly two months after issue for a price that gives a net effective yield of at least 6% per annum. (i) Determine whether the investor would make a capital gain if the bond is held until redemption. (ii) In what way does your answer to part (i) affect the assumptions made for calculating the issue price? Explain in general terms the reasoning behind your chosen pricing approach. (iii) Calculate the maximum…arrow_forwardSuppose A=D+E, E=$350,000 and E/A=0.7. Solve for D.arrow_forward

- hello, to make a long story short i am attempting to calculate:-1736.3+1662.7 ln(10). i have gotten that it equals 2092.21 but i notice theres a step in my solutions solving that has me a bit puzzled when i type in 1662.7x ln(10) in my calculator i get the answer: 58234, although my hw suggests that i should get the answer 50823412- any tips?maybe im missing a number while typing in my calculator? ill include a picture of my work below.. pls helparrow_forwardTo 4-digit accuracy, what is the Mean of IWM return and the Mean of EEM return?arrow_forwardHow did you get the 1000 and 1300?Can you please explain on how did you calculate the 22 and 20.38?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education