Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

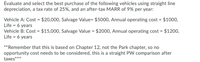

Transcribed Image Text:Evaluate and select the best purchase of the following vehicles using straight line

depreciation, a tax rate of 25%, and an after-tax MARR of 9% per year:

Vehicle A: Cost = $20,000, Salvage Value= $5000, Annual operating cost = $1000,

Life = 6 years

Vehicle B: Cost = $15,000, Salvage Value = $2000, Annual operating cost = $1200,

Life = 6 years

%3D

**Remember that this is based on Chapter 12, not the Park chapter, so no

opportunity cost needs to be considered, this is a straight PVW comparison after

taxes***

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the straight-line method to complete the first row of the depreciation table for an SUV that costs $41,000, has a residual value of $5,000 and an estimated life of six years. Year Annual depreciation Accumulated depreciation End-of-year book value 1 Complete the table below. Year Annual depreciation Accumulated depreciation End-of-year book value 1 $enter your response here $enter your response here $enter your response herearrow_forwardCalculate the depreciation in dollar and percentage terms, the yearly depreciation in percentage terms, and the percentage residual value based on the figures provided below. Round each answer to 2 decimals. Type your answers to the calculations in Table 7 of your data file. Remember to show your calculations. The gross capitalized cost of a vehicle is $18,200. At the end of a two-year lease, the residual value is $8,500. What is the depreciation on the vehicle in dollar and percentage terms? What is the yearly depreciation in percentage terms? What is the percentage residual value?arrow_forwardAn engineering analysis by net present worth (NPW) is to be made for the purchase of two devices, A and B. If an 8% interest rate is used, recommend the device to be purchased.arrow_forward

- help mearrow_forwardCompare three alternatives on the basis of their capitalized costs at /= 8% per year and select the best alternative. Alternative E F G $-460,000 $-30,000 $90,000 4 First Cost AOC, per Year Salvage Value Life, Years $-80,000 $-65,000 $40,000 2 The capitalized cost of alternative E is $ The best alternative is (Click to select) ▼ alternative F is $ $-960,000 $-3,000 $450,000 ∞0 and alternative G is $arrow_forwardProvide step by step manual solution, given, and depreciation table for below mentioned problem. Make sure yet that your answer is the same as the given answer before sending your solution. An asset costing P50,000 has a life expectancy of 6 years and an estimated salvage value of P8,000. Calculate the depreciation charge at the end of the fourth period using fixed-percentage method. Answer. P5,263.87arrow_forward

- rrarrow_forwardD1. Answer ASAP. Please complete all parts correctly.arrow_forwardRequired information A project has a first cost of $670,000, a salvage value of 27% of the first cost after 3 years, and annual (GI-OE) of $275,000. Assume the company has a Te of 37%. Determine the approximate after-tax rate of return (ROR). The after-tax rate of return (ROR) is determined to bearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education