Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

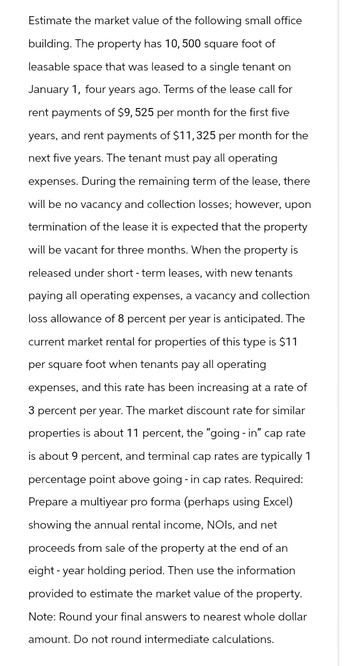

Transcribed Image Text:Estimate the market value of the following small office

building. The property has 10, 500 square foot of

leasable space that was leased to a single tenant on

January 1, four years ago. Terms of the lease call for

rent payments of $9, 525 per month for the first five

years, and rent payments of $11, 325 per month for the

next five years. The tenant must pay all operating

expenses. During the remaining term of the lease, there

will be no vacancy and collection losses; however, upon

termination of the lease it is expected that the property

will be vacant for three months. When the property is

released under short-term leases, with new tenants

paying all operating expenses, a vacancy and collection

loss allowance of 8 percent per year is anticipated. The

current market rental for properties of this type is $11

per square foot when tenants pay all operating

expenses, and this rate has been increasing at a rate of

3 percent per year. The market discount rate for similar

properties is about 11 percent, the "going - in" cap rate

is about 9 percent, and terminal cap rates are typically 1

percentage point above going - in cap rates. Required:

Prepare a multiyear pro forma (perhaps using Excel)

showing the annual rental income, NOIs, and net

proceeds from sale of the property at the end of an

eight year holding period. Then use the information

provided to estimate the market value of the property.

Note: Round your final answers to nearest whole dollar

amount. Do not round intermediate calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- On January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $93,000 each, beginning December 31, 2024, and on each December 31 through 2026. The lessor, HVAC Leasing, calculates lease payments based on an annual interest rate of 8%. Winn also paid a $204,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $297,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is the calendar year. Note: If no entry is required for a transaction/event,…arrow_forwardOn January 1, 2025, Sandhill Company leased equipment to Wildhorse Corporation. The following information pertains to this lease. 1. The term of the non-cancelable lease is 6 years. At the end of the lease term, Wildhorse has the option to purchase the equipment for $2,000, while the expected residual value at the end of the lease is $5,000. 2. Equal rental payments are due on January 1 of each year, beginning in 2025. 3. The fair value of the equipment on January 1, 2025, is $165,000, and its cost is $120,000. 4. The equipment has an economic life of 8 years. Wildhorse depreciates all of its equipment on a straight-line basis. 5. 6. Sandhill set the annual rental to ensure a 6% rate of return. Wildhorse's incremental borrowing rate is 8%, and the implicit rate of the lessor is unknown. Collectibility of lease payments by the lessor is probable. Both the lessor and the lessee's accounting periods end on December 31.arrow_forwardOn 31 December 20X1, Lessee Ltd. entered into a lease agreement by which Lessee leased a jutling machine for six years. Annual lease payments are $20,000, payable at the beginning of each lease year (31 December). At the end of the lease, possession of the machine will revert to the lessor. The normal economic life for this type of machine is 8 to 10 years. At the time of the lease agreement, jutling machines could be purchased for approximately $90,000 cash. Equivalent financing for the machine could have been obtained from Lessee's bank at 14%. Lessee uses straight-line depreciation for its jutling machines. Required: 1. Prepare a lease liability amortization table for the lease. 2. Prepare all journal entries relating to the lease and the leased asset for 20X1, 20X2, and 20X3. 3. How would the amounts relating to the leased asset and lease liability be shown on Lessee's statement of financial position at 31 December 20X4?arrow_forward

- On April 1, 2021, Primer Corp. signs a five-year lease to use office space. The present value of the monthly lease payments is $100,000. Record the lease.arrow_forwardA store has 5 years remaining on its lease in a mall. Rent is $2,000 per month, 60 payments remain, and the next payment is due in 1 month. The mall's owner plans to sell the property in a year and wants rent at that time to be high so that the property will appear more valuable. Therefore, the store has been offered a "great deal" (owner's words) on a new 5-year lease. The new lease calls for no rent for 9 months, then payments of $2,750 per month for the next 51 months. The lease cannot be broken, and the store's WACC is 12% (or 1% per month). a. Should the new lease be accepted? (Hint: Be sure to use 1% per month.) No b. If the store owner decided to bargain with the mall's owner over the new lease payment, what new lease payment would make the store owner indifferent between the new and old leases? (Hint: Find FV of the old lease's original cost at t = 9; then treat this as the PV of a 51-period annuity whose payments represent the rent during months 10 to 60.) Do not round…arrow_forwardNeed all four parts of this...don't attempt if you will not solve all four parts and can't give right answers.arrow_forward

- On January 1, 2020, Irwin Animation sold a truck to Peete Finance for $35,000 and immediately leased it back. The truck was carried on Irwin's books at $28,000. The term of the lease is 3 years, there is no bargain purchase option, and title does not transfer to Irwin at lease-end. The lease requires three equal rental payments of $8,696 at the end of each year (first payment on January 1, 2021). The appropriate rate of interest is 6%, the truck has a useful life of 5 years, and the residual value at the end of the lease term is expected to be $14,000, none of which is guaranteed. Prepare Irwin's 2020 journal entries.arrow_forward9arrow_forwardMasukharrow_forward

- Sun company engaged in leasing a machine for quality control that requires payment of $2000 at the end of each month. The economic life of the machine is five years. sun company normally subject to 6% interest rate per year in business transactions assume lease period is 54 months provide the journal entry that must be made on the date. The lease contract is signed. arrow_forwardGive me answer with explanationarrow_forwardFor his business, Nicholas leased equipment valued at $19,000. The terms of the lease required payments of $1550 every month. If the first payment is due eighteen months after the lease was signed and interest is 5% compounded semi-annually, what is the term of the lease? State your answer in years and months (from 0 to 11 months).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education