FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:es

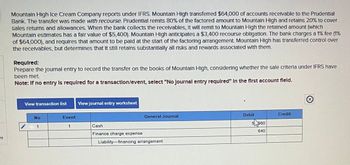

Mountain High Ice Cream Company reports under IFRS. Mountain High transferred $64,000 of accounts receivable to the Prudential

Bank. The transfer was made with recourse. Prudential remits 80% of the factored amount to Mountain High and retains 20% to cover

sales returns and allowances. When the bank collects the receivables, It will remit to Mountain High the retained amount (which

Mountain estimates has a fair value of $5,400). Mountain High anticipates a $3,400 recourse obligation. The bank charges a 1% fee (1%

of $64,000), and requires that amount to be paid at the start of the factoring arrangement. Mountain High has transferred control over

the receivables, but determines that it still retains substantially all risks and rewards associated with them.

Required:

Prepare the Journal entry to record the transfer on the books of Mountain High, considering whether the sale criteria under IFRS have

been met

Note: If no entry is required for a transaction/event, select "No Journal entry required" In the first account field.

View transaction list View journal entry worksheet

No

1

Event

1

General Journal

Cash

Finance charge expense

Liability-financing arrangement

Debit

5580

640

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vision Importing Company engaged in the following transactions involving promissory notes: Jul 2 Sold engines to morgan company for $180,000 to exchange for a 90-day, 12 percent promissory note. July 15 Sold engines to level company for $96,000 in exchange for a 90-day, 14 percent note. July 30 sold engines to level company for $90,000 in exchange for a 90-day, 11 percent note. Required: For each of the notes, determine the (a) maturity date, (b) interest on the note, and (c) maturity value. (Round to the nearest cent.) Assume that the fiscal year for Vision Importing ends on August 31. How much interest income should be recorded on that date? (Round to the nearest cent.)arrow_forwardBramble Corp. factors $630,000 of accounts receivable with Marin Inc., Inc. on a with recourse basis. Marin Inc. will collect the receivables. The receivable records are transferred to Marin Inc. on August 15, 2020. Marin Inc. assesses a finance charge of 3.0% of the amount of accounts receivable and also reserves an amount equal to 5.40% of accounts receivable to cover probable adjustments. Bramble prepares financial statements under ASPE. Assume the conditions for to be recorded as a sale are met. Prepare the journal entry on August 15, 2020, for Bramble to record the sale of receivables, assuming the recourse obligation has a fair value of $5,900arrow_forwardThe controller for Bramble Corporation has reached an agreement with Sheffield Financing Ltd. to sell a large portion of Bramble's past-due accounts receivable. Bramble agrees to sell $1,820,000 of accounts receivable to Sheffield with recourse. Bramble's controller estimates that the fair value of Bramble's liability to pay Sheffield for uncollectible accounts is $163.000. Sheffield will charge Bramble 9% of the total receivables balance as a financing fee, and will withhold an initial amount of 10% (a) Calculate the net proceeds and the gain or loss on the disposal of receivables to Sheffield Financing Ltd. Net proceeds ✓on disposal of receivables S $arrow_forward

- White Corporation has entered into an agreement to transfer accounts receivable to Murphy Company. Under the terms of this agreement, White receives 80% of the value of all the transferred accounts receivable (to reflect credit risk) and is charged a 1% service charge, which is based upon the dollar amount of transferred receivables. Interest is charged at an annual interest rate of 12% of any outstanding loan balance. The transferred receivables will continue to be collected by White with any cash flows being remitted to Murphy at the end of each month. White is not allowed to transfer the receivables to anyone else. White normally transfers its accounts receivable. The following selected 2019 transactions relate to this agreement: Dec 1 Accounts receivable of $160,000 are transferred. 11 A sales return of $1,000 on a transferred account is made. 31 Collections are made on $82,000 of the transferred accounts receivable plus interest for the month of December. This amount is…arrow_forwardVaughn Manufacturing assigns $7300000 of its accounts receivables as collateral for a $2.64 million 9% loan with a bank. Vaughn Manufacturing also pays a finance fee of 2% on the transaction upfront. What would be recorded as a gain (loss) on the transfer of receivables?arrow_forwardWinkler Company borrows $92,000 and pledges its receivables as security. The journal entry to record this transaction would be:arrow_forward

- Mountain High Ice Cream Company transferred $66,000 of accounts receivable to the Prudential Bank. The transfer was made with recourse. Prudential remits 90% of the factored amount to Mountain High and retains 10% to cover sales returns and allowances. When the bank collects the receivables, it will remit to Mountain High the retained amount (which Mountain estimates has a fair value of $5,600). Mountain High anticipates a $3,600 recourse obligation. The bank charges a 2% fee (2% of $66,000), and requires that amount to be paid at the start of the factoring arrangement. Required: Prepare the journal entry to record the transfer on the books of Mountain High assuming that the sale criteria are met. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 Record the transfer of accounts receivable. Note: Enter debits before credits. General Journal Debit Credit Event 1 Cash Loss…arrow_forward2arrow_forwardThe controller for Riverbed Corporation has reached an agreement with Concord Financing Ltd. to sell a large portion of Riverbed's past-due accounts receivable. Riverbed agrees to sell $1,950,000 of accounts receivable to Concord with recourse. Riverbed's controller estimates that the fair value of Riverbed's liability to pay Concord for uncollectible accounts is $177,000. Concord will charge Riverbed 7% of the total receivables balance as a financing fee, and will withhold an initial amount of 8%. (a) - Your answer is partially correct Calculate the net proceeds and the gain or loss on the disposal of receivables to Concord Financing Ltd Net proceeds 1657500 Loss on disposal of receivables $ 233500 iarrow_forward

- On December 1, 2020, RB Company assigned on a non-notification basis accounts receivable of Php6,000,000 to a bank in consideration for a loan of 80% of the accounts less a 5% service fee on the accounts assigned. The entity signed a note for the bank loan. On December 31, 2020, the entity collected assigned accounts of Php2,000,000 less discount of Php200,000. The entity remitted the collections to the bank in partial payment for the loan. The bank applied first the collection to the interest and the balance to the principal. The agreed interest is 1% per month on the loan balance. The entity accepted sales returns of Php100,000 on the assigned accounts and wrote off assigned accounts totaling Php300,000. What is the equity of the assignor in assigned accounts on December 31, 2020?arrow_forwardManjiarrow_forwardVikarmbhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education