FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:es

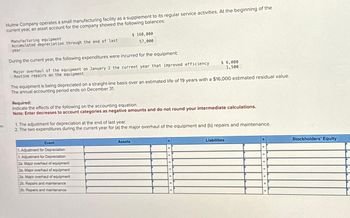

Hulme Company operates a small manufacturing facility as a supplement to its regular service activities. At the beginning of the

current year, an asset account for the company showed the following balances:

Manufacturing equipment

Accumulated depreciation through the end of last

year

During the current year, the following expenditures were incurred for the equipment:

Major overhaul of the equipment on January 2 the current year that improved efficiency

Routine repairs on the equipment

$ 168,000

57,000

The equipment is being depreciated on a straight-line basis over an estimated life of 19 years with a $16,000 estimated residual value.

The annual accounting period ends on December 31.

Required:

Indicate the effects of the following on the accounting equation.

Note: Enter decreases to account categories as negative amounts and do not round your intermediate calculations.

Event

1. Adjustment for Depreciation

1. Adjustment for Depreciation

2a. Major overhaul of equipment

2a. Major overhaul of equipment

2a. Major overhaul of equipment

2b. Repairs and maintenance

2b. Repairs and maintenance

$ 6,000

1,500

1. The adjustment for depreciation at the end of last year.

2. The two expenditures during the current year for (a) the major overhaul of the equipment and (b) repairs and maintenance.

Assets

=

Liabilities

+

+

+

+

+

+

+

Stockholders' Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- As part of a major renovation at the beginning of the year, Atiase Pharmaceuticals, Incorporated, sold shelving units (recorded as Equipment) that were 10 years old for $1,070 cash. The shelves originally cost $7,480 and had been depreciated on a straight-line basis over an estimated useful life of 10 years with an estimated residual value of $580. M9-10 (Algo) Part 1 Required: 1. Complete the accounting equation below, indicating the account, amount, and the effect of disposal. Assume that depreciation has been recorded to the date of sale. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign. Do not round intermediate calculations.) Cash Equipment Assets 1,070 (7,250) 420= Accumulated Depreciation-Equipment Liabilities Stockholders' Equarrow_forwardDuring the current year, Yost Company disposed of three different assets. On January 1 of the current year, prior to the disposal of the assets, the accounts reflected the following: Accumulated Depreciation Asset Machine A Machine B Original Cost Residual Value Estimated Life $33,000 $3,000 12 years 16,800 10 years Machine C 5,100 17 years 140,000 75,600 (straight line) The machines were disposed of during the current year in the following ways: a. Machine A: Sold on January 1 for $7,500 cash. $25,000 (10 years) 98,560 (8 years) 49,765 (12 years) b. Machine B: Sold on December 31 for $54,120; received cash, $43,296, and an $10,824 interest-bearing (12 percent) note receivable due at the end of 12 months. c. Machine C: On January 1, this machine suffered irreparable damage from an accident. On January 10, a salvage company removed the machine at no cost. P8-5 Part 1 Required: 1. Give all journal entries related to the disposal of each machine in the current year. a. Machine A. b.…arrow_forwardCurrent Attempt in Progress Shamrock Utilities Corporation incurred the following costs in constructing a new maintenance building during the fiscal period: Direct labour costs incurred up to the point when the building is in a condition necessary for use as management intended, but before Shamrock begins operating in the building, $79,100 Additional direct labour costs incurred before Shamrock begins operating in the building. $5,710 Material purchased for the building, $82,700 Interest on the loan to finance construction until completion, $2,430 Allocation of variable plant overhead based on labour hours worked on the building, $28,500 f. Architectural drawings for the building, $8,200 Allocation of the president's salary, $61,300 a. b. C. d. e. g. What costs should be included in the cost of the new building if Shamrock prepares financial statements in accordance with IFRS? With ASPE? (Assume that, if there is no specific guidance from GAAP, Shamrock's management would consider a…arrow_forward

- Zorzi Company purchased a machine on July 1, 2018, for $28.000. Zorzi paid $200 in title fees and county property tax of $125 on the machine In addition, Zorzi paid $500 shipping charges for delivery and $475 was paid to a local contractor to build and wire a platform for the machine on the plant floor The machine has an estimated useful life of 6 years with a salvage value of $3.000 Determine the depreciation base of Zorzis new machine. Zorzi uses straight-line depreciation. $25,000 $26.000 $26 300 None of the abovearrow_forwardNew lithographic equipment, acquired at a cost of $800,000 on March 1 at the beginning of a fiscal year, has an estimated useful life of 5 years and an estimated residual value of $90,000 The manager requested information regarding the effect of alternative methods on the amount of depreciation expense each year, In the first week of the fifth year, on March 4, the equipment was sold for $134,570. Required: 1. Determine the annual depreciation expense for each of the estimated 5 years of use, the accumulated depreciation at the end of each year, and the book value of the equipment at the end of each year by (a) the straight-line method and (b) the double-declining-balance method. 2. Journalize the entry to record the sale, assuming the manager chose the double-declining-balance method. 3. Journalize the entry to record the sale in (2), assuming that the equipment was sold for $88,180 instead of $134,570.arrow_forwardDouble Island Ltd constructed a Whizbang Machine and incurred the following costs in doing so: Amounts paid to employees to build the machine $120 000 Raw materials consumed in building the machine $45 000 Depreciation of manufacturing equipment attributed to the construction of the Whizbang Machine $25 000 REQUIRED Provide the journal entries that Double Island Ltd would use to account for the construction of the asset. Assume that immediately after the journal entries in part (a) have been made, new information becomes available that indicates that the recoverable amount of the Whizbang Machine is only $160 000. Provide the adjusting journal entriesarrow_forward

- 2arrow_forwardCopy equipment was acquired at the beginning of the year at a cost of $41,560 that has an estimated residual value of $3,800 and an estimated useful life of 5 years. It is estimated that the machine will output an estimated 944,000 copies. This year, 271,000 copies were made. Determine the (a) depreciable cost, (b) depreciation rate, and (c) units-of-activity depreciation for the year. Round "depreciation rate" to two decimal places. a. Depreciable cost $fill in the blank 1 b. Depreciation rate fill in the blank 2 per copy c. The units-of-output depreciation for the year $fill in the blank 3arrow_forwardgp.2 please provide woekingarrow_forward

- Oaktree Company purchased new equipment and made the following expenditures: Purchase price Sales tax Freight charges for shipment of equipment Insurance on the equipment for the first year Installation of equipment The equipment, including sales tax, was purchased on open account with payment due in 30 days. The other expenditures listed above were paid in cash. Required: Prepare the necessary journal entries to record the above expenditures (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 1 $50,000 2,700 750 958 1,500 2 Record the purchase of equipment.arrow_forwardOki Company pays $283,500 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment. 1. Paid $20,250 cash for a new component that increased the equipment's productivity. 2. Paid $5,063 cash for minor repairs necessary to keep the equipment working well. 3. Paid $13,200 cash for significant repairs to increase the useful life of the equipment from four to seven years. View transaction list Journal entry worksheet > Record the betterment cost of $20,250 paid in cash. Note: Enter debits before credits. Debit Credit Transaction General Journal 1 MacBook Airarrow_forwardLayton Company purchased tool sharpening equipment on October 1 for $108,000. The equipment was expected to have a useful life of three years, or 12,000 operating hours, and a residual value of $7,200. The equipment was used for 1,350 hours during Year 1, 4,200 hours in Year 2, 3,650 hours in Year 3, and 2,800 hours in Year 4. In a table show depreciation expense, accumulated deprecation at the end of the year, beginning and ending book value (Use double declining method only) Cost Beginning Book Value Accumulated Deprecation Depreciation expense Book value at Endarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education