ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

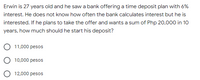

Transcribed Image Text:Erwin is 27 years old and he saw a bank offering a time deposit plan with 6%

interest. He does not know how often the bank calculates interest but he is

interested. If he plans to take the offer and wants a sum of Php 20,000 in 10

years, how much should he start his deposit?

11,000 pesos

10,000 pesos

O 12,000 pesos

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please provide a clear and complete solution. Answer fast for I have 30 minutes left. Thank you very much.arrow_forwardPlease I need answer Asap. thanksarrow_forwardIf ₱5,000 is invested for the period from March 19 to August 6, 2010 at 6% simple interest find:a. exact simple interest using exact time,b. exact simple interest using approximate time,c. ordinary simple interest using exact time, andd. ordinary simple interest using approximate time.arrow_forward

- How long in years will a certain sum of money to doubles its amount when deposited at a rate of 4% compounded bi-monthly?arrow_forwardYou just deposited $1,500 in a bank account that pays a 6.0% nominal interest rate, compounded quarterly. If you also add another $5,000 to the account one year (4 quarters) from now and another $6,500 to the account two years (8 quarters) from now, how much will be in the account three years (12 quarters) from now? O a. $15,543.04 O b. $14,324.75 Oc. $13,195.00 O d. $13,594.06 Oe. $14,294.52arrow_forwardDr. Pepito Perigrino wishes to have Php150,000.00 when he retires 15 years from now. If he can expect to receive 6% annual interest, how much should she set aside in each of 20 equal annual beginning-of-year deposits? O a. P3,487.00 O b. P3,874.00 O c. P3,784.00 O d. P3,847.00arrow_forward

- 3. Annual deposits were made in a fund earning 10% per annum. The first deposit was Php 20,000 and each deposit thereafter was 2,000 less than the preceding one. Determine the amount in the fund after the sixth deposit.arrow_forwardA3 help me solve this question without using tables in excel. An annual deposits of A1=$1,500 in a saving account is made for 6 years starting year 1. In year 9, a one-time deposit of $3,500 is made. In year 11, a one-time withdrawal of $2,500 is made. Then another series of annual deposits of A2 started for 7 years starting from year 12, increasing by $350 every year. If a one-time withdrawal of $900 was made in year 19 and the present worth of the whole amounts of deposits and withdrawals is $-20,500, what is the value of A2? If the whole life cycle is to be repeated forever with a life cycle of 19 years, what is the capitalized cost and the annual worth? Assume an interest rate of 6%.arrow_forwardDrill • You borrow Php 5,000 today and must repay a total of Php 4,500 exactly 1 year later. What is the interest amount and the interest rate paid?arrow_forward

- In solving, indicate the Cash Flow Diagram and Solution 1. On January 1, 2005, a person's savings account was worth Php 200,000. Every month thereafter, this person makes a cash contribution of Php 676 to the account. If the fund was expected to be worth Php 400,000 on January 1, 2010, a.) What monthly rate of interest was being earned on this fund? b.) What is the nominal rate compounded monthly? c.) What is the equivalent effective interest rate per year? Write your answer in decimal form and round it off into 5 decimal places. References:arrow_forwardPls answer asap. Thank you .. I will rate helpfularrow_forwardDiscount PHP 216,000 for120 days at a discount interest rate of 8%. (Note: To discount an amount means to find its present value.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education