Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Solve this general accounting question

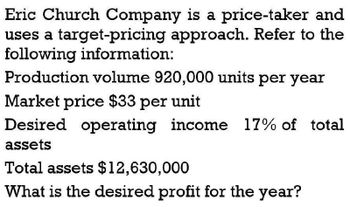

Transcribed Image Text:Eric Church Company is a price-taker and

uses a target-pricing approach. Refer to the

following information:

Production volume 920,000 units per year

Market price $33 per unit

Desired operating income 17% of total

assets

Total assets $12,630,000

What is the desired profit for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Faldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit? 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are 200,000 greater than expected. What would the total profit be? 3. Compute the margin of safety in sales revenue. 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected. 5. How many units must be sold to earn a profit equal to 10 percent of sales? 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of 180,000?arrow_forwardWhat is the desired profit for the year on these general accounting question?arrow_forwardWhat is the desired profit for the year? For this general accounting questionarrow_forward

- Rocky River Company is a price - taker and uses target pricing. Refer to the following information: Production volume Market price Desired operating income Total assets 601,000 units per year $30 per unit 17% of total assets $13,800,000 What is the target full product cost per unit? (Round your answer to nearest cent.) Assume all units produced are sold. OA. $24.90 OB. $26.10 OC. $30.00 OD. $5.10arrow_forwardProfit-Volume Chart For the coming year, Loudermilk Inc. anticipates fixed costs of $600,000, a unit variable cost of $75, and a unit selling price of $125. The maximum sales within the relevant range are $2,500,000. a. Determine the maximum possible operating loss. b. Compute the maximum possible operating profit. c. Construct a profit-volume chart on paper. Indicate whether each of the following levels of sales is in the operating profit area, operating loss area, or at the break-even point. 4,800 units 8,000 units 12,000 units 16,000 units 20,000 units d. Estimate the break-even sales (units) by using the profit-volume chart constructed in part (c). unitsarrow_forwardBeckham Company has the following information available: Selling price per unit: Variable cost per unit: Fixed costs per year: £400,000 Expected sales per year: 20,000 units What is the expected operating income (i.e. profit) for a year? Select one: O A. £500,000 O B. O C. £700,000 £680,000 £100 £55 O D. £480,000arrow_forward

- Please help me with calculationarrow_forwardFor the coming year, Cleves Company anticipates a unit selling price of $142, a unit variable cost of $71, and fixed costs of $603,500. Required: 1. Compute the anticipated break-even sales (units).fill in the blank 1 units 2. Compute the sales (units) required to realize a target profit of $298,200.fill in the blank 2 units 3. Construct a cost-volume-profit chart, assuming maximum sales of 17,000 units within the relevant range. From your chart, indicate whether each of the following sales levels would produce a profit, a loss, or break-even. $1,689,800 $1,505,200 $1,207,000 $908,800 $724,200 4. Determine the probable income (loss) from operations if sales total 13,600 units. If required, use the minus sign to indicate a loss.$fill in the blank 8arrow_forwardA company is making plans for next year, using cost-volume-profit analysis as its planning tool. Next year's sales data about its product are as follows Selling price P60 Variable manufacturing costs per unit 22.50 Variable selling and administrative costs 4.5 Fixed operating costs (60% is manufacturing costs) P159,500 Income tax rate 30% How much should sales be next year if the company wants to earn profit after tax of P23,100, the same amount that it earned last year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning