FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

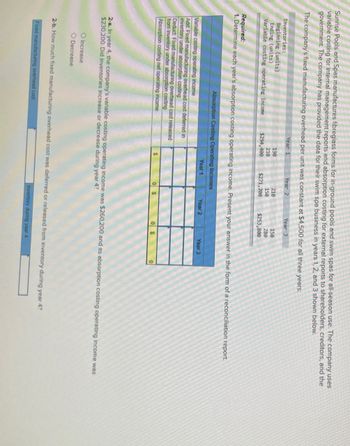

Transcribed Image Text:Sunrise Pools and Spas manufactures fibreglass forms for in-ground pools and swim spas for all-season use. The company uses

variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the

government. The company has provided the data for their swim spa business in years 1, 2, and 3 shown below.

The company's fixed manufacturing overhead per unit was constant at $4,500 for all three years:

Year 1

Year 2

Year 3

Inventories:

Beginning (units)

190

210

Ending (units)

Variable costing operating income

210

$294,400

150

$271,200

150

280

$253,800

Required:

1. Determine each year's absorption costing operating income. Present your answer in the form of a reconciliation report.

Absorption Costing Operating Incomes

Year 1

Year 2

Year 3

Variable costing operating income

Add Fixed manufacturing overhead cost deferred in

inventory under absorption costing

Deduct Fixed manufacturing overhead cost released

from inventory under absorption costing

Absorption costing net operating income

S

0 S

0 $

2-a. In year 4, the company's variable costing operating income was $260,200 and its absorption costing operating income was

$230,200. Did inventories increase or decrease during year 4?

O Increase

O Decrease

2-b. How much fixed manufacturing overhead cost was deferred or released from inventory during year 4?

Fixed manufacturing overhead cost

inventory during year 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hansabenarrow_forwardjlp.9arrow_forwardRequired Information [The following information applies to the questions displayed below.] Use the following information: P1 P2 Department Cost Service 1 (51) $115,000 Service 2 (52) 47,000 Production 1 375,000 (P1) Production 2 (P2) Total 246,000 $783,000 Percentage Service Provided to S1 0% S2 P1 P2 25% 30% 45% 20 60 20 0 What percentage of S1's costs is allocated to P1 and to P2 under the direct method? Service Department 1's Costsarrow_forward

- If a business had sales of $4,369,000 and a margin of safety of 20%, the break-even point was a.$3,495,200 b.$873,800 c.$7,864,200 d.$5,242,800arrow_forwardYour COGS$=$35,250 Total Labor = $26,000 Controllables = $5,750 Minimum Rent = $6,500 Advertising = $500 Net Sales $98,000 Your Controllable Profit% is:arrow_forwardCalculate the Contribution Margin Ratio: Sales 2,000,000 Rent 500,000. Depreciation 200,000. Variable COGS 60,000 Fixed COGS 35,000.arrow_forward

- Popper Company acquired 80% of the common stock of Cocker Company on January 1, 2022, when Cocker had the following stockholders' equity accounts. Common stock 40,000 shares outstanding $ 140,000 105,000 476,000 $ 721,000 Additional paid-in capital Retained earnings Total stockholders' equity To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2025. Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2025, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker. On January 1, 2025, Cocker issued 10,000 additional shares of common stock for $21 per share. Popper did not…arrow_forwardch7-50 Jellico Inc.'s projected operating income (based on sales of 450,000 units) for the coming year is as follows: Total Sales $ 12,150,000 Total variable cost 7,533,000 Contribution margin $ 4,617,000 Total fixed cost 2,875,878 Operating income $ 1,741,122 Required: 1(a). Compute variable cost per unit. Enter your answer to the nearest cent.$per unit 1(b). Compute contribution margin per unit. Enter your answer to the nearest cent.$per unit 1(c). Compute contribution margin ratio. % 1(d). Compute break-even point in units. units 1(e). Compute break-even point in sales dollars.$ 2. How many units must be sold to earn operating income of $376,542? units 3. Compute the additional operating income that Jellico would earn if sales were $50,000 more than expected.$ 4. For the projected level of sales, compute the margin of safety in units, and then in sales dollars. Margin of safety in units units Margin of safety in sales dollars $ 5. Compute the degree…arrow_forwardACG Manufacturing Ltd Statement of comprehensive 31/12/20X1 £'000 Total Unit % New project Sales(1000units) 250.000 250 100 VC 150.000 150 60 CM 100.000 100 40 FC 60.000 EBIT 40.000 Ex4: Prepare the I.S if: ACG replace paying fixed salary of £10,000/year by paying regarding to number of product sold at £20/unit Effect: Sales volume increase by 20% income as year ended atarrow_forward

- If selling price of a product is $20; variable cost per unit is 15 ; total contribution margin is 1000 and the net income $1500.What is the total units sold ? a. 500 b. 2000 c. 1200 d. -500 e. 200 -500 2000 1200 500 200arrow_forwardWhat part of P2,000 is P 800?arrow_forwardIgnore first question and answer only 2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education