FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ered

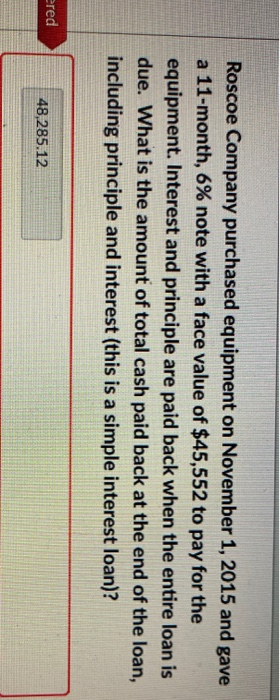

Roscoe Company purchased equipment on November 1, 2015 and gave

a 11-month, 6% note with a face value of $45,552 to pay for the

equipment. Interest and principle are paid back when the entire loan is

due. What is the amount of total cash paid back at the end of the loan,

including principle and interest (this is a simple interest loan)?

48,285.12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4 The Esquire Clothing Company borrowed a sum of cash on October 1, 2016, and signed a note payable. The annual interest rate was 12% and the company's year 2016 income statement reported interest expense of $1,260 related to this note. What was the amount borrowed? OA) $22,000 OB) $31,500 Oc) $10,500 OD) $42,000arrow_forwardGingerbread Corp was issued a $220,000 loan at 6%. The amortization schedule created by the company accountant is presented below. If Gingerbread Corp decided to pay off the entire principle balance left on the loan of $119,590 at the end of period 3 how much would the company save in interest expense? Interest expense saved ?arrow_forwardEB11. 12.4 Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from the bank in the amount of $310,000. The terms of the loan are 6.5% annual interest rate, payable in three months. Interest is due in equal payments each month. Compute the interest expense due each month. Show the journal entry to recognize the interest payment on February 24, and the entry for payment of the short-term note and final interest payment on April 24. Round to the nearest cent if requiredarrow_forward

- On January 2, 2017, Criswell Acres purchased from Mifflinburg Farm Supply a new tractor that had a cash selling price of $109,837. As payment, Criswell gave Mifflinburg Farm Supply $25,000 in cash and a $100,000, five-year note that provided for annual interest payments at 6%. At the time of the sale, the interest rate normally charged to farms with Criswell's credit rating is 10%. Required: 1. Prepare Mufflinburg Farm Supply's journal entry to record the sale. 2. Prepare the journal entry to record the first interest payment Mifflinburg Farm Supply received on December 31, 2017. 3. Determine the note receivable balance that Mifflinburg Farm Supply will report on December 31, 2018. 4. Determine Mifflinburg Farm Supply's note receivable balance on December 31, 2018, assuming that the company reports notes receivable at fair value and the relevant rate of interest at that time has fallen to 8%. Assume that the December 31, 2018, interest payment has been made.arrow_forwardStinson Corporation borrowed $85,000 at 8% compounded quarterly to buy a warehouse. Monthly payments of $1200 were made over the term of the loan. Construct a partial amortization schedule showing the last 2 payments. Determine the total amount paid to settle the loan. Show work, not just the answer. Determine the total principal repaid. Determine the total amount of interest paid. Show work, not just the answer.arrow_forwardA company borrows $100,000 with interest at j₁2 = 9%. The loan is to be amortized by monthly payments of $1550 for as long as necessary. A final smaller payment will be calculated so the loan will be exactly repaid. The outstanding balance immediately after the th th 88 payment is $796.44. What is the value of the 89" and final payment? O A. $790.51 B. $796.44 C. $802.41 D. $808.43arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education