FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

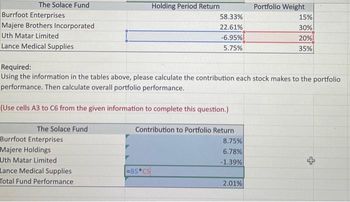

Transcribed Image Text:The Solace Fund

Burrfoot Enterprises

Majere Brothers Incorporated

Uth Matar Limited

Lance Medical Supplies

Burrfoot Enterprises

Majere Holdings

Uth Matar Limited

Lance Medical Supplies

Total Fund Performance

Holding Period Return

58.33%

22.61%

-6.95%

5.75%

=B5*C5

Required:

Using the information in the tables above, please calculate the contribution each stock makes to the portfolio

performance. Then calculate overall portfolio performance.

(Use cells A3 to C6 from the given information to complete this question.)

The Solace Fund

Contribution to Portfolio Return

8.75%

6.78%

-1.39%

Portfolio Weight

2.01%

15%

30%

20%

35%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- F1 plaese help.....arrow_forwardHistorical Realized Rates of Return You are considering an investment in either individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: ΤΑ -17.00% 37.00 28.00 ЇВ -6.00% 16.00 -12.00 -5.00 47.00 23.00 21.00 a. Calculate the average rate of return for each stock during the 5-year period. Do not round intermediate calculations. Round your answers to two decimal places. Stock A: Stock B: % % Std. Dev. b. Suppose you had held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? Do not round intermediate calculations. Round your answers to two decimal places. Negative values, if any, should be indicated by a minus sign. Year 2017 2018 2019 2020 2021 Average return c. Calculate the standard deviation of returns for each stock and for the portfolio.…arrow_forwardD4) Finance Consider a portfolio composed of shares AAA and BBB as shown in the following table. At 95% confidence level, select the correct statement AAA BBB Value 2,470,000 785,750 % investment 76% 24% Volatilities 2.32 % 2.69 % Correlation for both assets 0.65 Portfolio Value for both assets 3,255,750 a) The Component VaR of the Asset AAA is 92,223 and the component VaR of the Asset BBB is 27955.69 b) The contribution to the VaR of the Asset AAA is 77% and the one of the Asset 2 is 23% c) Both answers are correctarrow_forward

- A portrollo consists of assets with the following expected returns: Technology stocks Pharmaceutical stocks Utility stocks Savings account a. What is the expected return on the portfolio if the investor spends an equal amount on each asset? Round your answer to two decimal places. % 26% 16 9 4 b. What is the expected return on the portfolio if the investor puts 53 percent of available funds in technology stocks, 15 percent in pharmaceutical stocks, 14 percent in utility stocks, and 18 percent in the savings account? Round your answer to two decimal places. %arrow_forwardQuestion content area top Part 1 (Capital asset pricing model) Anita, Inc. is considering the following investments. The current rate on Treasury bills is 7 percent, and the expected return for the market is 12.5 percent. Using the CAPM, what rates of return should Anita require for each individual security? Stock Beta H 0.71 T 1.62 P 0.89 W 1.37 (Click on the icon in order to copy its contents into a spreadsheet.) Question content area bottom Part 1 a. The expected rate of return for security H, which has a beta of 0.71, is enter your response here%. (Round to two decimal places.) Part 2 b. The expected rate of return for security T, which has a beta of 1.62, is enter your response here%. (Round to two decimal places.) Part 3 c. The expected rate of return for security P, which has a beta of 0.89, is enter your response here%. (Round to two decimal places.) Part 4 d. The expected rate of return for…arrow_forwardAssume that you have just received information from your investment advisor that your portfolio has reached a value of $1,250,000. Your portfolio consists of three stocks, as follows: Stock Amount Invested % of Total Beta A $250,000 20% 1.12 B $400,000 32% .85 C $600,000 48% .55 Total: $1,250,000 100% Calculate the beta of this investment portfolio. Assume that the expected market return ( r m ) is 9 percent and the expected risk- free rate ( RF ) is 2 percent. What is the expected return ( r j ) for this investment portfolio?arrow_forward

- step by step explaination (no excel)arrow_forwardPls show Every step and conceptarrow_forward(c)) Discuss the following graphic, which shows the relationship between expected return and portfolio weights. The portfolio is comprised of a debt security D and an equity security E. What would the portfolio strategy be when Wp = 2 and ba WE = -1? 38 (33) -0.5 Expected Return 13% 8% Debt Fund 0 (ebenso) esenicut adol leu@ ledol (loorba (ognerloxel) Ismet tametnl Equity Fund 1.0 0 OC) becida nieu to 2.0 w (stocks) AB -1.0 68 XO.YOUTS RO w (bonds)=1-w (stocks) 15 V10 anollesup Figure 7.3 Portfolio expected return as a function of investment proportions la 21101TOarrow_forward

- Please see the attached diagram image. Please show how to solve this problem and please show all steps and formulas in Excel. Based on the Capital Asset Pricing Model (CAPM) and the diagram below, what is the return of the stock if its beta is 1.2 or 0.8?arrow_forwardConsider two asset classes: Stocks and Bonds. You estimate the following parameters for these two asset class funds. correlation matrix b/n Stocks and Bonds E(r ) sd(r) Stocks Bonds Stocks 19% 28% 10.5 Bonds 10% 8% 0.5 1 Consider a $80,000 portfolio consisting of $60,000 in Stocks and $20,000 in Bonds. So, the portfolio is 75% in Stocks and 25% in Bonds. Given the expected return on the portfolio is 16.75%, and the standard deviation of the portfolio return is 22.07%, what is the 2.5% value at risk (note: the 95% confidence interval lower limit on the portfolio value is the value of the portfolio at this level of loss)? (use 2 decimals without $, so a loss of -$10.00 is -10.00) Answer:Question 2 - 21205.76 Feedback The correct answer is: -21908.92 expainarrow_forwardCalculate the weighted average expected return of the portfolio. Stock Investment Expected ReturnA $20,000 15%B $4,000 10%C $26,000 12%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education