Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

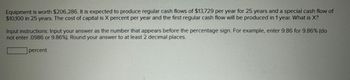

Transcribed Image Text:Equipment is worth $206,286. It is expected to produce regular cash flows of $13,729 per year for 25 years and a special cash flow of

$10,100 in 25 years. The cost of capital is X percent per year and the first regular cash flow will be produced in 1 year. What is X?

Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do

not enter .0986 or 9.86%). Round your answer to at least 2 decimal places.

percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Equipment is worth $339,976. It is expected to produce regular cash flows of $50,424 per year for 18 years and a special cash flow of $75,500 in 18 years. The cost of capital is X percent per year and the first regular cash flow will be produced today. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardng Equipment is worth $998,454. It is expected to produce regular cash flows of $78,377 per year for 20 years and a special cash flow of $34,800 in 20 years. The cost of capital is X percent per year and the first regular cash flow will be produced in 1 year. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou are offered an asset that costs $150,000 and has cash flows of $1,350 at the end of every month for the next 6years. Assume the cost of capital is 9percent per year.a. What is the IRR of the asset?b. What is the NPV of the asset? c. If your cost of capital is 12percent, should you purchase it? (Setup cash flows in Excel spreadsheets and uses the following Excel Financial functions, IRR, and NPV to derive your answers.arrow_forward

- Assume that at the beginning of the year, you purchase an investment for $6,300 that pays $130 annual income. Also assume the investment's value has increased to $6,900 by the end of the year. a. What is the rate of return for this investment? Note: Input the amount as a positive value. Enter your answer as a percent rounded to 2 decimal places. Rate of return % b. Is the rate of return a positive or a negative number? Positive Negativearrow_forwardAn investment has an expected return of X percent per year, is expected to make annual payments of $3,170 for 7 years, is worth $14,532, and the first payment is expected in 1 year What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardCan you show me how this is done? Emily Company has a minimum required rate of return of 9%. It is considering investing in a project that costs $90,671 and is expected to generate cash inflows of $23,576 at the end of each year for three years. The profitability index for this project is Round your answer to 2 decimal places. Selected Answer: 65 Correct Answer: 0.66 ± 0.05arrow_forward

- Assume that at the beginning of the year, you purchase an investment for $6,500 that pays $95 annual income. Also assume the investment's value has increased to $7,050 by the end of the year. a. What is the rate of return for this investment? Note: Input the amount as a positive value. Enter your answer as a percent rounded to 2 decimal places.arrow_forwardAn investment has an installed cost of $527,630. The cash flows over the four-year life of the investment are projected to be $212,200, $243,800, $203,500 and $167,410, respectively. If the discount rate is 10%, at what discount rate is the NPV just equal to 0? (Input in percentage, keep 2 decimals. e.g. if you got 0.10231, input 10.23) Question 10 The Yurdone Corporation wants to set up a private cemetery business. According to the CFO, Barry M. Deep, business is "looking up". As a result, the cemetery project will provide a net cash inflow of $145,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 4% per year forever. The project requires an initial investment of $1,900,000. The company is somewhat unsure about the assumption of a growth rate of 4% in its cash flows. At what constant growth rate would the company just break even if it still required a return of 11% on investment? (Input in percentage, keep 2 decimals. e.g. if you got…arrow_forwardYour company is considering a capital project that will require a net initial investment of $264,978. The project is expected to have a 7-year life and will generate an annual net cash inflow of $46,260. Using the present value tables, what is the internal rate of return? (Round answers to 0 decimal places, e.g. 25.) Click here to view the factor table. Internal Rate of Return eTextbook and Mediaarrow_forward

- Assume that at the beginning of the year, you purchase an investment for $7,200 that pays $100 annual income. Also assume the investment's value has decreased to $6,800 by the end of the year. (a) What is the rate of return for this investment? (Input the amount as a positive value. Enter your answer as a percent rounded to 2 decimal places.) Rate of return % (b) Is the rate of return a positive or negative number? Positive O Negativearrow_forwardPerez Company is considering an investment of $26,945 that provides net cash flows of $8,500 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals. (b) The hurdle rate is 7%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A Required B What is the internal rate of return of this investment? Present value factor Internal rate of return %arrow_forwardMake sure you're using the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education