FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

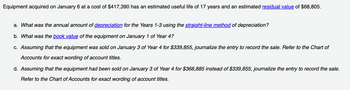

Transcribed Image Text:Equipment acquired on January 6 at a cost of $417,390 has an estimated useful life of 17 years and an estimated residual value of $68,805.

a. What was the annual amount of depreciation for the Years 1-3 using the straight-line method of depreciation?

b. What was the book value of the equipment on January 1 of Year 4?

c. Assuming that the equipment was sold on January 3 of Year 4 for $339,855, journalize the entry to record the sale. Refer to the Chart of

Accounts for exact wording of account titles.

d. Assuming that the equipment had been sold on January 3 of Year 4 for $368,885 instead of $339,855, journalize the entry to record the sale.

Refer to the Chart of Accounts for exact wording of account titles.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduce to depreciation expense

VIEW Step 2: Working for annual depreciation expense

VIEW Step 3: Working for accumulated depreciation and book value at end of year 3 or beginning of year 4

VIEW Step 4: Working for gain or loss on sale for $339,855

VIEW Step 5: Working for gain or loss on sale for $368,885

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Computer equipment was acquired at the beginning of the year at a cost of $55,699.00. The computer equipment has an estimated residual value of $3,518.00 and an estimated useful life of 3 years. Determine the 2nd year's depreciation using straight-line depreciation. Select the correct answer. $19,739.00 $18,566.33 $17,393.67 $34,787.33arrow_forwardEquipment was acquired at the beginning of the year at a cost of $537,500. The equipment was depreciated using the double-declining-balance method based on an estimated useful life of 9 years and an estimated residual value of $47,040. A. What was the depreciation for the first year? Round your intermediate calculations to 4 decimal places. Round the depreciation for the year to the nearest whole dollar. B. Assuming that the equipment was sold at the end of the second year for $532,597, determine the gain or loss on the sale of the equipment. C. Journalize the entry on Dec. 31 to record the sale. Refer to the Chart of Accounts for the exact wording of account titles. C. Journalize the entry on Dec. 31 to record the sale. Refer to the Chart of Accounts for the exact wording of account titles. How does grading work? PAGE 1 JOURNAL ACCOUNTING EQUATION Score: 45/49 DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 ✔ ✔ ✔…arrow_forwardEquipment with a cost of $148,767.00 has an estimated residual value of $8,167.00 and an estimated life of 7 years or 14,290 hours. It is to be depreciated by the straight-line method. What is the amount of depreciation for the first full year, during which the equipment was used 3,563 hours? Select the correct answer. $35,056.53 $20,085.71 $39.46 $7.00arrow_forward

- Indarrow_forwardEquipment was acquired at the beginning of the year at a cost of $625,000. The equipment was depreciated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $46,635. a. What was the depreciation for the first year? Round your answer to the nearest cent.$ b. Using the rounded amount from Part a in your computation, determine the gain(loss) on the sale of the equipment, assuming it was sold at the end of year eight for $105,608. Round your answer to the nearest cent and enter as a positive amount.$ Loss c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Round your answers to the nearest centarrow_forwardDengararrow_forward

- Equipment acquired at a cost of $104,000 has an estimated residual value of $6,000 and an estimated useful life of 10 years. It was placed in service on October 1 of the current fiscal year, which ends on December 31. If necessary, round your answers to the nearest cent. a. Determine the depreciation for the current fiscal year and for the following fiscal year by the straight-line method. Year 1 Year 2 Year 1 Depreciation Year 2 $ b. Determine the depreciation for the current fiscal year and for the following fiscal year by the double-declining-balance method. $ Depreciation $ $arrow_forwardA plant asset was purchased on January 1 for $59000 with an estimated salvage value of $9000 at the end of its useful life. The current year's Depreciation Expense is $5000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $30000. The remaining useful life of the plant asset is O 10.0 years. O 11.8 years. ○ 4.0 years. O 6.0 years.arrow_forwardEntries for Sale of Fixed Asset Equipment acquired on January 8 at a cost of $107,330 has an estimated useful life of 12 years, has an estimated residual value of $7,850, and is depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the end of the fourth year?$fill in the blank b. Assume that the equipment was sold on April 1 of the fifth year for $65,642. 1. Journalize the entry to record depreciation for the three months until the sale date. If an amount box does not require an entry, leave it blank. Round your answers to the nearest whole dollar if required. - Select - - Select - - Select - - Select - 2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select -arrow_forward

- information and question attached with imagearrow_forwardEquipment with a cost of $154,032 has an estimated residual value of $9,279 and an estimated life of 4 years or 14,078 hours. It is to be depreciated by the straight-line method. What is the amount of depreciation for the first full year, during which the equipment was used for 3,317 hours? a.$36,188.25 b.$34,106.10 c.$38,508.00 d.$34,149.74arrow_forwardA plant asset was purchased on January 1 for $120000 with an estimated salvage value of $10000 at the end of its useful life. The current year's Depreciation Expense is $10000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $60000. The remaining useful life of the plant asset is 5 years. O. 11 years. O 12 years. O 7 years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education