Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

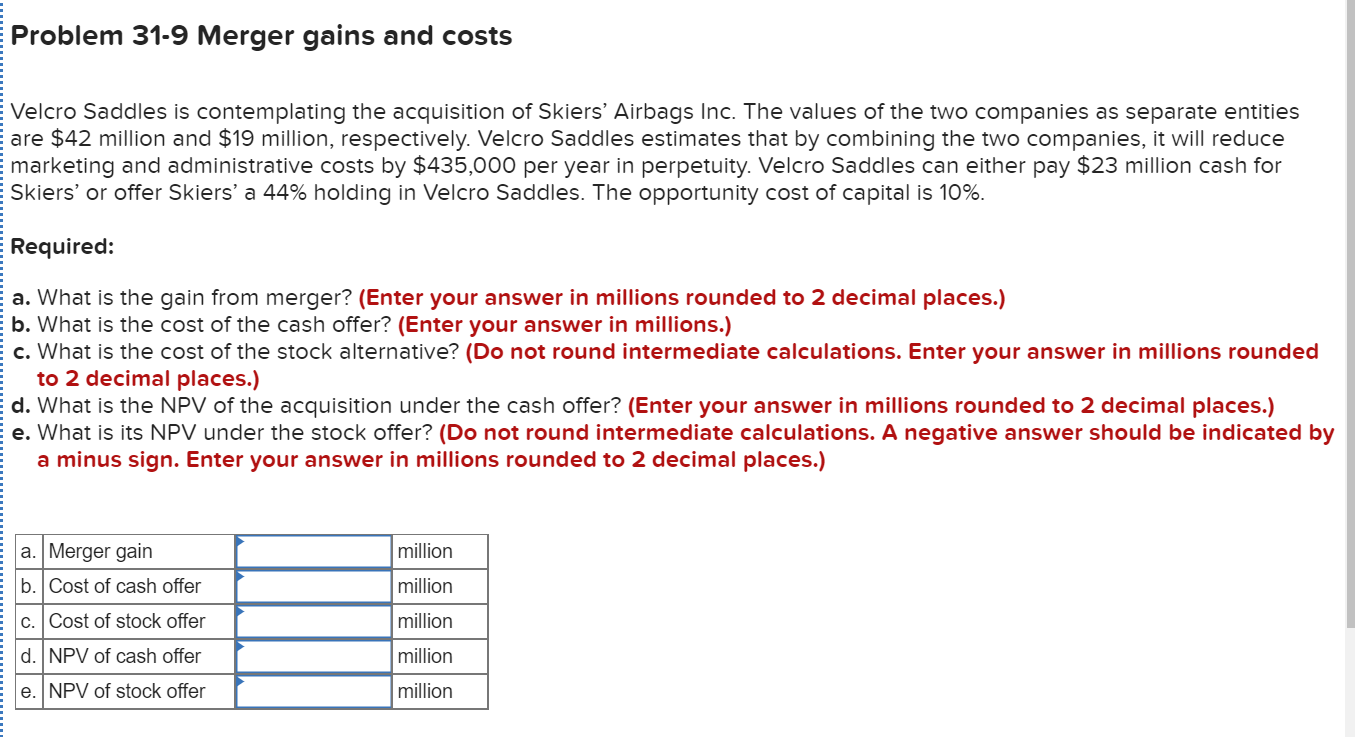

Transcribed Image Text:EProblem 31-9 Merger gains and costs

Velcro Saddles is contemplating the acquisition of Skiers' Airbags Inc. The values of the two companies as separate entities

are $42 million and $19 million, respectively. Velcro Saddles estimates that by combining the two companies, it will reduce

marketing and administrative costs by $435,000 per year in perpetuity. Velcro Saddles can either pay $23 million cash for

Skiers' or offer Skiers' a 44% holding in Velcro Saddles. The opportunity cost of capital is 10%.

ERequired:

a. What is the gain from merger? (Enter your answer in millions rounded to 2 decimal places.)

b. What is the cost of the cash offer? (Enter your answer in millions.)

E c. What is the cost of the stock alternative? (Do not round intermediate calculations. Enter your answer in millions rounded

to 2 decimal places.)

d. What is the NPV of the acquisition under the cash offer? (Enter your answer in millions rounded to 2 decimal places.)

e. What is its NPV under the stock offer? (Do not round intermediate calculations. A negative answer should be indicated by

a minus sign. Enter your answer in millions rounded to 2 decimal places.)

a. Merger gain

million

b. Cost of cash offer

million

c. Cost of stock offer

million

d. NPV of cash offer

million

e. NPV of stock offer

million

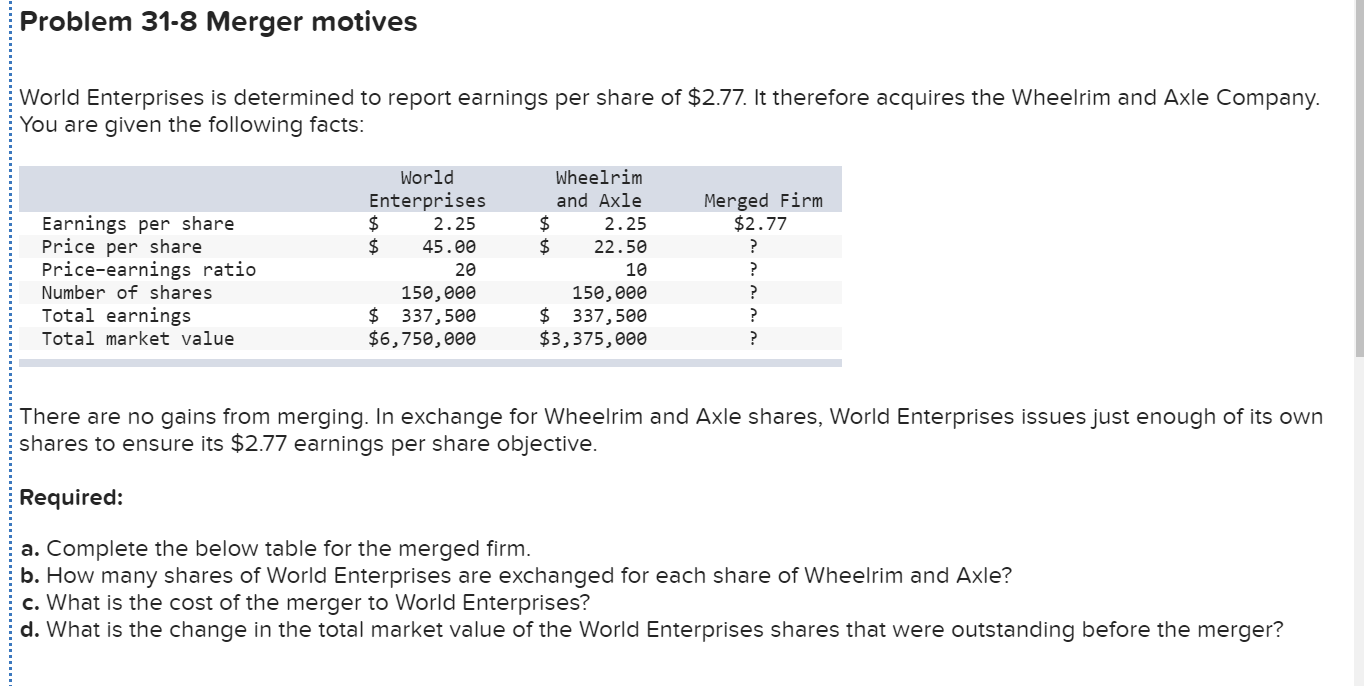

Transcribed Image Text:Problem 31-8 Merger motives

World Enterprises is determined to report earnings per share of $2.77. It therefore acquires the Wheelrim and Axle Company.

You are given the following facts:

World

Wheelrim

Enterprises

$4

2$

Merged Firm

$2.77

and Axle

Earnings per share

Price per share

Price-earnings ratio

Number of shares

2.25

2$

2.25

45.00

22.50

20

10

150,000

$ 337,500

$6,750,000

150,000

$ 337,500

$3,375,000

Total earnings

Total market value

There are no gains from merging. In exchange for Wheelrim and Axle shares, World Enterprises issues just enough of its own

shares to ensure its $2.77 earnings per share objective.

Required:

a. Complete the below table for the merged firm.

b. How many shares of World Enterprises are exchanged for each share of Wheelrim and Axle?

c. What is the cost of the merger to World Enterprises?

d. What is the change in the total market value of the World Enterprises shares that were outstanding before the merger?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Firm B Firm A $ Firm AB Price Per Share Total Earnings (millions) Shares Outstanding (millions of shares) Total Value (millions) 75 $ 40 $ 300 $ 200 200 60 $ 15,000 $ 2,400 $ 20,000 Firm A has proposed to acquire Firm B at a price of $65 per share for Firm B's stock. a) What is the NPV of the merger to Firm A? What is the NPV of the merger to Firm B? b) What will be the post-merger price per share for Firm A's stock if Firm A pays in cash? c) To make the value of a stock offer equivalent to a cash offer of $3,900 million, how many shares should Firm A give to the owners of Firm B?arrow_forward4,7,10arrow_forward8arrow_forward

- Bhaarrow_forwardP 1-2 Prepare balance sheet after an acquisition On January 2, 2011, Pet Corporation enters into a business combination with Sea Corporation in which Sea is dissolved. Pet pays $1,650,000 for Sea, the consideration consisting of 66,000 shares of Pet $10 par common stock with a market value of $25 per share. In addition, Pet pays the following expenses in cash at the time of the merger: 22 CHAPTER 1 Finders' fee Accounting and legal fees Registration and issuance costs of securities Balance sheet and fair value information for the two companies on December 31, 2010, immedi- ately before the merger, is as follows (in thousands): Cash Accounts receivable-net Inventories Land Buildings-net Equipment-net Total assets $ 70,000 130,000 80,000 $280,000 Accounts payable Note payable Capital stock, $10 par Other paid-in capital Retained earnings Total liabilities and owners' equity Pet Book Value $ 300 460 1,040 800 2,000 1,000 $5,600 $ 600 1,200 1,600 1,200 1,000 $5,600 Sea Book Value $ 60 100…arrow_forward34. Firm B's one million shares of stock currently sell for $20 each. Firm A estimates the economic gain from the merger to be $10 million and is prepared to offer $22 cash for each share of B. What percentage of the merger gain will be captured by firm B's shareholders?A. 20.00%B. 33.33%C. 50.00%D. 60.00%arrow_forward

- Please Solve with Explanation anr Do not give image formatarrow_forwardsh4arrow_forward2 3 4 5 6789E 01 10 11 RCC. Inc. has offered $870 million cash for all of the common stock in Universal Corporation. Based on recent market information, Universal is worth $730 million as an independent operation. For the merger to make economic sense for RCC, what would the minimum estimated present value of the enhancements from the merger have to be? MV as an independent operation Min. amount of synergies to justify the offer price Offer price ($m)arrow_forward

- Problem4 Current E & P $400,000 an Accumulated E & P 200,000. During the year Zeta distributes $800,000 to shareholders(A & B-$400, 000 to each) A has a basis in his stock $50,000 and B has a a basis of 200,000 Calculate the effect of the distribution on A and Barrow_forwardCompany C merge With company D Company C shares = $17, 6 mill outstanding Company D shares = $5, 2 mill outstanding Synergies from merge = $4 mill OFFER = COmpany C offers 1 of own share for 3 of Company D shares Find NPV for company C if acceptedarrow_forward4. Jackson company owns 80% of Canton corporation's common stock during October canceled merchandise to Jackson for $250,000 at December 31, 40% of the merchandise remains in Jackson's inventory gross profit percentage is 120% for Jackson and 30% for Canon the amount of intra- entity gross profit in inventory at December 31 That should be eliminated in the consolidation process is a. Zero b. $24,000, c. $75,000 d. $30,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education