Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

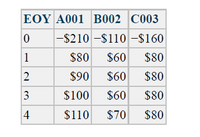

Xanadu Mining is considering three mutually exclusive alternatives, as shown in the table below. MARR is 10%/year. Solve a. What is the present worth of each alternative? b. Which alternative should be recommended?

Transcribed Image Text:EOY A001 B002 C003

-$210 -$110 -$160

1

$80

$60

$80

$90

$60

$80

3

$100

$60

$80

$110

$70

$80

2.

4-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Would you accept a project where you had an initial investment of $10,000,000 but the NPV was only $10,000? Group of answer choices A. There is not enough information B.Yes, because you will make the required return each year and the NPV in additional to the required return. C. No, the NPV is too small for such a large initial investmentarrow_forwardFor the following two alternatives, if the MARR is 10% per year (a)which one has a shorter payback period (b) which one do you select if you use the PW analysis. (c) is your selection different in (a) and (b)? Why? (d) use Spreadsheet to solve a and b. Alternative A: initial cost = $300,000 Revenue = $60,000 Alternative B: initial costs = $300,000 Revenue starts from n=1 at $10,000 and increases by $15,000 per year The expected life is 10 years for each alternative.arrow_forwardGenerro Company is considering the purchase of equipment that would cost$60,000and offer annual cash inflows of$16,300over its useful life of 5 years. Assuming a desired rate of return of10%, is the project acceptable? (PV of \$1 and PVA of \$1) (Use appropriate factor(s) from the tables provided.) Mitiple Choice The answer cannot be detergined. No, since the negative net present value indicates the investmeot will yield a fate of retum below the desred tate of return. Yes, since the investment will generate$81.500in future cosh flows, which is gremer than the purchase cont of$60,000Yes, since the positve net present valse ind cates the investment will eam a rate of return greater than10 h.arrow_forward

- Adam Andler Corp is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years. This is just one of many projects for the firm, so any losses on this project can be used to offset gains on other firm projects. What is the project's expected NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC or cost of capital Net investment cost (depreciable basis) The salvage value of its equipment No other fixed assets will be acquired for following years The company will require an increase in net working capital at the $10,000 beginning The company will liquidate all working capital at the end of the project -10,000 Units sold (constant through years) 60,000 $30.00 $50,000 $17.00 Average price per unit, Year 1 Fixed operating…arrow_forwardProject Analysis. Assume that you are evaluating the following three mutually exclusive projects: A. Complete the following analyses. (For the last two lines, Terminal Value, please write in the dollar amount of the terminal value.) B. Compare and explain the conflicting rankings of the NPVs and TRRs versus the IRRs. C. Using different discount rates, is it possible to get different rankings within the NPV calculation? Why or why not? D. If 10 percent is the required return, which project is preferred? E. Which is the fairer representation of these two projects, TRR or IRR? Why?arrow_forwardNonearrow_forward

- Consider these mutually exclusive alternatives. MARR = 8% per year, so all the alternatives are acceptable. Solve, a. At the end of their useful lives, alternatives A and C will be replaced with identical replacements (the repeatability assumption) so that a 20-year service requirement (study period) is met. Which alternative should be chosen and why? b. Now suppose that at the end of their useful lives, alternatives A and C will be replaced with replacement alternatives having an 8% internal rate of return. Which alternative should be chosen and why?arrow_forwardGiven mutually exclusive projects, which project should be selected given the MARR - 9%? Note that the actual rate of return for each of the project is greater than or equal to the MARR. The notation shows the project with the higher first cost minus the project with the lower first cost. (i.e. Ain-A = 8.2%neans that Project B has the higher first cost). The projects in order of smallest to largest first costs are Project A, then Project B and lastly Project C. Ain-A = 8.2% Aic-A = 10.1% Aie u = 10.5% O Project A O Project 8 O Project Carrow_forwardYou are analyzing a project with an initial cost of 130,000 pounds. The project is expected to return 20,000 pound the first year, 50,000 pound the second year, and 90,000 pound the third year. there is no salvage value. the current spot rate is 0.6211 pound. The nominal risk-free rate of return is 5.5% in the UK and 6% in the US. The return relevant to the project is 14% in the US. Assume that uncovered interest rate parity exists. What is the NPV of this project in US dollars using the approximate formula?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education