Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

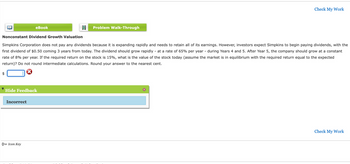

Transcribed Image Text:eBook

Hide Feedback

Incorrect

Nonconstant Dividend Growth Valuation

Simpkins Corporation does not pay any dividends because it is expanding rapidly and needs to retain all of its earnings. However, investors expect Simpkins to begin paying dividends, with the

first dividend of $0.50 coming 3 years from today. The dividend should grow rapidly - at a rate of 65% per year - during Years 4 and 5. After Year 5, the company should grow at a constant

rate of 8% per year. If the required return on the stock is 15%, what is the value of the stock today (assume the market is in equilibrium with the required return equal to the expected

return)? Do not round intermediate calculations. Round your answer to the nearest cent.

Icon Key

Problem Walk-Through

Check My Work

Check My Work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- mam.3arrow_forwardNonconstant Dividend Growth Valuation Simpkins Corporation does not pay any dividends because it is expanding rapidly and needs to retain all of its earnings. However, investors expect Simpkins to begin paying dividends, with the first dividend of $1.25 coming 3 years from today. The dividend should grow rapidly - at a rate of 65% per year - during Years 4 and 5. After Year 5, the company should grow at a constant rate of 10% per year. If the required return on the stock is 18%, what is the value of the stock today (assume the market is in equilibrium with the required return equal to the expected return)? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardNonearrow_forward

- Common stock value-Variable growth Newman Manufacturing is considering a cash purchase of the stock of Grips Tool. During the year just completed, Grips earned $3.29 per share and paid cash dividends of $1.59 per share (D = $1.59). Grips' earnings and dividends are expected to grow at 35% per year for the next 3 years, after which they are expected to grow 9% per year to infinity. What is the maximum price per share that Newman should pay for Grips if it has a required return of 11% on investments with risk characteristics similar to those of Grips? The maximum price per share that Newman should pay for Grips is $ (Round to the nearest cent.)arrow_forwardNonearrow_forwardGodzilla Corp.'s most recent dividend was $2. Next year, Godzilla Corp. plans to increase dividends 15%. After that Godzilla Corp. expects to grow dividends at a constant 5% per year from that point forward. The required rate of return for Godzilla Corp. stock is 10%. What is the current intrinsic value of Godzilla Corp. stock? Godzilla Corp. D0 $2 Dividend Growth Rate First Year 15% Constant Growth Rate after First Year 5% Required Rate of Return on Godzilla Corp. Stock 10% P0 ?arrow_forward

- Constant Dividend Growth Valuation Woidtke Manufacturing's stock currently sells for $28 a share. The stock just paid a dividend of $1.20 a share (i.e., Do $1.20), and the dividend is expected to grow forever at a constant rate of 5% a year. What stock price is expected 1 year from now? Do not round intermediate calculations. Round your answer to the nearest cent. $ What is the estimated required rate of return on Woidtke's stock (assume the market is in equilibrium with the required return equal to the expected return)? Do not round intermediate calculations. Round the answer to two decimal places.arrow_forwardCONSTANT GROWTH VALUATION Harrison Clothiers’ stock currently sells for $17.00 a share. It just paid a dividend of $1.00 a share (that is, D0 = $1.00). The dividend is expected to grow at a constant rate of 7% a year. What stock price is expected 1 year from now? Round to TWO decimal places.arrow_forwardевook Problem Walk-Through Holt Enterprises recently paid a dividend, Do, of $1.50. It expects to have nonconstant growth of 16% for 2 years followed by a constant rate of 4% thereafter. The firm's required return is 8%. a. How far away is the horizon date? I. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the end of Year 2. II. The terminal, or horizon, date is infinity since common stocks do not have a maturity date. III. The terminal, or horizon, date is Year 0 since the value of a common stock is the present value of all future expected dividends at time zero. IV. The terminal, or horizon, date is the date when the growth rate becomes nonconstant. This occurs at time zero. V. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the beginning of Year 2. -Select- V b. What is the firm's horizon, or continuing, value? Do not round intermediate calculations. Round your answer to the nearest…arrow_forward

- Saved Help Save & Exit Expected Return A company's current stock price is $85.50 and it is likely to pay a $4.50 dividend next year. Since analysts estimate the company will have a 12% growth rate, what is its expected return? Multiple Choicearrow_forwardDividend discount model NVIDIA (NVDA) Corporation just paid a dividend of $0.16 a share. Wall Street analysts expect that the dividend will grow at 95.05% per year for the next five years. After five years, the growth rate will fall to 6% in perpetuity. Assume a discount rate of 8%. a. Using the above assumptions, what is your estimated price per share for NVIDIA stock? b. What would the dividend need to be in year 1 to justify the current stock price of $726 per share?arrow_forwardSupernormal Growth (LO1) Duffs Co. is growing quickly. Dividends are expected to grow at a24% ratefor the next three years, with the growth rate falling off to a constant 6% thereafter. If the required returnis 11% and the company just paid a $1.90 dividend, what is the current share price?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education