FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

2

Southeastern College began the year with endowment investments of $1,450,000 and $860,000 of restricted cash designated by a donor for capital additions.

- During the year, an additional $524,000 ddonation was received for capital additions. These funds, together with those contributed in the prior year, were used to purchase 150 acres of land adjacent to the university.

- An alum contributed $360,000 to the permanent endowment and pledged to provide an additional $580,000 early next year. The cash was immediately invested.

- By terms of the endowment agreement, interest and dividends received on the investments are restricted for scholarships. Gains or losses from changes in the fair value of the investments, however, are not distributed but remain in the endowment. During the year, $66,000 of interest and dividends were received on endowment investments.

- At year-end, the fair value of the investments had increased by $9,300.

Required:

Prepare

-

Southeastern College is a public university.

-

Southeastern College is a private university.

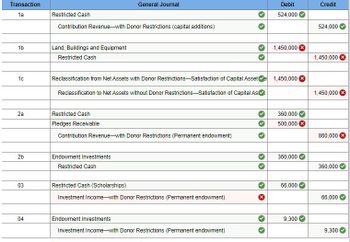

Transcribed Image Text:Transaction

1a

General Journal

Debit

Credit

Restricted Cash

524,000

Contribution Revenue-with Donor Restrictions (capital additions)

524,000

1b

Land, Buildings and Equipment

Restricted Cash

1,450,000

1,450,000 €

1c

Reclassification from Net Assets with Donor Restrictions-Satisfaction of Capital Asset(

1,450,000 (

Reclassification to Net Assets without Donor Restrictions-Satisfaction of Capital As

1,450,000

2a

Restricted Cash

360,000

Pledges Receivable

500,000

Contribution Revenue-with Donor Restrictions (Permanent endowment)

860,000

2b

Endowment Investments

Restricted Cash

03

Restricted Cash (Scholarships)

Investment Income-with Donor Restrictions (Permanent endowment)

04

Endowment Investments

Investment Income-with Donor Restrictions (Permanent endowment)

360,000

360,000

66,000

66,000

9,300

9,300

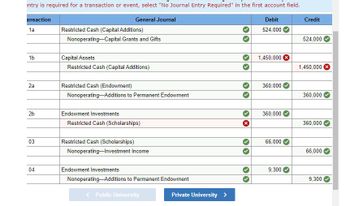

Transcribed Image Text:entry is required for a transaction or event, select "No Journal Entry Required" in the first account field.

ansaction

General Journal

1a

Restricted Cash (Capital Additions)

Nonoperating Capital Grants and Gifts

Debit

524,000

524,000

Credit

1b

Capital Assets

Restricted Cash (Capital Additions)

1,450,000 x

1,450,000

2a

Restricted Cash (Endowment)

360,000

Nonoperating-Additions to Permanent Endowment

360,000

2b

Endowment Investments

Restricted Cash (Scholarships)

360,000

360,000

03

Restricted Cash (Scholarships)

Nonoperating Investment Income

66,000

66,000

04

Endowment Investments

Nonoperating-Additions to Permanent Endowment

9,300

9,300

Public University

Private University >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Prepare journal entries for the following selected transactions of the Marvel Cares Foundation, which uses the restricted fund method and has an operating fund, a capital fund and an endowment fund: - Pledges totalling $325,000 were received of which $65,000 applies to the operations of the following year. It is estimated that 3% of the pledges will be uncollectible - The foundation purchased office equipment at a cost of $5,100 - Pledges of $285,000 were collected and pledges totalling $3,750 were written off as uncollectible - Air time with a value of $7,200 was donated by a local radio station - Interest and dividends received were $13,700 on endowment fund investments. Endowment fund earnings are unrestricted - Depreciation for the year amounted to $35,600arrow_forwardThe City of Sunnyville’s General Fund has the following net resources at year end: $55,000 for LT Advance to an internal service fund $375,000 approved by the City Council with specific conditions for its use $2,500 of supplies inventory $60,000 state grant for snow removal $150,000 City Council resolution approved for funds to renovate city hall $400,000 to be used to fund government operations in the future Outstanding encumbrances of $80,000 for the purchase of furniture & fixtures What would be the total “Non-spendable” fund balance? Select one: a. $2,500 b. $57,500 c. $75,000 d. $105,000arrow_forwardCaring Shop is a gift shop located in The Natural History Museum. Caring shop has annual sales revenue of $850,000. Additionally, the Natural History museum has investment income of $550,000 from its endowment, and an annual operating budget of $3 million. Both the income from the gift shop and the endowment income are used to support the exempt purpose of the museum. The balance of funding required for annual operations is provided through admission fees. Dan Nolan, a new board member, does not understand why the museum is subject to tax at all, particularly because all of the entity's profits are used in carrying out the mission of the museum. As the museum treasurer, write a letter to Dan Nolan explaining the reason for the tax consequences.arrow_forward

- The Western Falls School District received a $ 100,000 gift from a wealthy alumnus , and an agreement was reached that $10,000 per year would be paid to the valedictorian of the high school class as a freshman scholarship to college , until the funds were depleted . The $ 100,000 would be accounted for as : OA Private - Purpose Trust Fund A custodial fund An Expendable Trust Fund An investment trust fundarrow_forwardA government was awarded a grant from another government. The $8,000,000 grant is restricted to use for construction of a facility for one of the grantee government's enterprise activities. The grant is for half the cost of the facility. The grantor will reimburse half of the costs as they are incurred. At the end of the first fiscal year, $3,000,000 has been spent on the project. $1,500,000 has been collected from the grantor. How should the grantee's Enterprise Fund statement of cash flows report the cash inflows?arrow_forwardThe citizens of Spencer County approved the issuance of $2,008,000 in 6 percent general obligation bonds to finance the construction of a courthouse annex. A capital projects fund was established for that purpose. The preclosing trial balance of the courthouse annex capital project fund follows: Trial Balance—December 31, 2020 Debits Credits Cash $ 908,000 Contract payable $ 551,000 Due from state government 192,000 Encumbrances 108,000 Expenditures—capital 1,854,000 Intergovernmental grant 395,000 OFS: premium on bonds 57,000 OFS: proceeds sale of bonds 2,008,000 Budgetary fund balance—Reserve for encumbrances 108,000 OFU: Transfer out 57,000 $ 3,119,000 $ 3,119,000 Required:a. Prepare any closing entries necessary at year-end.b. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balance…arrow_forward

- 7 Inglis City had a beginning cash and cash equivalents balance in its internal service fund of $895,685. During the current year, the following transactions occurred: 1. Interest received on investments totaled $42,450. 2. The city acquired additional equity investments totaling $75,050. 3. A grant was received from the state in the amount of $50,000 for summer interns. 4. Receipts from sales of goods or services totaled $2,915,570. 5. Payments for supplies were made in the amount of $1,642,150. 6. Payments to employees for salaries amounted to $479,360. 7. Equipment was sold for $57,500. It had a book value of $56,655. 8. A $25,000 transfer was made to the General Fund. 9. Other cash expenses for operations were $89,200. 10. Long-term debt payments for capital acquisitions totaled $525,040. Required Prepare a statement of cash flows for the Inglis City internal service fund. (Ignore the reconciliation of operating income to net cash provided by operating activities because…arrow_forwardQuestion 3: The following balances were taken from Al Buraimi Company as at 31.12.2019 Name of accounts Balances Capital ...... Creditors 60 000 Overdraft 40 000 Loans 150 000 Notes Payable 50 000 Cash 60 000 Bank 200 000 Debtors 100 000 Marketable securities 120 000 Land 140 000 Buildings 240 000 Cars 140 000 Machines 180 000 Furniture 20 000 Insurance Expenses 40 000 Salaries Expenses 40 000 Rent Expenses 60 000 Interest Expenses 30 000 Phone Expenses 20 000 Electricity Expenses 24 000 Bad Debts 30 000 Depreciation Expenses 36 000 Services Revenues 60 000 Interest Revenues 60 000 Rent Revenues 40 000 Opening Stock 90 000 Purchases 360 000 Sales Returns 70 000 Sales 670 000…arrow_forwardThe City of Meringen operates a central garage through an internal service fund to provide garage space and repairs for all city-owned and operated vehicles. The central garage fund was established by a contribution of $200,000 from the general fund, when the building was acquired several years ago. The postclosing trail balance at June 30, 2014, was as follows: Debit Credit Cash $ 150,000 Due from general fund $ 20,000 Inventory of materials and supplies $ 80,000 Land $ 60,000 Building $ 200,000 Accumulated depreciation-building $ 10,000 Machinery and equipment $ 56,000 Accumulated depreciation-machinery $ 12,000 and equipment $ 38,000 Vouchers payable $ 200,000 Contribution from general fund $ 306,000 Net position $…arrow_forward

- Help mearrow_forwardThe county of Santa Clara is building a new park. The main financing source will be $1,000,000 bond issue. In addition, the general fund will transfer $100,000 transfer to fund the capital project. Please record the journal entries for the Capital Project Fund & the Government-Wide financial statements. 1. The county has signed a contract with Spectacular Construction to construct the park $1,000,000 2.The $1,000,000 bonds were issued at par 3. Spectacular Construction billed the county of Santa Clara $1,000,000 upon completion of the project 4. The park is completedarrow_forwardThe City of Sunnyville’s General Fund has the following net resources at year end: $55,000 for LT Advance to an internal service fund $375,000 approved by the City Council with specific conditions for its use $2,500 of supplies inventory $60,000 state grant for snow removal $150,000 City Council resolution approved for funds to renovate city hall $400,000 to be used to fund government operations in the future Outstanding encumbrances of $80,000 for the purchase of furniture & fixtures What would be the total “Restricted” Fund balance? Select one: a. $275,000 b. $210,000 c. $150,000 d. $60,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education