FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Entries for equity investments: less than 20% ownership

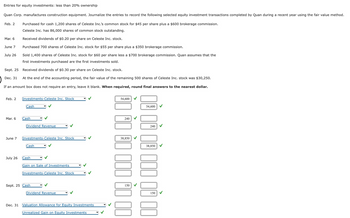

Quan Corp. manufactures construction equipment. Journalize the entries to record the following selected equity investment transactions completed by Quan during a recent year using the fair value method.

Feb. 2

Purchased for cash 1,200 shares of Celeste Inc.'s common stock for $45 per share plus a $600 brokerage commission.

Celeste Inc. has 86,000 shares of common stock outstanding.

Received dividends of $0.20 per share on Celeste Inc. stock.

Purchased 700 shares of Celeste Inc. stock for $55 per share plus a $350 brokerage commission.

Sold 1,400 shares of Celeste Inc. stock for $60 per share less a $700 brokerage commission. Quan assumes that the

first investments purchased are the first investments sold.

Sept. 25

Received dividends of $0.30 per share on Celeste Inc. stock.

Dec. 31 At the end of the accounting period, the fair value of the remaining 500 shares of Celeste Inc. stock was $30,250.

If an amount box does not require an entry, leave it blank. When required, round final answers to the nearest dollar.

Mar. 6

June 7

July 26

Feb. 2 Investments-Celeste Inc. Stock

Mar. 6

June 7

July 26

Cash

Dec. 31

Cash

Dividend Revenue

Investments-Celeste Inc. Stock

Cash

Cash

Gain on Sale of Investments

Investments-Celeste Inc. Stock

Sept. 25 Cash

Dividend Revenue

Valuation Allowance for Equity Investments

Unrealized Gain on Equity Investments

54,600 ✔

À000 000 À

240

38,850

150

54,600

240

38,850 ✔

0 00

150

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assessing Financial Statement Effects of Trading and Available-for-Sale Securities Use the financial statement effects template to record the following four transactions involving investments in marketable securities. Purchased 6,000 common shares of Liu, Inc., at $12.25 cash per share. Received a cash dividend of $1.50 per common share from Liu. Year-end market price of Liu common stock is $11.25 per share. Sold all 6,000 common shares of Liu for $66,300. Use negative signs with answers, when appropriate. Balance Sheet Transaction Cash Asset + Noncash Assets = Liabilities + Contributed Capital + Earned Capital (1) Answer Answer Answer Answer Answer (2) Answer Answer Answer Answer Answer (3) Answer Answer Answer Answer Answer (4) Answer Answer Answer Answer Answer Income Statement Revenue - Expenses = Net Income Answer Answer Answer Answer Answer Answerarrow_forwardEquity Method for Stock Investment On January 4, Year 1, Ferguson Company purchased 140,000 shares of Silva Company directly from one of the founders for a price of $39 per share. Silva has 400,000 shares outstanding, including the Daniels shares. On July 2, Year 1, Silva paid $406,000 in total dividends to its shareholders. On December 31, Year 1, Silva reported a net income of $1,259,000 for the year. Ferguson uses the equity method in accounting for its investment in Silva. cash/cash dividends/dividend revenue/income of silva company/investment in silva company stock/notes receivable/ a. Provide the Ferguson Company journal entries for the transactions involving its investment in Silva Company during Year 1. Year 1, Jan. 4 fill in the blank 702aed00a020001_2 fill in the blank 702aed00a020001_4 Year 1, July 2 fill in the blank 702aed00a020001_6 fill in the blank 702aed00a020001_8 Year 1, Dec. 31 fill in the blank 702aed00a020001_10…arrow_forwardEquity Method for Stock Investment On January 4, Year 1, Ferguson Company purchased 84,000 shares of Silva Company directly from one of the founders for a price of $51 per share. Silva has 300,000 shares outstanding, including the Daniels shares. On July 2, Year 1, Silva paid $227,000 in total dividends to its shareholders. On December 31, Year 1, Silva reported a net income of $755,000 for the year. Ferguson uses the equity method in accounting for its investment in Silva. a. Provide the Ferguson Company journal entries for the transactions involving its investment in Silva Company during Year 1.arrow_forward

- Please don't provide answer in image format thank youarrow_forwardEntries for equity investments: less than 20% ownership On February 22, Triangle Corporation acquired 2,900 shares of the 100,000 outstanding common stock of Jupiter Co. at $23.80 plus commission charges of $580. On June 1, a cash dividend of $0.60 per share was received. On November 12, 1,000 shares were sold at $29 less commission charges of $120. At the end of the accounting period on December 31, the fair value of the remaining 1,900 shares of Jupiter Company’s stock was $24.50 per share. In your computations, round per share amounts to two decimal places. When required, round final answers to the nearest dollar. Question Content Area a. Using the cost method, journalize the entry for the purchase of stock. If an amount box does not require an entry, leave it blank. Feb. 22 Investments-Jupiter Co. Stock Investments-Jupiter Co. Stock Cash Cash Feedback Area Feedback Question Content Area b. Using the cost method, journalize the…arrow_forwardEquity method journal entries (price equals book value) Prepare journal entries for the transactions below relating to an Equity Investment accounted for using the equity method. a. An investor purchases 14,400 common shares of an investee at $16 per share; the shares represent 25% ownership in the investee and the investor concludes that it can exert significant influence over the investee. b. The investee reports net income of $172,800. c. The investor receives a cash dividend of $1.50 per common share from the investee. d. The investor sells all 14,400 common shares of the investee for $260,280. General Journal Ref. Description Debit Credit a. b. C. d. Equity investmentarrow_forward

- Equity Method for Stock Investment On January 4, Year 1, Ferguson Company purchased 64,000 shares of Silva Company directly from one of the founders for a price of $54 per share. Silva has 200,000 shares outstanding, including the Daniels shares. On July 2, Year 1, Silva paid $157,000 in total dividends to its shareholders. On December 31, Year 1, Silva reported a net income of $575,000 for the year. Ferguson uses the equity method in accounting for its investment in Silva. a. Provide the Ferguson Company journal entries for the transactions involving its investment in Silva Company during Year 1. Year 1, Jan. 4 Year 1, July 2 Year 1, Dec. 31 b. Determine the December 31, Year 1, balance of Investment in Silva Company Stock.arrow_forwardInstructions Chart of Accounts Journal Instructions Yerbury Corp. manufactures construction equipment. Journalize the entries to record the following selected equity investment transactions completed by Yerbury during a recent year. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers to the nearest dollar. Feb. Mar. June July 2 Purchased for cash 5,200 shares of Wong Inc. stock for $19 per share plus a $120 brokerage commission. Received dividends of $0.25 per share on Wong Inc. stock. Purchased 2,000 shares of Wong Inc. stock for $25 per share plus a $115 brokerage commission. Sold 6,200 shares of Wong Inc. stock for $38 per share less a $105 brokerage commission. Yerbury assumes that the first investments purchased are the first investments sold. Received dividends of $0.50 per share on Wong Inc. stock. 6 7 26 Sept. 25 Check My Work 3 more Check My Work uses remaining I All work saved. DELLarrow_forwardAssessing Financial Statement Effects of Marketable Equity Securities Use the financial statement effects template to record the accounts and amounts for the following four transactions involving investments in marketable equity securities. a. Purchased 14,000 common shares of Heller Co. at $16 cash per share. b. Received a cash dividend of $1.25 per common share from Heller. c. Year-end market price of Heller common stock is $17.50 per share. d. Sold all 14,000 common shares of Heller for $220,920 cash. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. tion N/A N/A N/A N/A Cash Asset (224,000) 17,500 + 220,920 * N/A ◆ * N/A 0 N/A * N/A Noncash Assets 224,000 = = 21,000 * N/A 0✓ = ♦ = N/A * N/A (171,500) * = * N/A Balance Sheet Liabilities 0 0✔ 0 0 4 + > N/A N/A N/A N/A Contrib. Capital 0 0✔ 0…arrow_forward

- Entries for Stock Investments, Dividends, and Sale of Stock Seamus Industries Inc. buys and sells investments as part of its ongoing cash management. The following investment transactions were completed during the year: Feb. 24 Acquired 2,000 shares of Tett Co. stock for $80 per share plus a $200 brokerage commission. May 16 Acquired 2,000 shares of Issacson Co. stock for $40 per share plus a $100 commission. July 14 Sold 500 shares of Tett Co. stock for $100 per share less a $50 brokerage commission. Aug. 12 Sold 1,000 shares of Issacson Co. stock for $34 per share less an $80 brokerage commission. Oct. 31 Received dividends of $0.30 per share on Tett Co. stock. Journalize the entries for these transactions under the fair value method. If an amount box does not require an entry, leave it blank. Feb. 24 Investments-Tett Co. Stock fill in the blank 2 fill in the blank 3 Cash fill in the blank 5 fill in the blank 6 May 16 Investments-Issacson Co. Stock fill…arrow_forwardPlease do not give solution in image format ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education