FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

infoPractice Pack

Question

infoPractice Pack

Transcribed Image Text:00

R

# 3

p21 MyLab and Mastering - AC X

O Pearson MyLab and Master X

Assignments

O Pearson ACT -

O OneLogin

i act.pearsoncmg.com/activity/1/4/1

YouTube

Maps

BC - Tuition Paym...

Apps M Gmail

A Accounting Cycle Tutorial

Step 1: Account Balances

O0000

4

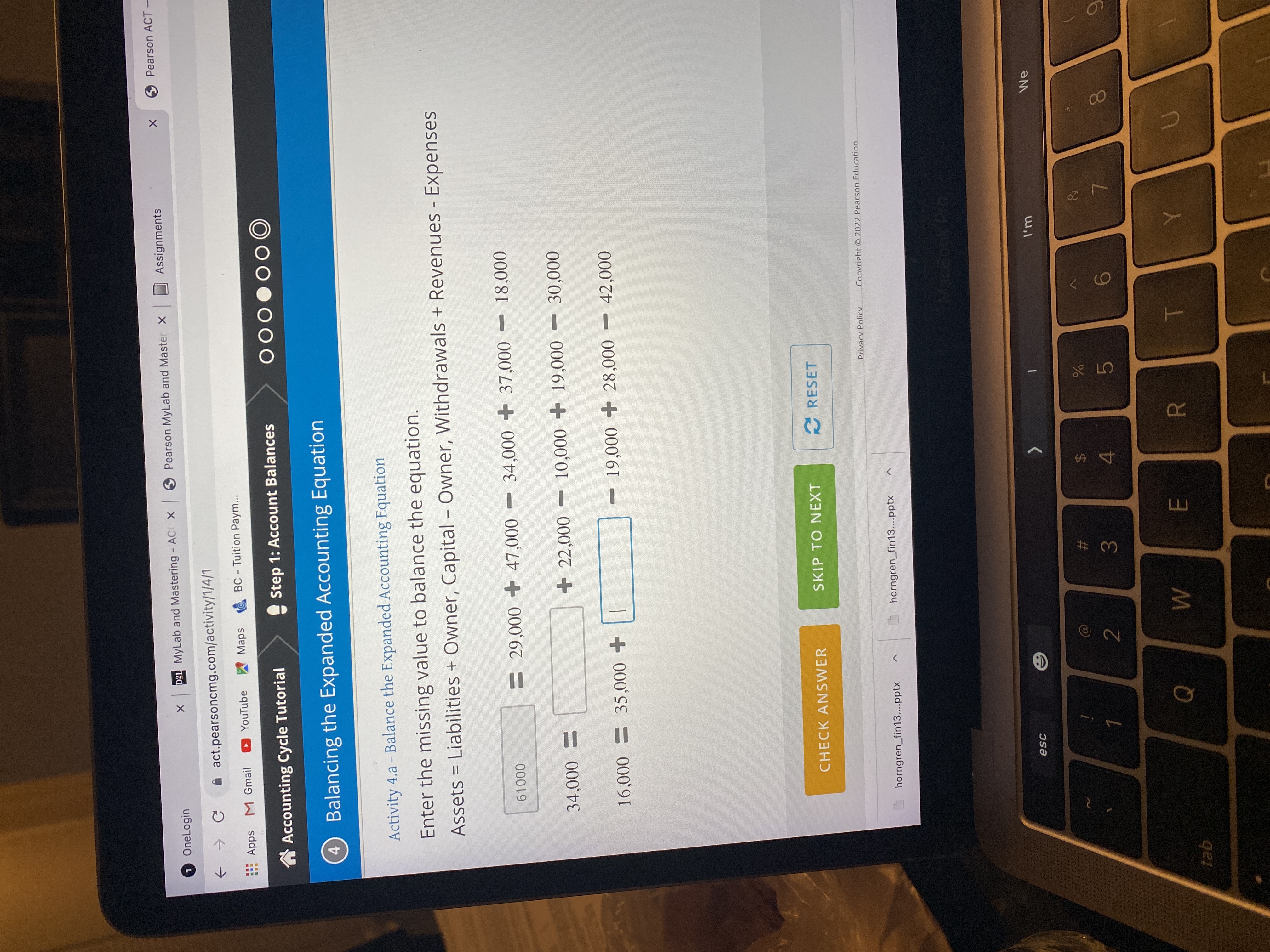

Balancing the Expanded Accounting Equation

Activity 4.a - Balance the Expanded Accounting Equation

Enter the missing value to balance the equation.

Assets = Liabilities + Owner, Capital - Owner, Withdrawals + Revenues - Expenses

%3D

29,000 + 47,000 34,000 + 37,000 – 18,000

000

+ 22,000

10,000 + 19,000 – 30,000

= 000ʻ

16,000 = 35,000

19,000 + 28,000 – 42,000

CHECK ANSWER

SKIP TO NEXT

E RESET

Privacy Policy

Convright © 2022 Pearson Education

horngren_fin13..pptx

horngren_fin13..pptx

MacBook Pro

esc

We

%24

4.

&

%

2

ger

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Includes step-by-step video

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. 2. 3. 4. 5. Present Value ? $36,289 15,884 46,651 15,376 Future Value $ 40,000 65,000 40,000 100,000 ? i 10% 5 ? 10 8 ? n 7 ? 8 20arrow_forwardIf the profit margin is 0.1142, asset turnover is 0.5619 and financial leverage is 1.2937, what is the return on asset? Multiple Choice 0.1142 0.7269 0.0830 0.0642arrow_forwardProvide true solutionarrow_forward

- If total equity decreased by RO10,00oo, then, to balance the accounting equation Select one a. Equity must have decreased by R0.10,000. O b Liabilities must have decreased by R.O.10,000. c. Assets must have decreased by R.O.10,000 O d. Assets must have increased by R.O.10,000.arrow_forwardResidual Income = $23000 Operating income = 35,844 Cost of Capital = 12% What is return on investment? Don't round any intermediate calculations. Enter your answer to one decimal place. Do not use commas, percentage or dollar signs.arrow_forward* 24 Study the below and answer the questions that follow. Table 2.4 (Millions Company A Company B / Company C Now- Current Assets R136 822 & 124 948 104 516 Total Asset R231945 8227291 256 718 Inventories R5412 26454 Rio 343 Non-Current Liabilities 245232 R34 142 R53 434 Total Liabilities R75231 285 010 R95 010 Calculate the quick ratio of all companies using tablearrow_forward

- If assets are $375,000 and equity is $125,000, then llablikies are: O O Multiple Choice O $500,000. $125,000. $625,000. $250,000. $375,000 15arrow_forwardConsider the following table: Vehicle #1 $24,350 W X What is the value of y? 2.24 1.03 1.45 1.72 000. Vehicle #2 $34,890 1 Z Vehicle #3 $59,980 y 100arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education