FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

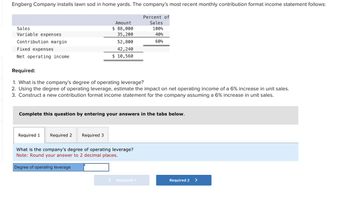

Transcribed Image Text:Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Required 1

Amount

$ 88,000

35, 200

Required:

1. What is the company's degree of operating leverage?

2. Using the degree of operating leverage, estimate the impact on net operating income of a 6% increase in unit sales.

3. Construct a new contribution format income statement for the company assuming a 6% increase in unit sales.

Required 2 Required 3

52,800

42, 240

$ 10,560

Complete this question by entering your answers in the tabs below.

Degree of operating leverage

What is the company's degree of operating leverage?

Note: Round your answer to 2 decimal places.

Percent of

Sales

100%

40%

60%

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $ 88,000 35,200 52,800 41,360 $ 11,440. Percent of Sales 100% 40% 60% Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 6% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 6% increase in unit sales.arrow_forwardEngberg Company installs lawn sod in home yards. The company’s most recent monthly contribution format income statement follows: Amount Percent of Sales Sales $ 94,000 100% Variable expenses 37,600 40 Contribution margin 56,400 60% Fixed expenses 43,240 Net operating income $ 13,160 Required: 1. What is the company’s degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 5% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 5% increase in unit sales.arrow_forwardRequired information [The following information applies to the questions displayed below] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units the relevant range of production is 500 units to 1500 units) Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 35,000 31,000 22,000 14,960 $7,040 12. What is the degree of operating leverage? (Round your answer to 2 decimal places) Degree of operating leveragearrow_forward

- 3. RequIred Informatlon The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: $2,300,000 Sales Variable expenses Contribution margin Fixed expenses 1,170,000 Net operating income Average operating assets $ 1,437,500 At the beginning of this year, the company has a $287,500 investment opportunity with the following cost and revenue characteristics: 50% of sales Contribution margin ratio Fixed expenses $4161,000 The company's minimum required rate of return is 15%. 7. If the comnpany pursues the investment opportunity and otherwise performs the same as last year, what margin will it earn this year? < Prev 15. of 15 re to search T12L F4 F5 F7 F11arrow_forwardThe following income statement applies to Finch Company for the current year: Income Statement Sales revenue (480 units × $30) $ 14,400 Variable cost (480 units × $15) (7,200 ) Contribution margin 7,200 Fixed cost (4,000 ) Net income $ 3,200 Required a. Use the contribution margin approach to calculate the magnitude of operating leverage. b. Use the operating leverage measure computed in Requirement a to determine the amount of net income that Fincharrow_forward1) Ehrlich Enterprises prepared the following contribution format income statement based on a sales volume of 3,000 units (the relevant range of production is 1,000 units to 5,000 units): Contribution Margin Income Statement Sales $ 48,000 Variable expenses 30,000 Contribution margin 18,000 Fixed expenses 10,000 Net operating Income $ 8,000 If sales decline to 1,300 units, what would be the net operating income (loss)? If the selling price increases by $3 per unit and the sales volume decreases by 100 units, what would be the net operating income? What is the break-even point in unit sales? What is the break-even point in dollar sales?arrow_forward

- Contribution Margin Ratio a. Young Company budgets sales of $1,240,000, fixed costs of $41,900, and variable costs of $186,000. What is the contribution margin ratio for Young Company? % b. If the contribution margin ratio for Martinez Company is 62%, sales were $567,000, and fixed costs were $274,200, what was the operating income?arrow_forwardIf a company, sold 37,000 units, total sales were $148,000, total variable expenses were $105,080, and fixed expenses were $38,900. What is the company's contribution margin (CM) ratio? What is the estimated change in the companys net operating income if it can increase sales volum by 525 units and total sales by $2,100. Contribution margin ratio ___________________% Estimated change in net operating income ___________________%arrow_forwardSubject : - Accountingarrow_forward

- Refer to the data in requirement 5. Assume the new plant is built and that next year the company manufactures and sells 32,000 balls (the same number as sold last year). Prepare a contribution format income statement and compute the degree of operating leverage. Note: Round "Degree of operating leverage" to 2 decimal places. Show less Northwood Company Contribution Income Statement 0 $0 Degree of operating leveragearrow_forwardSunn Company manufactures a single product that sells for $120 per unit and whose variable costs are $90 per unit. The company's annual fixed costs are $432.000 Management targets an annual income of $750,000. (1) Compute the unit sales to earn the target income. Numerator: 1 Denominator: (2) Compute the dollar sales to earn the target income.. Numerator: Denominator P M = Units to Achieve Target Units to achieve target Dollars to Achieve Target Dollars to achieve targetarrow_forwardCurrent operating income for Bay Area Cycles Co. is $22,000. Selling price per unit is $100, the contribution margin ratio is 25%, and fixed expense is $88,000. Required: 1. Calculate Bay Area Cycle's breakeven point in units and total sales dollars. Break-even units Break-even dollars 2. Calculate Bay Area Cycle's margin of safety and margin of safety ratio. Margin of safety Margin of safety ratio %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education