FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

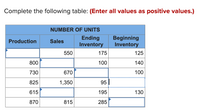

Transcribed Image Text:Complete the following table: (Enter all values as positive values.)

NUMBER OF UNITS

Ending

Inventory

Beginning

Inventory

Production

Sales

550

175

125

800

100

140

730

670

100

825

1,350

95

615

195

130

870

815

285

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Physical counts of inventory ?arrow_forwardChapter 7 Inventories 387 4. Determine the ending inventory cost as of March 31. 5. Based upon the preceding data, would you expect the inventory using the last-in, first- out method to be higher or lower?arrow_forwardShoney Video Concepts produces a line of video streaming servers that are linked to personal computers for storing movies. These devices have very fast access and large storage capacity. Shoney is trying to determine a production plan for the next 12 months. The main criterion for this plan is that the employment level is to be held constant over the period. Shoney is continuing in its R&D efforts to develop new applications and prefers not to cause any adverse feelings with the local workforce. For the same reason, all employees should put in full workweeks, even if this is not the lowest-cost alternative. The forecast for the next 12 months is MONTH January February March April May June FORECAST DEMAND 605 805 905 605 405 305 MONTH July August September October November December FORECAST DEMAND 205 205 305 705 805 905 Manufacturing cost is $220 per server, equally divided between materials and labor. Inventory storage cost is $6 per unit per month and is assigned based on the ending…arrow_forward

- 3arrow_forwardFIFO and LIFO costs under perpetual inventory system The following units of an item were available for sale during the year: DATA Beginning inventory Sale First purchase Sale Second purchase Sale Ending inventory Quantity 8,100 5,000 15,400 12,600 15,900 13,100 8,700 REQUIRED: a. What is the total cost of the ending inventory according to FIFO? b. What is the total cost of the ending inventory according to LIFO? a. FIFO method b. LIFO method Price Inventory Cost Using formulas and cell references from the problem data, perform the required analysis. Formulas entered in the green cells orange cells. Transfer amounts to CNOWv2 for grading. $160 $300 $167 Formulas $300 $172 $300arrow_forwardLower-of-Cost-or-Market InventoryOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 9. ProductInventoryQuantityUnitCost PriceUnitMarket Value per Unit(Net Realizable Value)Model A300$140$125Model B50090112Model C1506059Model D800120115Model E400140145 Inventory at the Lower of Cost or MarketProductTotal CostTotal MarketLower of Total Cost or Total MarketA$$$B C D E Total$$$arrow_forward

- Custom Cabinets Inc. (CCI) uses a job-order costing system. During February and March only 3 jobs were worked on. Job 1602 was completed on March 15th. The other two jobs were still in process at March 31st, CCl's year end. Here is a summary of the data from the job cost sheets for the 3 jobs: Job 1602 Job 1603 Job 1604 February costs incurred: Direct materials 16,000 $ 9,000 $ Direct labour 13,500 7,300 Manufacturing overhead 21,600 11,680 March costs incurred: Direct materials 8,400 21,000 Direct Labour 4,000 5,800 10,300 Manufacturing overhead ? ? Manufacturing overhead is applied to jobs on asis of direct lab cost. Ba ces in the inventory accounts at the end of February were as follows: Raw Materials 24 40,000 Work in Process Finished goods 85,000 Required (where possible complete your work in the space immediately below each question. If you need more space insert additional rows): 1 What is the February 28th work in process balance? Assume no over/under applied manufacturing…arrow_forward141 20 28 Totals c. Determin Start by en Once all of hand at the Date Aug. 1 3 12 More info Aug. 1 Aug. 3 Aug. 12 Aug. 15 Aug. 20 Aug. 28 8 $ Beginning merchandise inventory, 10 books @ $15 each Sold 3 books @ $20 each Purchased 8 books @ $18 each Sold 9 books @ $20 each Purchased 4 books @ $20 each Sold 5 books @ $25 each 18 S Print 144 3 $ Done 15 S 45 - X 10 S 7 $ 7 S 8 $ 18 LA CA 15 S 15 S 15 S 18 S CA CAT cord us ew inv of mer Hand To Coarrow_forwardplease help solve 21arrow_forward

- Define average days in inventory.arrow_forwardDuring periods of rising costs, which inventory costing method produces the highest gross profit?arrow_forwardSales revenue Purchases Net income as a percent of sales revenue Beginning inventory Expenses including income taxes Tax rate a. Required a. Prepare the company's single-step income statement. b. Prepare the journal entry at period-end to eliminate beginning inventory and to record ending inventory. Note: Do not use negative signs with your answers. Income Statement Sales revenue Cost of goods sold: Beginning inventory Plus: Purchases Cost of goods available for sale Less: Ending inventory Cost of goods sold Gross margin Expenses Income before taxes Income taxes Net income $ $ $440,000 $308,000 $ 15% $55,000 $99,000 25% 440,000 55,000 308,000 X 0 x 0 x 0 x x 0 x 0 x 0 xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education