Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

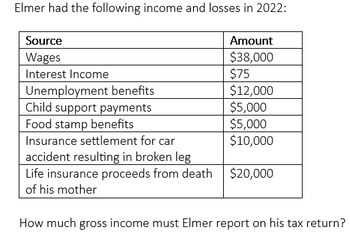

Transcribed Image Text:Elmer had the following income and losses in 2022:

Source

Wages

Interest Income

Unemployment benefits

Child support payments

Food stamp benefits

Insurance settlement for car

accident resulting in broken leg

Life insurance proceeds from death

of his mother

Amount

$38,000

$75

$12,000

$5,000

$5,000

$10,000

$20,000

How much gross income must Elmer report on his tax return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- LO.6 Harvey is a self-employed accountant with earned income from the business of $120,000 (after the deduction for one-half of his self-employment tax). He uses a defined contribution Keogh plan. What is the maximum amount Harvey can contribute to his retirement plan in 2020?arrow_forwardChuck a single taxpayer earns $78,000.00 in taxable income and $13, 300.00 in interest from an investment in city of heflin bonds. How much federal tax will he owe? What is his average tax rate? What is his effective tax rate? What is his current marginal tax rate?arrow_forwardMario, a single taxpayer with two dependent children, has the following items of income and expense during 2020: Gross receipts from business $144,000 Business expenses 180,000 Net capital gain 22,000 Interest income 3,000 Itemized deductions (state taxes, residence interest, and contributions) 24,000 a. Determine Mario's taxable income or loss for 2020. Adjusted gross income Less: itemized deductions Less: Deduction for qualified business income Loss b. Indicate which items are adjustments to taxable income or loss when computing an NOL. Business receipts Business Expenses Net capital gain Interest income Itemized deductions c. Determine Mario's NOL for 2020. Mario's NOL is ?arrow_forward

- Jessica had the following gains and losses for the year: Long-term loss = $45,000 Short-term loss = $15,000 Long-term gain = $20,000 Short-term gain = $19,000 How much gain or loss will Jessica deduct on her current tax return? $0 Long-term capital loss of $3,000 Long-term capital loss of $21,000 Short-term capital gain of $4,000; and $25,000 long-term lossarrow_forwardCindy had the following income and deductions listed on her 2020 individual income tax return. Business income $37,000 Interest income on personal investments $5,000 Less Business expenses $40,000 Less Nonbusiness deductions $7,000 Loss shown on tax return ($5,000) Compute the amount of Cindy's 2020 net operating loss. Show all of your work.arrow_forwardIn 2023, Mickey and Minnie Mouse are married, and their taxable income is $600,000, which includes $100,000 of unrecaptured $1250 gains from the sale of real estate (taxed at a maximum rate of 25 %) and $200,000 of long-term capital gain from the sale of stock. SHOW YOUR WORK. Questions 1. What is the Mouse's ordinary income for 2023? 2. What is the Mouse's ordinary tax liability for 2023? on the gain from selling the real estate in 2023? the net long-term capital gain from the sale of stock in 2023? Mouse's total income tax liability in 2023? 3. What is the Mouse's tax 4. What is the Mouse's tax on 5. What is thearrow_forward

- The Tax Formula for Individuals, A Brief Overview of Capital Gains and Losses (LO 1.3, 1.9) In 2020, Manon earns wages of $54,000. She also has dividend income of $2,800. Manon is single and has no dependents. During the year, Manon sold silver coins held as an investment for a $7,000 loss. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, filing separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 Calculate the following amounts for Manon: a. Adjusted gross income $fill in the blank b. Standard deduction $fill in the blank c. Taxable income $fill in the blankarrow_forward1.Charles, who is single and age 61, had AGI of $400,000 during 2020. He incurred the following expenses and losses during the year. Medical expenses before AGI floor$28,500State and local income taxes15,200Real estate taxes4,400Home mortgage interest5,400Charitable contributions14,800Unreimbursed employee expenses8,900Gambling losses (Charles had $7,400 of gambling income)9,800Compute Charles's total itemized deductions for the year. 2.For the following exchanges, indicate which qualify as like-kind property.a.lnventory of a sporting goods store in Charleston for land in Savannah.b.lnvestment land in Virginia Beach for office building in Williamsburg.c.Used automobile used in a business for a new automobile to be used in the business.d.Investment land in Paris for investment land in San Francisco.e.Shares of Texaco stock for shares of Exxon Mobil stock.arrow_forwardDuring 2023, Anmol Frank had the following transactions: Alimony received (divorce occured in 2017) Interest income on IBM bonds She borrowed money to buy a new car Value of BMW received as a gift from aunt Federal income tax withholding payments The taxpayer's AGI is: a. $74,000. b. $76,000. c. $79,000. d.) $81,000. e. $90,000.arrow_forward

- In 2019, Michael has net short-term capital losses of $1,500, a net long-tern capital loss of $27,000, and other ordinary taxable income of $45,000. a. calculate the amount of michael deduction for capital losses on his tax return for 2019. b. Calculate the amount and nature of his capital loss carry forward. Long-tern capital carryforward. Short-term capital loss carryforward.arrow_forwardGary's income for the tax year 2022/23 comprises a salary of £140,000 and dividends of £20,000. He is not entitled to a personal allowance. How will his dividends be taxed? O a. £2,000 at 0% and £8,000 at 33.75% and £10,000 at 39.35% O b. All at 39.35% O c. £10,000 at 33.75% and £10,000 at 39.35% O d. £2,000 at 0% and £10,000 at 33.75% and £8,000 at 39.35%arrow_forwardVikrambhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education