FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

A1

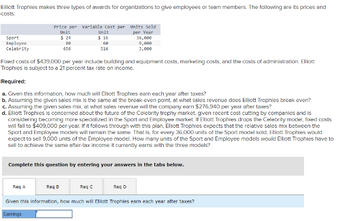

Transcribed Image Text:Elliott Trophies makes three types of awards for organizations to give employees or team members. The following are its prices and

costs:

Sport

Employee

Celebrity

Price per Variable Cost per Units Sold

Unit

per Year

$ 24

88

656

Req A

Unit

$ 16

Fixed costs of $439,000 per year include building and equipment costs, marketing costs, and the costs of administration. Elliott

Trophies is subject to a 21 percent tax rate on income.

68

516

Required:

a. Given this information, how much will Elliott Trophies earn each year after taxes?

b. Assuming the given sales mix is the same at the break-even point, at what sales revenue does Elliott Trophies break even?

c. Assuming the given sales mix, at what sales revenue will the company earn $276,940 per year after taxes?

d. Elliott Trophies is concerned about the future of the Celebrity trophy market, given recent cost-cutting by companies and is

considering becoming more specialized in the Sport and Employee market. If Elliott ophies drops the Cele

mode fixed costs

will fall to $409,000 per year. If It follows through with this plan, Elllott Trophies expects that the relative sales mix between the

Sport and Employee models will remain the same. That is, for every 36,000 units of the Sport model sold, Elliott Trophies would

expect to sell 9,000 units of the Employee model. How many units of the Sport and Employee models would Elliott Trophies have to

sell to achieve the same after-tax income it currently earns with the three models?

Req B

Complete this question by entering your answers in the tabs below.

Req C

36,000

9,000

3,000

Req D

Given this information, how much will Elliott Trophies earn each year after taxes?

Earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education