FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Ekiya, who is single, has been offered a position as a city landscape consultant. The position pays $127,400 in wages. Assume Ekiya has no dependents. Ekiya deducts the standard deduction instead of itemized deductions, she is not eligible for the qualified business income deduction, and she did not make any charitable donations.

-what is the amount of Ekiya’s after-tax compensation (ignore payroll taxes)?

-suppose Ekiya receives a competing job offer of $122,000 in wages and non taxable (excluded) benefits worth $5,400. What is the amount of Ekiyas after tax compensation for the competing offer?

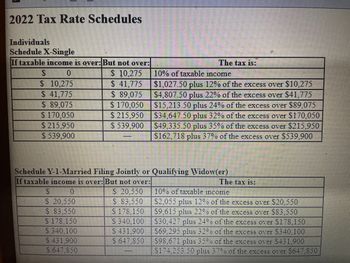

Transcribed Image Text:2022 Tax Rate Schedules

Individuals

Schedule X-Single

If taxable income is over: But not over:

$

0

$ 10,275

$ 41,775

$ 89,075

$ 170,050

$ 215,950

$ 539,900

$ 10,275

$ 41,775

$ 89,075

$ 170,050

$215,950

$ 539,900

$ 20,550

S 83,550

$ 178,150.

S 340,100

The tax is:

Schedule Y-1-Married Filing Jointly or Qualifying Widow(er)

If taxable income is over: But not over:

$

0

$ 20,550

$ 83.550

$ 178,150

$ 340,100

$ 431,900

$ 647.850

S 431,900

S 647,850

10% of taxable income

$1,027.50 plus 12% of the excess over $10,275

$4,807.50 plus 22% of the excess over $41,775

$15,213.50 plus 24% of the excess over $89,075

$34,647.50 plus 32% of the excess over $170,050

$49,335.50 plus 35% of the excess over $215,950

$162,718 plus 37% of the excess over $539,900

The tax is:

10% of taxable income

$2,055 plus 12% of the excess over $20,550

$9,615 plus 22% of the excess over $83,550

$30,427 plus 24% of the excess over $178,150

S69,295 plus 32%

S98,671 plus 35%

of the excess over $340,100

of the excess over $431,900

$174.253.50 plus 37% of the excess over $647,850

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ! Required information [The following information applies to the questions displayed below.] Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $70,000. Meg works part time at the same university. She earns $43,000 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules, Dividends and Capital Gains Tax Rates.) b. What is the Comers' tax liability for 2023 if they report the following capital gains and losses for the year? Short-term capital gains Short-term capital losses Long-term capital gains. Long-term capital losses $ 1,500 0 13,000 (10,000) Note: Round your final answer to two decimal places. Total tax liabilityarrow_forwardA taxpayer operates a business through a single-member LLC (disregarded for federal tax purposes). The taxpayer contributes $30,000 cash and equipment worth $50,000 (having an adjusted basis of $20,000) to the LLC to fund its operations. The LLC obtains a loan from a bank of $100,000. Because the LLC has no established credit, the taxpayer has to personally guarantee the loan. What is the taxpayer's amount at risk? O The taxpayer is at risk in the amount of $30,000. The taxpayer is at risk in the amount of $50,000. O The taxpayer is at risk in the amount of $80,000. O The taxpayer is at risk in the amount of $150,000.arrow_forwardFirst Metro Pacific was able to persuade Francis to join the company as its Assistant Vice President for Finance which included a car plan worth P3,000,000 in its compensation The company purchased the vehicle and registered the same in favor of Francis. Assuming further that Francis is a non-resident alien not engaged in trade or business, how much is the fringe benefits tax?arrow_forward

- Susan, a single taxpayer, owns and operates a bakery (as a sole proprietorship). The business is not a specified services business. In 2021, the business pays $60,000 in W-2 wages, has $150,000 of qualified property, and $200,000 in net income (all of which is qualified business income). Susan also has a part-time job earning wages of $13,600, receives $3,400 of interest income, and will take the standard deduction. What is Susan’s qualified business income deduction?arrow_forwardVella owns and operates an illegal gambling establishment. In connection with this activity, he has the following expenses during the year: Rent Bribes Travel expenses Utilities Wages Payroll taxes Property insurance Illegal kickbacks $33,500 50,250 3,350 20,100 248,000 16,750 1,675 30,150 What are Vella's total deductible expenses for tax purposes?arrow_forward- Required information [The following information applies to the questions displayed below.] Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $69,100. Meg works part time at the same university. She earns $43,900 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules, Dividends and Capital Gains Tax Rates.) Note: Round your final answers to the nearest whole dollar amount. a. What is the Comers' tax liability for 2023 if they report the following capital gains and losses for the year? Short-term capital gains Short-term capital losses Long-term capital gains Long-term capital losses Total tax liability $ 9,450 (2,450) 15,200 (6,900)arrow_forward

- Linda and her sister Hannah own a bed and breakfast hotel in Maine in which they provide maid services and breakfast to their tenants. Which of the following is true regarding the tax return that Linda must file. Select one: a. She must file Schedule C b. She must file Schedule E C. She must file Schedule C and E d. None of the abovearrow_forwardWhich one of the following costs is most likely NOT fully deductible? Group of answer choices Jose, a local business owner, pays $30,000 in Self-Employment taxes. Sandra owns a mini golf course. She pays her employer portion of payroll taxes because of her employees, which totals to $12,000. Travis owns a CPA firm and pays his son Joe as an associate. Joe is a CPA and is paid the same salary as the other associates. X-Corp writes off a $12,000 business debt owed by Sam because he has not responded to their numerous requests for payment.arrow_forwardT uses frequent flyer miles to take his family on a vacation. T received the miles duringbusiness travel paid for by his employer. The normal airfare for his vacation wouldhave cost $7,000.a. T must realize and recognize $7,000 as income.b. Although T has realized income, he will not be required to recognize it becausethe IRS has chosen, as a matter of administrative convenience, not to requiretaxpayers to recognize the value of frequent flyer tickets earned duringemployer-paid travel.c. Had T earned the frequent flyer miles during travel he had paid for himself, theissue of income realization and recognition would not arise.d. Both (a) and (c) are correct.e. Both (b) and (c) are correct. T buys a parcel of real estate for $100,000, which he finances by giving the seller a nonrecoursemortgage for the full purchase price. The debt is due in one balloon payment inYear 5. When the debt becomes due in Year 5, T decides to give the property back to theseller in satisfaction of the debt…arrow_forward

- Michelle is an active participant in the rental condominium property she owns. During the year, the property generates a ($16.500) loss; however, Michelle has sufficient tax basis and at risk amounts to absorb the loss. if Michelle has $118.000 of salary. $10.300 of long-term capital gains, $3.300 of dividends, and no additional sources of income or deductions, how much loss can Michelle deduct? Mumple Choice O 10 losses from rental property are passive losses and can only be offset by passive income O $7,300 O $9.200 $16.500 ð None of the choices are connectarrow_forward[The following information applies to the questions displayed below.] Matt and Meg Comer are married and file a joint tax return. They do not have any children. Matt works as a history professor at a local university and earns a salary of $64,150. Meg works part-time at the same university. She earns $33,450 a year. The couple does not itemize deductions. Other than salary, the Comers’ only other source of income is from the disposition of various capital assets (mostly stocks). (Use the tax rate schedules,Dividends and Capital Gains Tax Rates.) (Round your final answers to the nearest whole dollar amount.) a. What is the Comers’ total income tax liability for 2019 (including income tax on wages) if they report the following capital gains and losses for the year? Short-term capital gains $ 9,090 Short-term capital losses (2,090 ) Long-term capital gains 15,170 Long-term capital losses (6,170 )arrow_forwardKaren Most has a federal tax levy of $2,100.50 against her. If Most is single with two personal exemptions and had a take-home pay of $499.00 this week, how much would her employer take from her to satisfy part of the tax levy?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education