FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Effect of doubtful accounts on net income

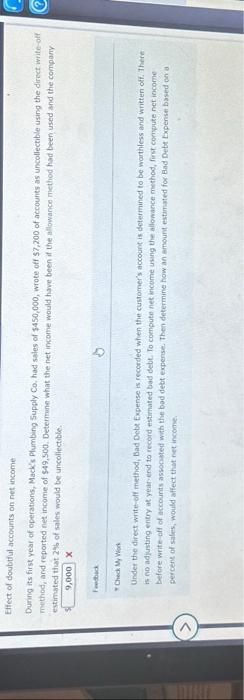

During its first year of operations, Mack's Plumbing Supply Co. had sales of $450,000, wrote off $7,200 of accounts as uncollectible using the direct write-off

method, and reported net income of $49,500. Determine what the net income would have been if the allowance method had been used and the company

estimated that 2% of sales would be uncollectible.

9,000 X

Feedback

Check My Work

Under the direct write-off method, Bad Debt Expense is recorded when the customer's account is determined to be worthless and written off. There i

is no adjusting entry at year-end to record estimated bad debt. To compute net income using the allowance method, first compute net income

before write-off of accounts associated with the bad debt expense. Then determine how an amount estimated for Bad Debt Expense based on a

percent of sales, would affect that net income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- mi.3arrow_forwardMaple Leafs Construction has the following data for the year ended December 31, Year 1: Accounts receivable (January 1, Year 1) $455,000 Credit sales 900,000 Collections from credit customers 825,000 Customer accounts written off as uncollected 15,000 Allowance for doubtful accounts (after write-off of uncollected accounts) 2,100 Estimated uncollected accounts based on an aging 29,200 analysis (December 31, Year 1) Refer to Maple Leafs Construction. What is the balance of accounts receivable at December 31, Year 1? O $455,000 O $511,900 O $515,000 O $440,000arrow_forwardAmount to be reportedarrow_forward

- Account answerarrow_forwardEffect of Doubtful Accounts on Net Income) During its first year of operations, Fisher Plumbing Supply Co. had sales of $590,000, wrote off $9,400 of accounts as uncollectible using the direct write-off method, and reported net income of $64,900. Determine what the net income would have been if the allowance method had been used, and the company estimated that 1 1/4% of sales would be uncollectible. 72,275 Xarrow_forwardNeed help with accounting ASAParrow_forward

- Don't give answer in image formatarrow_forwardEstimating Doubtful Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company’s accounts receivable on December 31, and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Age Class Balance Percent Uncollectible Not past due $532,000 1/2 % 1–30 days past due 58,500 4 31-60 days past due 26,600 6 61–90 days past due 19,200 14 91–180 days past due 13,800 41 Over 180 days past due 10,100 80 $660,200 Estimate what the proper balance of the allowance for doubtful accounts should be as of December 31. Age Class Balance PercentUncollectible Estimated UncollectibleAccounts Amount Not past due $532,000 1/2% $fill in the blank 1 1-30 days past due 58,500 4 fill in the blank 2 31-60 days past due 26,600 6 fill in the blank 3 61-90 days past due 19,200 14 fill in the blank 4 91-180 days past due 13,800 41 fill in the blank 5 Over 180…arrow_forwardView Policies Current Attempt in Progress Vaughn Manufacturing has outstanding accounts receivable totaling $ 6.47 million as of December 31 and sales on credit during the year of $ 24.5 million. There is also a credit balance of $ 11500 in the allowance for doubtful accounts. If the company estimates that 6% of its outstanding receivables will be uncollectible, what will be the amount of bad debt expense recognized for the year? O $388200. O $ 399700. O $ 376700. O $1470000. Save for Later Attempts: 0 of 1 used Submit Answerarrow_forward

- i need the answer quicklyarrow_forwardment/chec Show Me How Print Item Estimating Doubtful Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31, and a historical añalysis of the percentage of uncollectible accounts in each age category are as follows: Percent Age Class Balance Uncollectible Not past due $782,000 1/2 % 1-30 days past due 86,000 4 31-60 days past due 39,100 7 61-90 days past due 28,200 18 91-180 days past due 20,300 41 Over 180 days past due 14,900 80 $970,500 Estimate what the proper balance of the allowance for doubtful accounts should be as of December 31. Percent Estimated Uncollectible Age Class Balance Uncollectible Accounts Amount Not past due $782,000 1/2% 1-30 days past due 86,000 4 31-60 days past due 39,100 7arrow_forwardi need full details solution.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education