FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

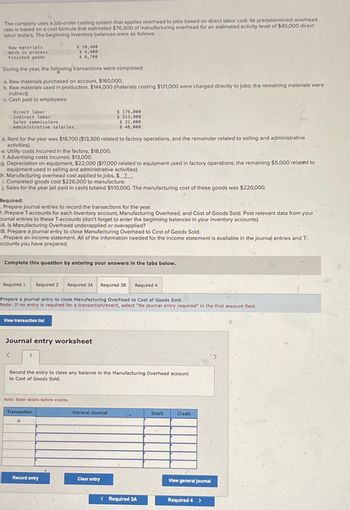

Transcribed Image Text:The company uses a job-order costing system that applies overhead to jobs based on direct labor cost. Its predetermined overhead

rate is based on a cost formula that estimated $76,500 of manufacturing overhead for an estimated activity level of $45,000 direct

labor dollars. The beginning inventory balances were as follows:

Raw materials

Work in process

Finished goods

During the year, the following transactions were completed:

a. Raw materials purchased on account, $160,000.

b. Raw materials used in production, $144,000 (materials costing $121,000 were charged directly to jobs; the remaining materials were

indirect).

c. Cash paid to employees:

Direct labor

Indirect labor

Sales commissions

Administrative salaries

d. Rent for the year was $18,700 ($13,300 related to factory operations, and the remainder related to selling and administrative

activities).

e. Utility costs incurred in the factory, $18,000.

f. Advertising costs incurred, $13,000.

g. Depreciation on equipment, $22,000 ($17,000 related to equipment used in factory operations; the remaining $5,000 related to

equipment used in selling and administrative activities).

h. Manufacturing overhead cost applied to jobs, $_?__

i. Completed goods cost $226,000 to manufacture.

j. Sales for the year (all paid in cash) totaled $510,000. The manufacturing cost of these goods was $220,000.

Required:

1. Prepare journal entries to record the transactions for the year.

2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your

ournal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts).

BA. Is Manufacturing Overhead underapplied or overapplied?

B. Prepare a journal entry to close Manufacturing Overhead to Cost of Goods Sold.

1. Prepare an income statement. All of the information needed for the income statement is available in the journal entries and T-

accounts you have prepared.

Required 1

$ 10,400

$ 4,400

$ 8,700

Complete this question by entering your answers in the tabs below.

<

View transaction list

Prepare a journal entry to close Manufacturing Overhead to Cost of Goods Sold.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Journal entry worksheet

$ 176,000

$ 213,900

$ 22,000

$ 48,000

1

Required 2 Required 3A Required 3B

Note: Enter debits before credits.

Transaction

a.

Record the entry to close any balance in the Manufacturing Overhead account

to Cost of Goods Sold.

Record entry

General Journal

Required 4

Clear entry

< Required 3A

Debit

Credit

View general Journal

Required 4 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Yi.15.arrow_forwardTotal Manufacturing Costs ₱325,000 Applied Overhead Costs, 75% of direct labor cost ₱075,000 Selling expenses ₱316,000 Administrative expenses ₱314,000 What is the cost of direct materials? Show solution Group of answer choices ₱175,000 ₱193,750 ₱220,000 ₱150,000arrow_forwardComplete the following (assume $93,500 of overhead to be distributed): (Round the "Ratio" to 2 decimal places.) Amount of Overhead Square Feet Ratio Allocated Department A Department B 15,040 31,960arrow_forward

- Test and Pack Department 120,000 Total $306,000 The direct labor information for the production of 7,500 units of each product is as follows: Assembly Department Test and Pack Department Blender 750 dlh 2,250 dlh Toaster oven 2,250 750 Total 3,000 dlh 3,000 dlh Four Finger Appliance used direct labor hours to allocate production department factory overhead to products. If required, round all per unit answers to the nearest cent. a. Determine the two production department factory overhead rates. Assembly Department per direct labor hour Test and Pack Department per direct labor hour b. Determine the total factory overhead and the factory overhead per unit allocated to each product. Product Total Factory Overhead Factory Overhead Per Unit Blender Toaster ovenarrow_forwardJournalize the following transactions: Materials used in production, $40,000 Paid plant supervisor’s salary, $6,000 Plant depreciation, $10,000 Production labor costs incurred, $80,000 MOH is allocated at the rate of 120% of direct labor costs Cost of goods manufactured, $200,000 Revenue on account, $450,000 Cost of goods sold, $300,000 Paid advertising costs, $90,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education