ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

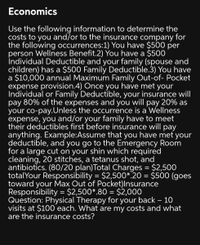

Transcribed Image Text:Economics

Use the following information to determine the

costs to you and/or to the insurance company for

the following occurrences:1) You have $500 per

person Wellness Benefit.2) You have a $500

İndividual Deductible and your family (spouse and

children) has a $500 Family Deductible.3) You have

a $10,000 annual Maximum Family Out-of- Pocket

expense provision.4) Once you have met your

Individual or Family Deductible, your insurance will

pay 80% of the expenses and you will pay 20% as

your co-pay.Unless the occurrence is a Wellness

expense, you and/or your family have to meet

their deductibles first before insurance will pay

anything. Example:Assume that you have met your

deductible, and you go to the Emergency Room

for a large cut on your shin which required

cleaning, 20 stitches, a tetanus shot, and

antibiotics. (80/20 plan)Total Charges = $2,500

totalYour Responsibility = $2,500*.20 = $500 (goes

toward your Max Out of Pocket)Insurance

Responsibility = $2,500*.80 = $2,000

Question: Physical Therapy for your back – 10

visits at $100 each. What are my costs and what

are the insurance costs?

|3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Tim exercises everyday and eats healthy. Cam is a couch potato and smokes. A health insurance company can't tell the difference between Tim and Cam's behavior. As a result, Tim will be offered a policy with a _____ and Cam will be offered a policy with a ______. A. low deductible; low premium B. low deductible; low deductible C. high deductible; low deductible D. high deductible; high deductible E. low deductible; high premiumarrow_forwardWhat benefit does the PPO provide? Select all that apply. covers out of network doctors and specialists freedom to see more doctors requires referrals provides primary care physician only covers in network providersarrow_forwardPlease see attachment and Type out the correct answer ASAP and step by step with proper explanation of each option.ill give upvote only for correct answerarrow_forward

- You have been recruited as an expert in health economics to recommend what is the best therapy for a group of patients. In the image below you will find the decision tree showing the probabilities for different health states and outcomes for patients undergoing two possible treatments, No drug therapy and Drug therapy. Based on the expected cost, which therapy would you recommend as the least expensive? Explain how you arrived at your recommendation and show your calculations the space provided. No drug theraphy ? Drug theraphy ? HEALTH STATES PROBABILITIES Remain in Good Health 0.5 Develop disease A 0.2 Develop disease B 0.2 Die 0.1 Remain in Good Health 0.53 Develop disease A 0.16 Develop disease B 0.22 Die 0.09 OUTCOMES (Costs) $0 $400 $300 $200 SO $800 $500 $0arrow_forward6. The demand for the doctor's visits, Q, is the following: Q= 5 – 0.04P. The market price of a visit, equals the MC of $100. What is the equilibrium number of visits? What if the consumer purchases full-coverage (no coinsurance) health insurance and the demand stays the same. How many doctor visits would the patient consume? Calculate the deadweight loss or moral hazard cost as a result of the insurance coverage. Remember, DWL is there if units for which MB>MC are not produced, or if units for which MC>MB are produced.arrow_forwardThe Tucker family has health insurance coverage that pays 80 percent of out-of-hospital expenses after a deductible of $1,000 per person. If one family member has doctor and prescription medication expenses of $2,200, what amount would the insurance company pay?arrow_forward

- Empirical evidence suggests that state laws mandating health insurance coverage for alcoholism treatment leads to moral hazard on the part of the insured population. Given this information, what are you most likely to observe in a state that has passed such a law? A. Less use of alcohol treatment facilities B. Lower rates of drunk driving C. Higher rates of alcoholism D. Lower sales of alcoholarrow_forwardFederal law allows workers who leave a job to continue to participate in the health insurance they were receiving through their previous employer. However, they have to pay the full monthly premium (including both the employee and employer portions), as well as a 2 percent administrative fee. This high price has led many people, especially the healthier ones, to drop coverage. Insurance companies report that these plans lose them money. This phenomenon is an example of: a. Adverse Selection b. Moral Hazard c. Tragedy of the Commons d. Commodity Egalitarianismarrow_forwarda) Suppose that your employer offered you $5,000 in cash instead of health insurance coverage. Health insurance is excluded from state and federal income taxes. (To keep the problem simple we will ignore Social Security and Medicare wage taxes.) The cash would be subject to state income taxes (8%) and federal income taxes (28%). How much would the value of the insurance ($5000) compared to the post-tax cash. b) How different would this calculation look for a worker who lived would face a state with zero income tax rate percent and a federal income tax rate of 15 percent. What would a worker consider if they believe themselves to be healthy and unlikely to need healthcare this year.arrow_forward

- 1. If you are trying to use a RDD setup to evaluate the effect of health insurance on health, and you qualify for a health insurance subsidy if your family income is below $20,000. What's the running variable? What's treatment, and what's the outcome?arrow_forwardWhich option is the most effective for companies and employees: a standard fee-for-services health care insurance option or a high-deductible health insurance plan.arrow_forwardRecall that the goal of the Affordable Care Act (also known as Obamacare) legislation was get more people access to affordable health insurance. It was widely reported that health insurance premiums under Obamacare were getting much more expensive. What was the main factor causing the premiums to get more expensive? Many of the new enrollees were young teenagers unable afford their own insurance, so other people are paying for them The plan required a lot of paperwork and administrative tasks, and insurance companies had to hire a lot of people to get these tasks done The new enrollees were older and sicker than expected, increasing health care usage and expenses, causing costs and insurance premiums to rise Obamacare created new medical technologies which were expensive to usearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education