ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

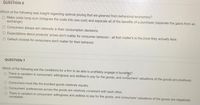

Transcribed Image Text:QUESTION 6

Which of the following was insight regarding optimal pricing that we gleaned from behavioral economics?

O Make costs lump sum (integrate the costs into one cost) and separate allof the benefits of a purchase (separate the gains from an

exchange).

O Consumers always act rationally in their consumption decisions.

O Expectations about products' prices don't matter for consumer behavior - all that matter's is the price they actually face,

O Default choices for consumers don't matter for their behavior.

QUESTION 7

Which of the following are the conditions for a firm to be able to profitably engage in bundlhpg?.

O There is variation in consumers' willingness and abilities to pay for the goods, and consumers' valuations of the goods are positively

correlated.

O Consumers must like the bundled goods relatively equally.

Consumers' preferences across the goods are relatively consistent with each other.

O There is variation in consumers' willingness and abilities to pay for the goods, and consumers' valuations of the goods are negatively

correlated.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- QUESTION 14 Refer to the information provided in Figure 6.15 below to answer the question that follows. Jason's preferences and budget constraint Number of sandwiches 150 0 B E A D C Number of hot dogs Figure 6.15 100 Refer to Figure 6.15. Why is Jason not maximizing his utility at point C? O He is not spending his entire budget. His marginal utility per dollar spent on the last sandwich is greater than his marginal utility per dollar spent on his last hot dog. His marginal utility per dollar spent on the last sandwich is less than his marginal utility per dollar spent on his last hot dog. O He is maximizing his utility at point C.arrow_forwardBob's utility function implies O time stationarity O transitivity O impatience O all of the above I need help with the questionsarrow_forward48 aces How big would that budget have to be before he would spend a dollar buying a first cup of coffee? Instructions: Enter your answer as a whole number. here to search Suppose that Omar's marginal utility for each additional cup of coffee is 2.5 utils per cup no matter how many cups he drinks. On the other hand, his marginal utility per doughnut is 10 for the first doughnut he eats, 9 for the second he eats, 8 for the third he eats, and so on (that is, declining by 1 util per additional doughnut). In addition, suppose that coffee costs $1 per cup, doughnuts cost $1 each, and Omar has a budget that he can spend only on doughnuts, coffee, or both. O Saved II Help 4 Sawarrow_forward

- 4please answer part a and b of quesrion #1arrow_forwardProblem 2 Suppose that John's preferences over meat (M) and vegetables (V) are represented by the following utility function U(M,V) = a ln(M) + (1 − a) ln(V) where 0 < a < 1. ¹No claim of realism is made for the numbers in this example. 1 (a) Write down the Lagrangian for John's optimization problem. (Recall that John max- imizes utility given an income, I, and prices på and på for the goods.) (b) Solve for John's optimal consumption bundle (M*, V*) (as a function of income and prices) using the Lagrangian method. = (c) Suppose a = . Suppose also that John has income I = 1 and pv 2. What is the value of John's optimal happens if John's income doubles to I = 400? 200 and faces prices p consumption bundle? What =arrow_forward1. This question will let you examine/explore a more interesting utility func- tion than the simple example discussed in class as there will be both cross-price elas- ticity and an inferior good. Suppose you are told a consumer has the following utility function: U (9219₂) = 9z+√9z+ 9₂ You should assume income is Y, the price of good r is P2, and the price of good z is P₂. This question will ask about several concepts discussed in lecture. (a) What is the Marshallian demand for goods x and z? I.e. find (qq) for both interior solutions and corner solutions. Note: the outcome is "ugly" for the interior section and both corner should include constraints, i.e. limits using Y relative to f(P, P₂). Hint: if solving using MRS = MRT, can use this information again in part (d). (b) Suppose you are told P₂ = $8 and P₂ = $1. Create a graph showing the Income Consumption Curve (ICC) for Y = {$12.25, $35, $49, $70, $98). Be sure to clearly label the graph. Based on the ICC, which of the goods is…arrow_forward

- Please help any info will helparrow_forwardA date with Alex costs you $100 and gives you an additional 1000 units of utility. A date with Kelly costs you $200 and an additional 4,000 units of utility. Based only on the information you have, using the theory of rational choice, you most likely would: O be indifferent between the two dates O go on a date with Alex because the marginal utility per dollar is the greater of the two O go on a date with Kelly O go on a date with Alexarrow_forward12) A consumer’s preferences are given by U(X,Y) = X0.6Y0.4. The price of X is 4, and the price of Y is 5. The consumer has an income of $2000.a) What is the utility maximizing choice of X and Y?b) How would the utility maximizing choice change if price of X falls to 3 because of a pricesubsidy?c) Given the answers to the previous parts plot a linear demand function for X.d) Show that the consumer would prefer the cash equivalent of the price subsidy in part b.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education