ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:...

...

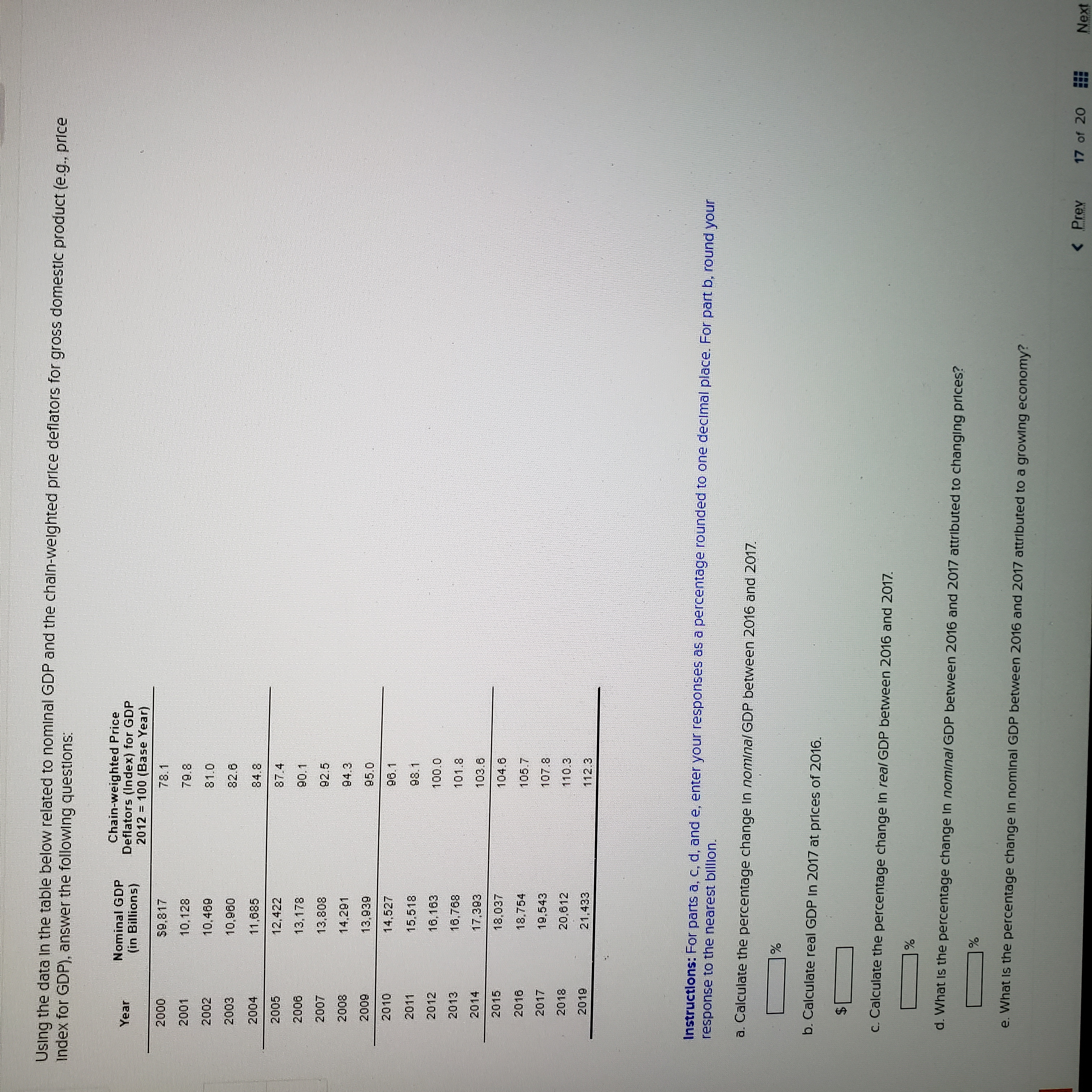

Using the data In the table below related to nominal GDP and the chaln-welghted price deflators for gross domestic product (e.g., price

Index for GDP), answer the followIng questions:

Nominal GDP

(in Billions)

Chain-weighted Price

Deflators (Index) for GDP

2012 = 100 (Base Year)

Year

78.1

2001

10,128

10,469

82.6

2004

11,685

84.8

12,422

87.4

13,178

90.1

9007

13,808

92.5

14,291

600

2010

14,527

96.1

2011

15,518

2012

16,163

0 00

101.8

16,768

2014

2015

18,037

104.6

2016

18,754

105.7

2017

19,543

107.8

20,612

21,433

112.3

Instructlons: For parts a, c, d, and e, enter your responses as a percentage rounded to one deClmal place. For part b, round your

response to the nearest billion.

a. Calculate the percentage change In nominal GDP between 2016 and 2017.

b. Calculate real GDP In 2017 at prices of 2016.

24

C. Calculate the percentage change in real GDP between 2016 and 2017.

d. What Is the percentage change In nomlnal GDP between 2016 and 2017 attributed to changing prices?

e. What Is the percentage change In nominal GDP between 2016 and 2017 attributed to a growing economy?

< Prey

17 of 20

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Year 2014 (base) 2015 Product Quantity Price Quantity Price 2016 Quantity Price Beer 15 550 575 Pizza 7 275 280 Hot Wings 10 640 660 Given the above table, the nominal GDP in 2015 is: 500 300 600 17 8 12 20 10 13 A/ (whole number) dollars. The real A (whole number) GDP in 2016 is: dollars. The GDP deflator for 2016 equals:arrow_forward4.arrow_forwardPlease answer the questions provided on the image below.arrow_forward

- [The following scenario applies to the next three questions:] A country makes goods Y and Z in Years 1 and 2 at the quantities and prices shown below. The implicit price deflator in Year 1 is 177. Quantity Price Y 55 138 Use the chain-link method for the base prices. Question 1.4: Real GDP Question 1.3: GDP at base prices What is the GDP in Year 1 at the base prices? A. 18,501.50 B. 18,736.00 C. 18,859.50 D. 19,081.50 E. 19,192.00 What is Real GDP in Year 2? A. 8,208.64 B. 8,640.68 C. 9,072.71 D. 9,504.74 E. 9,936.78 Year 1 D. 218.78 E. 230.29 Z 183 47 Question 1.5: Implicit price deflator What is the implicit price deflator in Year 2? A. 184.24 B. 195.75 C. 207.27 Y 67 164 Year 2 Z 133 67arrow_forwardE. Refer to the following data compiled by the US government for 2022 for purposes of calculating the GDP Deflator for 2 commodities: ketchup & mustard. First, categorize each data point as either (R) for Real or (N) for Nominal. Then, use the GDP Deflator equation from your notes to calculate what the 'GDP Deflator' is. 2022 Data: *Ketchup & Mustard valued at previous (constant) prices in 2022 = $300 *Ketchup & Mustard valued at current prices in 2022 = $900 Q9: Category (R or N) Q10: GDP Deflator = (Show the equation itself here, as well as the math you used to get your answer):arrow_forwardConsider the GDP deflator and real GDP, given in thousands of dollars, for the country of Barbados. Year year 1 year 2 year 3 Real GDP $20,597 $10,557 $40,977 What is the nominal GDP for year 1? What is the nominal GDP for year 2? GDP deflator What is the nominal GDP for year 3? 122 The base year, or base period, is year 3. For the given years, calculate the nominal GDP. Round your answers to the nearest dollar. 113 100 year 1: year 2: year 3: $ $ 13234 Incorrect 12457 Incorrect 40977arrow_forward

- Suppose you are given the following data for a particular economy (unit: Millions of Euros):Gross National Income mp (GNImp) =1650Investment (I) = 220(Iliq) Net investment = 210Private consumption(C) =1100Net External Income (NEI) = 0Net Indirect Taxes (NIT) = 231Public Spending (G) = 363 Calculate: a) Balance of Goods and Services or Net Exports (NX) and Amortizations/Depreciations (A). b) Net National Product at Base Prices (NNPbp) and Net Domestic Product at Base Prices (NDPbp)arrow_forwardSolve d and e onlysarrow_forwardThe table below presents a brief summary of City A’s total spending, local GDP, and population changes. Read the table and answer the following questions. 2010 2020 Total spending ($ million) 89 104.12 Local GDP ($ millions) 110 134 Population 50,000 56,275 CPI deflators (2012=1) 0.96 1.05 Calculate % change for City A’s total spending from 2010 to 2020 in current dollars. *Results round to the nearest 2 decimal places. Calculate % change for City A’s total spending from 2010 to 2020 in constant dollars. *Results round to the nearest 2 decimal places. Why does % change calculated from constant dollars differ from % change calculated from current dollar? Calculate per capita spending in 2010 and 2020, respectively, using constant dollars. *Results round to the nearest dollar. 2010 per capita spending: 2020 per capita spending: Calculate the compound annual growth rate of per capita spending from 2010 to 2020…arrow_forward

- Question 1: In an economy, there are only two goods (Cars and cycles) produced. The data for last three years is given in the below table. Calculate the nominal and real GDP of three years and then find the GDP deflator for all the three years. Find year on year (YoY) inflation for 2018 and 2019. Note: the base year for this economy is given as 2017. year Price of Car (AED) Number of Car Price of cycle (AED) Number of cycle 2017 1000 10 200 900 2018 1200 15 210 1000 2019 1500 25 250 1500 Question 2: Explain the role of fiscal and monetary policy in an economy facing a recession. Use appropriate graph to justify your answerarrow_forwardConsider the following national accounts data for Westeros: Westeros' National Accounts (2019) GDP Item (S billions) Corporate income 140 Еxports 50 Wages and salaries 550 Net international income to the rest of the 8 world Gross investment 160 Government purchases 184 Indirect taxes 75 Personal consumption 500 Imports 27 Depreciation 79 Proprietors' incomes and rents Which is the following is the income-based estimate of GDP for Westeros? 65 $909 billion $751 billion $558 billion $939 billionarrow_forwardThe following table gives nominal and real GDP for an economy for two years. Based on the table, in Year 2, the value of the GDP deflator is Year 1 1430.0 1,300 Nominal GDP Real GDP (Round your answer to one decimal place.) The inflation rate between Year 1 and Year 2 is %. (Round your answer to one decimal place.) Year 2 1820.0 1560.0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education