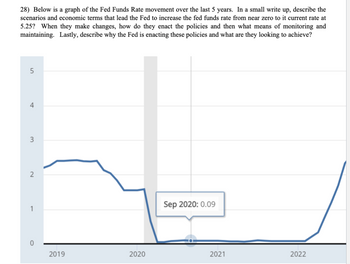

28) Below is a graph of the Fed Funds Rate movement over the last 5 years. In a small write up, describe the scenarios and economic terms that lead the Fed to increase the fed funds rate from near zero to it current rate at 5.25? When they make changes, how do they enact the policies and then what means of monitoring and maintaining. Lastly, describe why the Fed is enacting these policies and what are they looking to achieve? 5 4 3 2 1 0 2019 2020 Sep 2020: 0.09 2021 2022 29) Based on the below monthly chart of US inflation. What would have been your estimate of expected inflation in 2019 and 2021? When inflation jumped in March of 2021, who were the winners and losers from this unexpected jump in inflation? With inflation trending down in 2023, who is likely to continue to benefit? 2017 2.5 2.7 2018 2.1 2.2 2019 1.6 1.5 2020 2.5 2.3 2021 1.4 1.7 2022 7.5 7.9 2023 6.4 6.0 2.4 2.4 1.9 1.5 2.6 8.5 5.0 2.2 2.5 2.0 1.8 0.3 0.1 4.2 5.0 8.3 8.6 1.9 2.8 4.9 1.6 1.7 1.9 2.2 2.9 2.9 2.7 2.3 1.8 1.7 1.7 1.0 1.3 1.4 5.4 5.3 5.4 8.5 8.3 1.6 0.6 5.4 9.1 4.0 3.0 2.0 2.5 1.8 1.2 6.2 8.2 7.7 3.2 3.7 3.7 3.2 2.2 2.2 2.1 1.2 6.8 7.1 Avail. Dec. 12 2.1 1.9 2.3 1.4 7.0 6.5 2.1 2.4 1.8 1.2 4.7 8.0

28) Below is a graph of the Fed Funds Rate movement over the last 5 years. In a small write up, describe the scenarios and economic terms that lead the Fed to increase the fed funds rate from near zero to it current rate at 5.25? When they make changes, how do they enact the policies and then what means of monitoring and maintaining. Lastly, describe why the Fed is enacting these policies and what are they looking to achieve? 5 4 3 2 1 0 2019 2020 Sep 2020: 0.09 2021 2022 29) Based on the below monthly chart of US inflation. What would have been your estimate of expected inflation in 2019 and 2021? When inflation jumped in March of 2021, who were the winners and losers from this unexpected jump in inflation? With inflation trending down in 2023, who is likely to continue to benefit? 2017 2.5 2.7 2018 2.1 2.2 2019 1.6 1.5 2020 2.5 2.3 2021 1.4 1.7 2022 7.5 7.9 2023 6.4 6.0 2.4 2.4 1.9 1.5 2.6 8.5 5.0 2.2 2.5 2.0 1.8 0.3 0.1 4.2 5.0 8.3 8.6 1.9 2.8 4.9 1.6 1.7 1.9 2.2 2.9 2.9 2.7 2.3 1.8 1.7 1.7 1.0 1.3 1.4 5.4 5.3 5.4 8.5 8.3 1.6 0.6 5.4 9.1 4.0 3.0 2.0 2.5 1.8 1.2 6.2 8.2 7.7 3.2 3.7 3.7 3.2 2.2 2.2 2.1 1.2 6.8 7.1 Avail. Dec. 12 2.1 1.9 2.3 1.4 7.0 6.5 2.1 2.4 1.8 1.2 4.7 8.0

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

We can't answer subjective or opinion-based questions as they require personal interpretation. For guidance on crafting effective writing assignments, we recommend using bartleby research. A question credit has been added to your account for future use.

Your Question:

Transcribed Image Text:28) Below is a graph of the Fed Funds Rate movement over the last 5 years. In a small write up, describe the

scenarios and economic terms that lead the Fed to increase the fed funds rate from near zero to it current rate at

5.25? When they make changes, how do they enact the policies and then what means of monitoring and

maintaining. Lastly, describe why the Fed is enacting these policies and what are they looking to achieve?

5

4

3

2

1

0

2019

2020

Sep 2020: 0.09

2021

2022

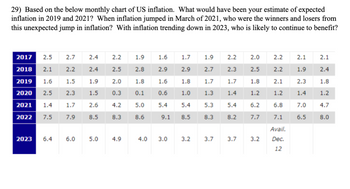

Transcribed Image Text:29) Based on the below monthly chart of US inflation. What would have been your estimate of expected

inflation in 2019 and 2021? When inflation jumped in March of 2021, who were the winners and losers from

this unexpected jump in inflation? With inflation trending down in 2023, who is likely to continue to benefit?

2017 2.5

2.7

2018 2.1 2.2

2019 1.6

1.5

2020 2.5 2.3

2021 1.4

1.7

2022 7.5

7.9

2023 6.4

6.0

2.4

2.4

1.9

1.5

2.6

8.5

5.0

2.2

2.5

2.0

1.8

0.3

0.1

4.2 5.0

8.3

8.6

1.9

2.8

4.9

1.6

1.7

1.9

2.2

2.9 2.9

2.7

2.3

1.8

1.7

1.7

1.0

1.3

1.4

5.4 5.3 5.4

8.5

8.3

1.6

0.6

5.4

9.1

4.0 3.0

2.0

2.5

1.8

1.2

6.2

8.2 7.7

3.2 3.7 3.7 3.2

2.2

2.2

2.1

1.2

6.8

7.1

Avail.

Dec.

12

2.1

1.9

2.3

1.4

7.0

6.5

2.1

2.4

1.8

1.2

4.7

8.0

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you