FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:eBook

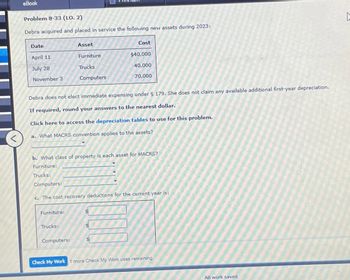

Problem 8-33 (LO. 2)

Debra acquired and placed in service the following new assets during 2023:

Date

Asset

Cost

April 11

Furniture

$40,000

July 28

Trucks

40,000

November 3

Computers

70,000

Debra does not elect immediate expensing under § 179. She does not claim any available additional first-year depreciation.

If required, round your answers to the nearest dollar.

Click here to access the depreciation tables to use for this problem.

a. What MACRS convention applies to the assets?

b. What class of property is each asset for MACRS?

Furniture:

Trucks:

Computers:

c. The cost recovery deductions for the current year is:

Furniture:

Trucks:

Computers:

Check My Work 1 more Check My Work uses remaining.

All work saved.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- D1.arrow_forwardCurrent Attempt in Progress Blossom Department Store determines it will cost $107,000 to restore the area (considered a land improvement) surrounding one of its store parking lots, when the store is closed in 2 years. Blossom estimates the fair value of the obligation at December 31, 2025, is $93,000. Prepare the journal entry to record the asset retirement obligation. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter 0 for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Creditarrow_forward! Required information [The following information applies to the questions displayed below.] Burbank Corporation (calendar-year-end) acquired the following property this year: (Use MACRS Table 1. Table 2, and Exhibit 10-10.) Asset Used copier New computer equipment Furniture New delivery truck Luxury auto Total Placed in Service November 12 June 6 Maximum cost recovery deduction July 15 October 28 January 31 Basis $ 12,200 18,400 36,400 23,400 74,400 $ 164,800 Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. Note: Round your answer to the nearest whole dollar amount. Check my work a. Assuming no bonus or §179 expense, what is Burbank's maximum cost recovery deduction for this year?arrow_forward

- Required information [The following information applies to the questions displayed below.] Hero Sandwich Shop had the following long-term asset balances as of January 1, 2024: Land Building Equipment Patent Cost $86,000 451,000 227,900 205,000 Accumulated Depreciation Book Value $86,000 288,640 179,700 123,000 • Hero purchased all the assets at the beginning of 2022. • The building is depreciated over a 10-year service life using the double-declining-balance method and estimating no residual Land Building Equipment Patent 0 value. • The equipment is depreciated over a 9-year service life using the straight-line method with an estimated residual value of $11,000. HERO SANDWICH SHOP December 31, 2024 $(162,360) (48,200) (82,000) • The patent is estimated to have a five-year useful life with no residual value and is amortized using the straight-line method. • Depreciation and amortization have been recorded for 2022 and 2023 (first two years). 3. Calculate the book value for each of the…arrow_forwardComputing Partial Period Depreciation under Multiple Depreciation Methods Compute depreciation expense for 2021 for each asset #1, #2, #3, and #4. Note: Do not round until your final answer. Round your final answer to the nearest whole dollar. Acquisition Acquisition Useful Salvage 2021 Depreciation Value Asset Date Depreciation Method Cost Life Expense #1 Jan. 1, 2020 Straight-line $4,000 4 years $200 $ 950 v #2 Aug. 30, 2020 Double-declining-balance 5,800 8 years 400 $ 1,125 x #3 Feb. 1, 2021 Sum-of-the-years'-digits 7,200 4 years 320 $ 1,147 x #4 Jul. 31, 2021 Straight-line 13,520 8 years 0 $arrow_forwardint Item Exercise 8-21 (Algorithmic) (LO. 2) Lopez acquired and placed in service a building on June 1, 2018, for $8,470,300. Compute the depreciation deduction assuming the building is classified as (a) residential and (b) non residential. Click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. a. Calculate Lopez's cost recovery deduction for 2023 if the building is classified as residential rental real estate. 307,980 b. Calculate Lopez's cost recovery deduction for 2023 if the building is classified as nonresidential real estate. 217,178arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education