FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

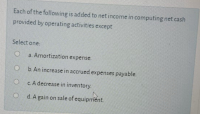

Transcribed Image Text:Each of the following is added to net income in computing net cash

provided by operating activities except

Select one:

a. Amortization expense.

b. An increase in accrued expenses payable.

c. A decrease in inventory.

d. A gain on sale of equipment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 7arrow_forwardAny gain or loss from the sale of equipment is reported in the operating activities section of the statement of cash flows. True Falsearrow_forwardThe following schedule relates the income statement with cash flows from operating activities, derived by both the direct and indirect methods. Some elements necessary to complete the schedule are missing. Required: Complete the schedule by determining each of the following missing elements: (Amounts to be deducted should be indicated with a minus sign.) Income Statement Sales Gain on sale of equipment Cost of goods sold Salaries expense Depreciation expense Interest expense Insurance expense Loss on sale of land Income tax expense Net Income Cash flows from Operating Activities Indirect Method Net income Adjustments: $432 Decrease in accounts receivable 36 Gain on sale of equipment Increase in inventory Increase in accounts payable (66) (21) Depreciation expense Decrease in bond discount (45) Decrease in prepaid insurance (18) Loss on sale of land (51) Increase in income tax payable Net cash flows from operating activities Direct Method 18 Cash received from customers (36) (Not…arrow_forward

- Hamburger Heaven's income statement for the current year and selected balance sheet data for the current and prior years ended December 31 are presented below. Income Statement Sales Revenue $1,860 Expenses: Cost of Goods Sold 850 Depreciation Expense Salaries and Wages Expense Rent Expense 150 450 200 Insurance Expense 75 Interest Expense Utilities Expense 45 Net Income 35 Selected Balance Sheet Accounts Current Year Prior Year 72 Inventory Accounts Receivable 55 355 400 Accounts Payable Salaries/Wages Payable Utilities Payable Prepaid Rent Prepaid Insurance 225 260 39 25 25 10 14 TIP: Prepaid Rent decreased because the amount taken out of Prepaid Rent (and subtracted from net income as Rent Expense) was more than the amount paid for rent in cash during the current year. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardExercise 15-2 (Algo) Net Cash Provided by Operating Activities [LO15-2] For the year just completed, Hanna Company had net income of $81,000. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: Current assets: Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Income taxes payable December 31 Beginning of Year End of Year $ 60,000 $ 162,000 $ 448,000 $ 11,000 $368,000 $ 7,500 $ 35,000 $ 78,000 $ 186,000 $ 346,000 $ 14,000 $ 390,000 $ 12,000 $ 25,000 The Accumulated Depreciation account had total credits of $44,000 during the year. Hanna Company did not record any gains or losses during the year.arrow_forwardIn the operating activities portion of the statement of cash flows when utilizing the indirect method, explain why depreciation expenditure, depletion expense, and amortization expense are added to net income in the operating activities section of the statement of cash flows.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education