FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

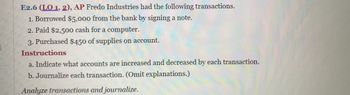

Transcribed Image Text:E2.6 (LO 1, 2), AP Fredo Industries had the following transactions.

1. Borrowed $5,000 from the bank by signing a note.

2. Paid $2,500 cash for a computer.

3. Purchased $450 of supplies on account.

Instructions

a. Indicate what accounts are increased and decreased by each transaction.

b. Journalize each transaction. (Omit explanations.)

Analyze transactions and journalize.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pina Colada Corp. had the following transactions. 1. Borrowed $5,065 from the bank by signing a note. 2. Paid $2,533 cash for a computer. 3. Purchased $456 of supplies on account. Journalize each transaction. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation Debit Credit 1. enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount 2. enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount 3. enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amountarrow_forward2. Post the following February transactions to T-accounts for Accounts Receivable and Cash, indicating the ending balance (assume no beginning balances in these accounts). A.Provided legal services to customers for cash, 5,600 B. Provided legal services to customers on account, $4,700 C. Collected cash from customers account, $3,500arrow_forwardPina Colada Corp. has the following transactions during August of the current year. Aug. 1 4 16 27 Journalize the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Opens an office as a financial advisor, investing $4,000 in cash in exchange for common stock. Pays insurance in advance for 6 months, $1,650 cash. Receives $2,200 from clients for services performed. Pays secretary $1,010 salary. Aug. 1 Account Titles and Explanation | Debit Creditarrow_forward

- P2-6C. Cookie Mejias, owner of Mejias Company, would like to know how each of the following situations would affect the totals of the trial balance and individual ledger accounts: 1. An $850 payment for a desk was recorded as a debit to Office Equipment, $85, and a credit to Cash, $85. 2. A payment of $300 to a creditor was recorded as a debit to Accounts Payable, $300, and a credit to Cash, $100. 3. An Accounts Receivable collection of $400 was recorded as a debit to Cash, $400, and a credit to C. Mejias, Capital, $400. 4. The payment of a liability of $400 was recorded as a debit to Accounts Payable, $40, and a credit to Supplies, $40. 5. A purchase of equipment for $800 was recorded as a debit to Supplies, $800, and a credit to Cash, $800. Situation 1. 2. 3. 4. 5. 6. 6. A payment of $95 to a creditor was recorded as a debit to Accounts Payable, $95, and a credit to Cash, $59. What would you tell Cookie? Which accounts would be overstated and which would be understated? Which would…arrow_forwardSubject :"-Accountingarrow_forward8. ABC Cleaning Company paid off the $280 they owe to XYZ Corp, check #104. • Which accounts are affected? Is it an increase or decrease to the account? Where will the debit and credit be reported? Okay Youarrow_forward

- A company engaged in the following transactions: Dec.1- Performed services for cash, $750 Dec.1- Paid expenses in cash, $550. Dec 2- Performed services on credit, $900. Dec 3- Collected on account, $600. Dec 4- Incurred expenses on credit, $650. Dec 5- Paid on account, $350. Enter the correct titles on the following T accounts, as attached, and enter the above transactions in the accounts. Determine the cash balance after these transactions, the amount still to be received, and the amount still to be paid.arrow_forwardEvaluate each of the following transactions in terms of their effect on assets, liabilities, and equity. 1. Receive payment of $12,000 owed by a customer2. Purchase equipment for $45,000 in cash3. Issue $85,000 in stock4. Borrow $67,000 from a bank What is the net change in Total Liabilities & Equity? Please don't provide answer in image format thank youarrow_forwardIndicate what impact the following transactions would have on the accounting equation, Assets = Liabilities + Equityarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education