FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

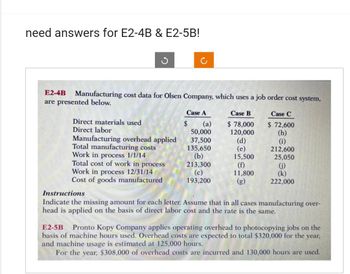

Transcribed Image Text:need answers for E2-4B & E2-5B!

E2-4B Manufacturing cost data for Olsen Company, which uses a job order cost system,

are presented below.

Direct materials used

Direct labor

Manufacturing overhead applied

Total manufacturing costs

Work in process 1/1/14

Total cost of work in process

Work in process 12/31/14

Cost of goods manufactured

Case A

$

(a)

50,000

37,500

135,650

(b)

213,300

(c)

193,200

Case B

$ 78,000

120,000

(d)

(e)

15,500

11,800

(g)

Case C

$ 72,600

(h)

(i)

212,600

25,050

(j)

(k)

222,000

Instructions

Indicate the missing amount for each letter. Assume that in all cases manufacturing over-

head is applied on the basis of direct labor cost and the rate is the same.

E2-5B Pronto Kopy Company applies operating overhead to photocopying jobs on the

basis of machine hours used. Overhead costs are expected to total $320,000 for the year,

and machine usage is estimated at 125,000 hours.

For the year, $308,000 of overhead costs are incurred and 130,000 hours are used.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ces The following data from the just completed year are taken from the accounting records of Mason Company: Sales Direct labor cost Raw material purchases Selling expenses Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead costs Inventories Raw materials. Work in process Finished goods Beginning $ 7,000 $ 10,000 $ 20,000 Required 1 Required 2 Required 3 Ending $ 15,000 $ 5,000 $ 35,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials. 2. Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 3. Prepare an income statement. Complete this question by entering your answers in the tabs below. Mason Company Schedule of Cost of Goods Manufactured Beginning work in process inventory Direct materials: Prepare a schedule of cost of goods manufactured. Assume all raw materials used…arrow_forwardOn January 1, 2019, Kelly Corporation acquired bonds with a face value of $400,000 for $386,808.18, a price that yields a 9% effective annual interest rate. The bonds carry a 8% stated rate of interest, pay interest semiannually on June 30 and December 31, are due December 31, 2022, and are being held to maturity. Required: Prepare journal entries to record the purchase of the bonds and the first two interest receipts using the: 1. straight-line method of amortization 2. effective interest method of amortizationarrow_forward(3)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education