FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

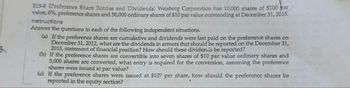

Transcribed Image Text:E15-8 (Preference Share Entries and Dividends) Weisberg Corporation has 10,000 shares of $100 bar

value, 6%, preference shares and 50,000 ordinary shares of $10 par value outstanding at December 31, 2015.

Instructions

Answer the questions in each of the following independent situations.

(a) If the preference shares are cumulative and dividends were last paid on the preference shares on

December 31, 2012, what are the dividends in arrears that should be reported on the December 31,

2015, statement of financial position? How should these dividends be reported?

(b) If the preference shares are convertible into seven shares of $10 par value ordinary shares and

3,000 shares are converted, what entry is required for the conversion, assuming the preference

shares were issued at par value?

(c) If the preference shares were issued at $107 per share, how should the preference shares be

reported in the equity section?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 3. How much is the TOTAL subscribed share capital (assuming subscriptions receivable is collectible on January 5, 2022)? 4. How much is the TOTAL share premium?arrow_forwardPLEASE ANSWER WITHOUT IMAGEarrow_forwardPE 2-8B. Horizontal Analysis OBJ. 5 EE 2-8 p. 83 Two income statements for Satterfield Company follow: Prepare a horizontal analysis of Satterfield Company’s income statements.arrow_forward

- P13-6A Rainy Day Corporation has 50,000 $0.50 preferred shares and 600,000 common shares issued and outstanding. During a three-year period, Rainy Day Corporation declared and paid cash dividends as follows: 2017, $0; 2018, $114,000; and 2019, $260,000. Required 1. Compute the total dividends to preferred shares and common shares for each of the three years if a. Preferred shares are noncumulative. b. Preferred shares are cumulative. 2. For requirement 1b, record the declaration of the 2019 dividends on December 22, 2019, and the payment of the dividends on January 12, 2020. 3 Computing dividends on preferred and common shares 1. b. 2018: Preferred, $50,000arrow_forwardOn January 1, 2020, Company D issued 6,000 shares of its $2 par Common Stock when the market price was $30 and issued 1,000 shares of its $25 par Preferred Stock when the market price was $62 per share. What amounts would be reported on the balance sheet for Preferred Stock and Paid-In Preferred Stock? the above information is all that was given on the assignment, no further information was given for the questionarrow_forwardJupiter corporation had the following shares outstanding at December 31. 2018: Ordinary shares, par P80 - 320.000: 6% preference shares, par P80 - 160.000. Accumulated profits for dividend distribution amounted to P64.400. No dividends were declared for 2016 and 2017. If the preference share capital is cumulative and fully participating, what is the dividends per share of the preference share? (Round off answers to two decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education