FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

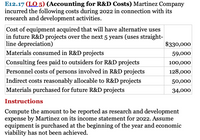

Transcribed Image Text:E12.17 (LO 5) (Accounting for R&D Costs) Martinez Company

incurred the following costs during 2022 in connection with its

research and development activities.

Cost of equipment acquired that will have alternative uses

in future R&D projects over the next 5 years (uses straight-

line depreciation)

Materials consumed in R&D projects

$330,000

59,000

Consulting fees paid to outsiders for R&D projects

100,000

Personnel costs of persons involved in R&D projects

128,000

Indirect costs reasonably allocable to R&D projects

50,000

Materials purchased for future R&D projects

34,000

Instructions

Compute the amount to be reported as research and development

expense by Martinez on its income statement for 2022. Assume

equipment is purchased at the beginning of the year and economic

viability has not been achieved.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Virtual Co. incurred research and development costs in 2023 as follows: Materials used in research and development projects $ 450,000 Equipment acquired that will have alternate future uses in future research and development projects 3,000,000 Depreciation for 2023 on above equipment 300,000 Personnel costs of persons involved in research and development projects 750,000 Consulting fees paid to outsiders for research and development projects 300,000 Indirect costs reasonably allocable to research and development projects 225,000 Total $5,025,000 Assume economic viability has not been achieved. What amount of research and development costs should be charged to Virtual’s 2023 income statementarrow_forwardRequired information [The following information applies to the questions displayed below.] On January 1, 2024, the Allegheny Corporation purchased equipment for $162,000. The estimated service life of the equipment is 10 years and the estimated residual value is $8,000. The equipment is expected to produce 350,000 units during its life. Required: Calculate depreciation for 2024 and 2025 using each of the following methods. 2. Double-declining-balance. Formula Amount for 2024 Amount for 2025 Double-Declining-Balance Method X X X = Depreciation Expense % = % =arrow_forwardi need help with these two accounting 2102 questions. can you show work pleasearrow_forward

- a Determine cost of plant acquisitions. E9.1 (LO 1), C Writing The following expenditures relating to plant assets were made by Glenn Company during the first 2 months of 2022. 1. Paid $7,000 of accrued taxes at the time the plant site was acquired. 2. Paid $200 insurance to cover a possible accident loss on new factory machinery while the machinery was in transit. 3. Paid $850 sales taxes on a new delivery truck. 4. Paid $21,000 for parking lots and driveways on the new plant site. 5. Paid $250 to have the company name and slogan painted on the new delivery truck. 6. Paid $8,000 for installation of new factory machinery. 7. Paid $900 for a 2-year accident insurance policy on the new delivery truck. 8. Paid $75 motor vehicle license fee on the new truck. Instructions a. Explain the application of the historical cost principle in determining the acquisition cost of plant assets. b. List the numbers of the transactions, and opposite each indicate the account title to which each…arrow_forwardQuestion 14: Based on the wage-bracket method, the federal income tax withholding for an employee who is married, is paid biweekly, completed the pre-2020 Form W-4, claims 2 federal withholding allowances, and earns $1,899 is $arrow_forwardCandalibra Company incurred the following costs during the year ended December 31, 2018: Laboratory research aimed at discovery of new knowledge $300,000 Costs of testing prototype and design modifications (economic viability not achieved) 55,000 Quality control during commercial production, including routine testing of products 210,000 Construction of research facilities having an estimated useful life of 12 years but no alternative future use 440,000 What is the total amount to be classified and expensed as research and development in 2018 under U.S. GAAP? 79arrow_forward

- i need the answer quicklyarrow_forward35.During 2021, King Co. incurred the following costs: Testing in search for process alternatives 720,000 Costs of testing prototype and design modifications 500,000 Modification of the formulation of a process 1,220,000 Research and development services performed by Queen Corp. for King 650,000 In King's 2021 statement of profit or loss, research and development expense should be 1,220,000 1,870,000 2,590,000 3,090,000arrow_forwardMunabhaiarrow_forward

- Sunland Corporation, which uses straight-line depreciation and amortization, incurred the following costs in 2026: Acquisition of R&D equipment with a useful life of 4 years in R&D projects (no salvage) $996000 Cost of making minor modifications to an existing product Advertising expense to introduce a new product 146000 760000 Engineering costs incurred to advance a product to full production stage 860000 What amount should Sunland report as research & development expense in 2026? O $1109000 O $1192000 O $1952000 $1620000arrow_forwardD1.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education