FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

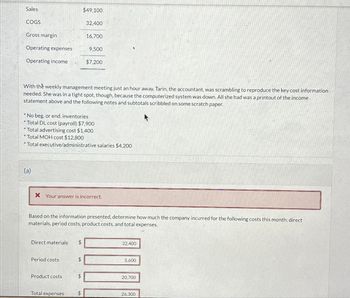

Transcribed Image Text:Sales

COGS

Gross margin

Operating expenses

Operating income

(a)

With the weekly management meeting just an hour away, Tarin, the accountant, was scrambling to reproduce the key cost information

needed. She was in a tight spot, though, because the computerized system was down. All she had was a printout of the income

statement above and the following notes and subtotals scribbled on some scratch paper.

Direct materials $

*No beg. or end. inventories

Total DL cost (payroll) $7,900

*Total advertising cost $1,400

Total MOH cost $12,800

Total executive/administrative salaries $4,200

Period costs

Product costs

$49,100

X Your answer is incorrect.

Total expenses

32,400

Based on the information presented, determine how much the company incurred for the following costs this month: direct

materials, period costs, product costs, and total expenses.

$

16,700

$

9,500

$

$7,200

32,400

5,600

20,700

26,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An IT auditor is conducting data analysis procedures on an employee expense report file and notices several expenses for $24.99 from the same individual. The company’s policy requires that any expenses that are under $25.00 do not require a receipt. The IT auditor should: [SELECT ALL THAT APPLY a) Maintain professional skepticism and investigate these transactions further b) Pass on investigating these items further, focusing on higher dollar amounts c) Evaluate the business process approval controls, and related procedures d) Discuss fraud awareness and detection programs with management to gain an understanding of management’s commitment to fraud prevention and related entity-level anti-fraud controls.arrow_forwardAble, an accounts payable supervisor for ABC Company, bought supplies for a company he owned on the side. Able entered vouchers in ABC Company’s accounts payable system for the cost of the supplies. Checks were cut to pay for these unauthorized expenses during normal daily check runs. The goods ordered were drop-shipped to a location where Able could collect them. This is an example of: a. An expense reimbursement scheme b. A commission scheme c. A billing scheme d. An invoice kickback schemearrow_forwardAssume you are a new hire in the accounting department of an organization. One of your responsibilities is the reconciliation of the operating account. After the end of the month you are given a copy of the bank statement and the cancelled checks, and are instructed to perform your reconciliation. You notice that there are some faint markings on a portion of the bank statement that could be alterations. What steps would you take in performing the reconciliation?arrow_forward

- Lamar LLC is in the process of updating its revenues and receivables systems with the implementation of new accounting software. James Loden, Inc. is an independent information technology consultant who is assisting Tamar with the project. James has developed the following checklist containing internal control points that the company should consider in this new implementation: Will customer orders be received via the Internet? Are all collections from customers received in the form of checks? Are product quantities monitored regularly?arrow_forwardAccount inquiry (hours) Account billing (lines) Account verification (accounts) Correspondence (letters) The above activities are carried out at two of its regional offices. Activities $78,000 2,000 hours $41,000 20,000 lines $16,000 22,000 accounts $12,000 1,400 letters Account inquiry (hours) Account billing (lines) Account verification (accounts) Correspondence (letters) Northeast Office 180 hours 16,000 lines 1,400 accounts 70 letters Midwest Office What is the cost per letter for the correspondence activity? (Round your answer to the nearest cent.) 300 hours 7,000 lines 600 accounts 130 letters OA. $6.00 B. $29.29 O C. $8.57 OD. $0.73 1arrow_forwardAnswer multi choice question in photo pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education