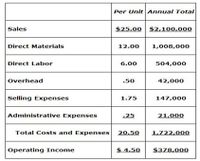

the Party Connection prepares complete party kits for various types of celebrations. It is currently operating at 80% of its capacity. It costs The Party Connection $20.50 to make a packet that it sells for $25.00. It currently makes and sells 84,000 packets per year. Detailed information attached

The Party Connection has received a special order request for 25,000 packets at a price of $23 per packet to be shipped overseas. Suppose the following information is discovered with further analysis:

o The per unit overhead cost of $0.50 is 50% variable ($0.25) and 50% fixed ($0.25).

o The per unit Selling costs of $1.75 is 26.67% variable ($0.47) and 73.33% fixed ($1.28).

o Administrative expenses would not change.

• Should the Party Connection accept this special order?

Step by stepSolved in 2 steps

- Economic Dispatch Question It is required to investigate the economic dispatch of three power plants located in the western part of Victoria. The total load (PD) to be supplied by those power plants is 1500 MW. Assume the cost functions and the generation limits for these power plants are as follows. 350+ 4.2 P₁ + 0.006 P² 600 + 3.1 P₂ + 0.004 P² 500+ 4.2 P3 +0.007 P3 a) b) c) Plant 1: C₁ Plant 2: C₂ Plant 3: C3 = = = 150 ≤ P₁ ≤ 550 350 ≤ P₂ ≤ 700 120 ≤P3 ≤ 400 If the total load is shared among the three power plants equally, what is power generation of each power plant and what is the total operating cost in $/hr in this case. Find the optimal (economic) dispatch of each plant, the incremental operating cost 1, and the total operation cost in $/hr. (You don't need to use the iteration method). If it is expected that those power plant will operate in average 18 hrs a day, how much saving in cost if the economic dispatch operation with shared power operation (in part a).arrow_forwardA company manufactures two types of leaf blowers: an electric Turbo model and a gas-powered Tornado model. The company's production plan calls for the production of at least 690 blowers per month. It costs $74 to produce each Turbo model and $111 to manufacture each Tornado model, and the company has at most $63,640 per month to use for production. Find the number of units that should be produced to maximize profit for the company, and the maximum profit, if the profit on each Turbo model is $35 and the profit on each Tornado model is $40. The maximum value is $ by producing integers or decimals.) units of the Turbo model and units of the Tornado model. (Typearrow_forwardJenny Tanaka wants to buy a new car, and the annual gasoline expense is a major consideration. Her present car gets 25 miles per gallon (mpg), and she is considering purchasing a new car that gets 40 mpg. Jenny now drives about 12,000 miles per year and pays $3.25 per gallon of gasoline. She therefore calculates an annual gasoline consumption of 480 gallons for her 25 mpg car (12,000 miles/25 mpg) compared to 300 gallons consumed per year for the 40 mpg car (12,000 miles/40 mpg). Since driving the higher- mileage car would use 180 gallons less per year, Jenny estimates the new car will save her $585 in gasoline expense per year (180 gallons 3 $3.25 per gallon). Suppose Jenny buys the 40 mpg car. According to economic theory, Jenny's actual annual savings on gasoline will be 7 1 C 1 U C VI 10 V K W S TACAZEC 10 GUNS TOMBER 2 than her initial estimate of $585.arrow_forward

- EMERGENCY! Production just informed management that one of its five glycol squeezers has been destroyed by a rogue computer virus. Production capability is now only 23000 gallons at most. The squeezer cannot be fixed and IceLess cannot afford a replacement. This breakdown will NOT lower fixed costs. This breakdown will not change variable cost per unit, either. If only 23000 gallons are produced, and the earning target remains $94400 above fixed costs, what price per gallon must now be charged? (show your calculations What is the Contribution Margin Ratio (CMR) if the price is $8.82 per gallon? At a price of $10.95 per gallon, what will be the DOL (assume 23000 gallons are sold , that $94400 above fixed costs is to be earned, and that other costs are as initially given)(show your calculations).arrow_forward(You will need to use a spreadsheet to tackle these questions.) 1. How much of q can be produced for £60,000 if the total cost function is TC = 86 + 152q − 12q2 + 0.6q3? 2. What output can be produced for £150,000 if TC = 130 + 62q − 3.5q2 + 0.15q3? 3. Solve for x when 0 = −1,340 + 14x + 2x2 − 1.5x3 + 0.2x4 + 0.005x5 − 0.0002x6arrow_forwardwhat is the terminology for this definition below: Year serving as point of comparison for other yearsarrow_forward

- A lash adjuster keeps pressure constant on engine valves, thereby increasing fuel efficiency in automobile engines. The relationship between price (p) and monthly demand (D) for lash adjusters made by the Wicks Company is given by this equation D (1.900-py0 10 What is the demand (0) when total revenue is maximized? What important data are needed if maximum profit is desired? G The total revenue is maximized when demand is 9500 units per month (Round to the nearest whole number) Select all important data that are needed if maximum profit is desired. DA Variable cost per lash adjuster B. Fixed cost per month C. Variable cost per engine valve D. Variable cost per gallon of fuelarrow_forward9arrow_forwardA company manufactures two types of typewriters-electrical (E) and manual (M). The revenue function of the company, in thousands is: R(E, M) = 8E + 5M + 2EM – E² – 2M² + 20. Determine the quantity of electrical and manual typewriters which lead to maximum revenue. Also calculate the maximum revenue.arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education