FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:(e) If dividends of $72,000 were in arrears on preferreu SLUCK, WInutu

reported for retained earnings?

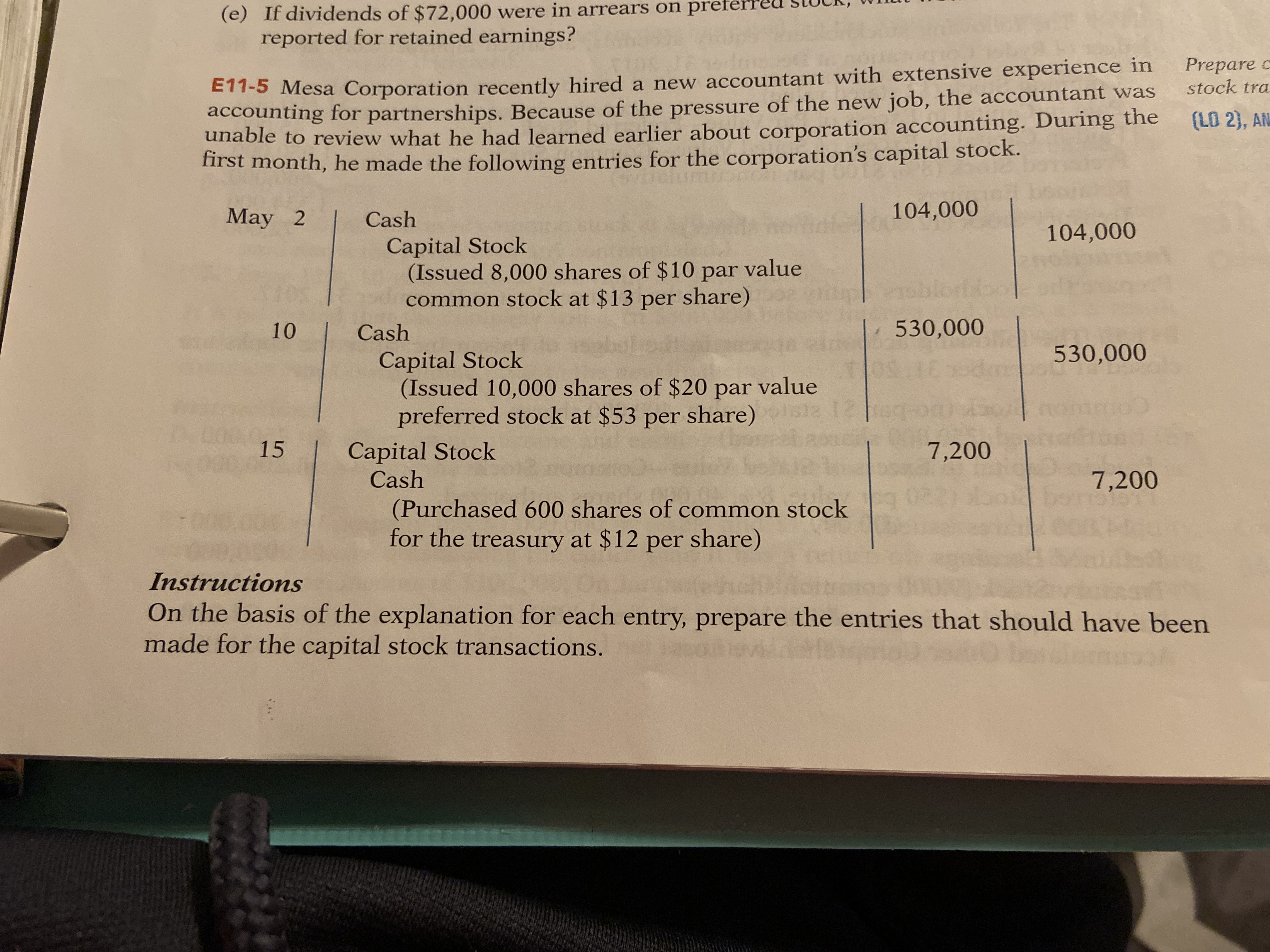

ETT-5 Mesa Corporation recently hired a new accountant with extensive experience in

accounting for partnerships. Because of the pressure of the new job, the accountant was

unable to review what he had learned earlier about corporation accounting. During the

first month, he made the following entries for the corporation's capital stock.

Prepare c

stock tra

(LO 2), AN

May 2

Cash

104,000

104,000

Capital Stock

(Issued 8,000 shares of $10 par value

common stock at $13 per share)

noblorb

10

Cash

530,000

Capital Stock

(Issued 10,000 shares of $20 par value

preferred stock at $53 per share)

530,000

12

15

Capital Stock

Cash

7,200

7,200

be

(Purchased 600 shares of common stock

for the treasury at $12 per share)

Instructions

On the basis of the explanation for each entry, prepare the entries that should have been

made for the capital stock transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Similar questions

- Please do not give solution in image format ?arrow_forwardMarcellus Corporation reports the following components of stockholders' equity on January 1. Common stock-$10 par value, 110,000 shares authorized, 40,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity During the year, the following transactions affected its stockholders' equity accounts. $ 400,000 60,000 330,000 $ 790,000 January 2 Purchased 4,000 shares of its own stock at $23 cash per share. January 5 Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. February 28 Paid the dividend declared on January 5. July 6 Sold 2,000 of its treasury shares at $27 cash per share. August 22 Sold 2,000 of its treasury shares at $19 cash per share. September 5 Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend declared on September 5. December 31 Closed the $549,500…arrow_forwardFinancial Statements from the End-of-Period Spreadsheet Demo Consulting is a consulting firm owned and operated by Jesse Flatt. The following end-of-period spreadsheet was prepared for the year ended August 31, 20V9: Demo Consulting End-of-Period Spreadsheet For the Year Ended August 31, 20Y9 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash 10,710 10,710 Accounts Receivable 25,500 25,500 Supplies 2,700 2,270 430 Land 22,190 22,190 Office Equipment 20,910 20,910 Accumulated Depreciation 2,830 1,350 4,180 Accounts Payable 6,890 6,890 Salaries Payable 330 330 Common Stock 8,600 8,600 Retained Earnings 17,410 17,410 Dividends 3,320 3,320 Fees Earned 70,770 70,770 Salary Expense 19,130 330 19,460 Supplies Expense 2,270 2,270 Depreciation Expense 1,350 1,350 Miscellaneous Expense 2,040 2,040 106,500 106,500 3,950 3,950 108,180 108,180 Based on the preceding spreadsheet, prepare an income statement for Demo Consulting. Demo Consulting…arrow_forward

- Global Air Inc. recently hired a new accountant with limitedreal-world experience in corporate accounting. Prior to starting the new job, the accountant was very busy and was unable to reviewany texts on corporation accounting. During the first month, he made the following entries for the corporation’s capital stock: Oct. 5 Cash 39,000 Capital Stock 1,000 Gain on Sale of Stock 38,000 (Issued 1,000 shares of $1 par value common stock at $39 per share) 12 Cash 330,000 Capital Stock 330,000 (Issued 3,000 shares of $100 par value preferred stock at $110 per share) 13 Capital Stock 20,000 Cash 20,000 (Purchased 500 shares of common stock for the treasury at $40 per share) 26 Cash 22,500 Capital Stock 500 Gain on Sale of Stock…arrow_forwardOn September 1, the board of directors of a company, declares a stock dividend on its 22,000, $13 par, common shares. The market price of the common stock is $42 on this date.Required:1. 2. & 3. Record the necessary journal entries assuming a small (10%) stock dividend, a large (100%) stock dividend, and a 2-for-1 stock split. need helparrow_forwardGodaarrow_forward

- Give step by step explanation.arrow_forwardLooking for the Less: Cash dividends declared to find the Retained earnings.. Attached the journal entries as well.arrow_forwardRequired information [The following information applies to the questions displayed below.] Tarrant Corporation was organized this year to operate a financial consulting business. The charter authorized the following stock: common stock, $11 par value, 11,900 shares authorized. During the year, the following selected transactions were completed: a. Sold 7,000 shares of common stock for cash at $22 per share. b. Sold 2,200 shares of common stock for cash at $27 per share. c. At year-end, the company reported net Income of $6,100. No dividends were declared. Required: 1. Prepare the journal entries required to record the sale of common stock in (a) and (b). Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 2 1 Sold 7,000 shares of common stock for cash at $22 per share. Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit…arrow_forward

- Hickory Inc. experienced the following stockholders' equity transactions (listed in chronological order) during it's first year of operations. Based on these transactions, calculate the balances that would appear in the stockholders' equity accounts listed below. Formatting: Please round to the nearest dollar and do not use dollar signs (i.e. enter '1,000' rather than '$1,000'). All numbers should be positive. Common Stock, 100,000 shares of $1 par value common stock authorized Preferred Stock, 50,000 shares of $10 par value preferred stock authorized 1 Issued 5,000 common shares at $30 per share 2 Exchanged 4,000 preferred shares for a piece of equipment with a fair value of $49,000. 3 Issued 2,500 common shares at $25 per share 4 Purchased 500 of own common shares on the open market at $24 per share 5 Declared a 30% common stock dividend. Common stock was trading at $23 per share on the date of declaration.…arrow_forwardplease answer do not image.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education